Please click on the following link to listen in to my regular weekly radio interview with Eric King on the King World News Markets and Metals Wrap.

http://tinyurl.com/76as9hh

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

Saturday, June 30, 2012

Friday, June 29, 2012

Hedge Funds Continue to Pummel Silver - Until Today

If you want to talk about how utterly insane our markets have become and how schizophrenic the trading action has mutated into, look no further than the last two days of trading this very week.

On Thursday, silver was mauled by hedge fund selling tied to both long liquidation and brand new fresh short selling. The result? Silver hit a 52 week low! One day later - it rockets to close 5% higher in a single day. This is the type of madness that has been unleashed by Central Bank interference into the market place which is the SOLE CAUSE of this volatility.

I could give example after example of commodity futures markets which had hit multi month lows on Thursday only to come storming back higher on Friday. Gasoline hit a 6 month low and then comes flying back $.15/ gallon on Friday because what changed? Crude oil had just reached an 8 month low on Thursday only to them come back on Friday and rise nearly 10% in price in a single day.

What has been happening is that hedge funds have been liquidating long positions across the entirety of the commodity spectrum and building short positions in anticipation of further declines in the growth of the global economy. The craven capitulation by German Chancellor Merkel to the demands of the beggar nations of Spain and Italy, roiled the markets and scared the hell out of the shorts and enticed a huge wave of fresh buying to boot.

Many of the friends of gold complain about the sharp selloffs in gold and in silver as these hedge funds liquidate their long positions en masse at the end of bull market rallies. Yet, it is these exact same mindless machines that come in on the buy side and cause these enormous rallies on the way back up. If you want them on the way up, just be prepared to deal with them on the way down. They are here to stay, sadly I might add.

I have written about this many times but I think today is a perfect example of how utterly useless these computerized trading programs have rendered the commodity futures markets for the PURPOSE FOR WHICH THEY CAME INTO BEING, namely, as vehicles in which commercial end users and producers could manage risk and lock in profits or costs.

Hedgers, which is what these folks are, cannot hedge anything in this sort of wild market environment. Their hedges get all blown to hell and force margin calls to them just like any other trader has to deal with. With these almost incessant price reversals, both up and down, reading the markets has become nigh an exercise in futility for risk managers. How are they supposed to hedge future production or future costs in an environment in which prices reverse 10% in a single day. Is this a change in the trend? If the market going to reverse? Have the market dynamics of supply and demand changed? What happens if we read this wrong and institute our hedges and then the market totally re-reverses on us again?

More and more commercials are no longer comfortable using futures contracts for risk management. Instead they are entering into private forward contracts innoculating themselves from this new brand of fools known as hedge funds. While the exchanges may pat themselves on the back for opening their doors to the HFT crowd, the hedge fund crowd and the quant crowd, ultimately they will merely watch the backbone of the futures industry slowly begin to exit. That will empty the playing field of the hedgers and leave the casino with only more of these other parasites to prey off of one another.

That being said, take a look at the silver COT chart showing the massive build in the number of OUTRIGHT SHORT positions that occured through the early part of this week. Keep in mind that this chart does not even include the fresh selling that took the price of silver to a 52 week low on Thursday.

Notice that it is the largest short position they have held in more than 5 years. It could be a much longer time frame than that - I merely stopped charting the data after that far back.

Now take a look at the silver chart and behold the downdraft. As you can, except for a brief period at the latter part of May and into early June, the course of this market has been steadily lower.

Now look back at the OUTRIGHT SHORT POSITION chart above. Do you notice that dip on the right hand side of the chart in the otherwise uptrending line showing the huge build in short positions? This dip occured at the exact same time silver was ekeing out an upmove of about $2.50 in that same time frame. In other words, SHORT COVERING by hedge funds, as well as some fresh buying took the metal higher. Once the short covering abated, the rally was sold with ferocity as brand new hedge fund shorting took the metal down to this week's 52 week low.

It has been this selling which has smashed the CCI, the Continuous Commodity Index lower. Interesting enough, the CCI as a whole had actually been faring a bit better than had silver this last week as the weather market that has seized the entirety of the grain complex, has enabled the index to move higher even as silver lingered near its lows this week. Were it not for the strength in the grains and the resultant spillover in the livestock markets, the CCI would have dropped lower as well.

Suffice it to say that the massive short covering rally that took place across the entirety of the commodity complex shoved the CCI sharply higher blowing it throught its 50 day moving average with ease and putting it in the position of challenging resistance at the 550 level. If next week rolls around and we still see these wild eyed hedge funds with an appetite for risk, that should be an easy matter. If that is the case, Silver will follow this index higher and will OUTPERFORM gold in percentage terms once again.

If risk is out the hedge funds turn sellers, then look for this index to drop lower with silver going along for the ride and losing ground against gold.

If silver is going to get anything going to the upside, it will first have to mount a successful challenge of today's high near $28. Above that, resistance lies near $29 and then another dollar higher at $30. If silver can get a handle of "3" on it and keep that, then we will have a chance of seeing some fireworks.

If that is the case, EXPECT bullion bank selling and swap dealer selling to meet this rally. This is when that segment of traders will sell the silver market, on the way up, not on the way down as some of these "blame everything on Morgan" advocates continue to assert. The bullion banks sell rallies - who do you think is on the opposite side of all those hedge fund buys attempting to absorb as many of those bids as they can to try to stem the rise of the metal? Answer - Bullion banks - nearly everyone else is buying!

Moving over to gold - if the metal can clear $1620 - $1630, which it is in position to test early next week, then it will make another run first at $1650 and then $1665 or so. I will be surprised if it can clear $1665 without any clear signs of QE coming from the Fed. The dose of liquidity coming from the Euro zone will be insufficient in itself to launch the gold market higher. It will need another jolt from this side of the Atlantic.

The thumping the US Dollar took today was pretty dramatic - Once again, for whatever the reason, (in Technical Analysis it is not important), it once again failed to manage TWO SUCCESSIVE CLOSES ABOVE the 83 level. That level is now reinforced on the charts as significant resistance. If the Dollar ever does mount those two closes above there, it is going reach for 85.

On the downside, even after today's massacre, it is still trading above the 50 day moving average. The key will be this red support line shown on the chart. If it breaches that line and fails to recover by day's end, it will drop as low as 80.50 initially where it will have a chance to bounce.

On Thursday, silver was mauled by hedge fund selling tied to both long liquidation and brand new fresh short selling. The result? Silver hit a 52 week low! One day later - it rockets to close 5% higher in a single day. This is the type of madness that has been unleashed by Central Bank interference into the market place which is the SOLE CAUSE of this volatility.

I could give example after example of commodity futures markets which had hit multi month lows on Thursday only to come storming back higher on Friday. Gasoline hit a 6 month low and then comes flying back $.15/ gallon on Friday because what changed? Crude oil had just reached an 8 month low on Thursday only to them come back on Friday and rise nearly 10% in price in a single day.

What has been happening is that hedge funds have been liquidating long positions across the entirety of the commodity spectrum and building short positions in anticipation of further declines in the growth of the global economy. The craven capitulation by German Chancellor Merkel to the demands of the beggar nations of Spain and Italy, roiled the markets and scared the hell out of the shorts and enticed a huge wave of fresh buying to boot.

Many of the friends of gold complain about the sharp selloffs in gold and in silver as these hedge funds liquidate their long positions en masse at the end of bull market rallies. Yet, it is these exact same mindless machines that come in on the buy side and cause these enormous rallies on the way back up. If you want them on the way up, just be prepared to deal with them on the way down. They are here to stay, sadly I might add.

I have written about this many times but I think today is a perfect example of how utterly useless these computerized trading programs have rendered the commodity futures markets for the PURPOSE FOR WHICH THEY CAME INTO BEING, namely, as vehicles in which commercial end users and producers could manage risk and lock in profits or costs.

Hedgers, which is what these folks are, cannot hedge anything in this sort of wild market environment. Their hedges get all blown to hell and force margin calls to them just like any other trader has to deal with. With these almost incessant price reversals, both up and down, reading the markets has become nigh an exercise in futility for risk managers. How are they supposed to hedge future production or future costs in an environment in which prices reverse 10% in a single day. Is this a change in the trend? If the market going to reverse? Have the market dynamics of supply and demand changed? What happens if we read this wrong and institute our hedges and then the market totally re-reverses on us again?

More and more commercials are no longer comfortable using futures contracts for risk management. Instead they are entering into private forward contracts innoculating themselves from this new brand of fools known as hedge funds. While the exchanges may pat themselves on the back for opening their doors to the HFT crowd, the hedge fund crowd and the quant crowd, ultimately they will merely watch the backbone of the futures industry slowly begin to exit. That will empty the playing field of the hedgers and leave the casino with only more of these other parasites to prey off of one another.

That being said, take a look at the silver COT chart showing the massive build in the number of OUTRIGHT SHORT positions that occured through the early part of this week. Keep in mind that this chart does not even include the fresh selling that took the price of silver to a 52 week low on Thursday.

Notice that it is the largest short position they have held in more than 5 years. It could be a much longer time frame than that - I merely stopped charting the data after that far back.

Now take a look at the silver chart and behold the downdraft. As you can, except for a brief period at the latter part of May and into early June, the course of this market has been steadily lower.

Now look back at the OUTRIGHT SHORT POSITION chart above. Do you notice that dip on the right hand side of the chart in the otherwise uptrending line showing the huge build in short positions? This dip occured at the exact same time silver was ekeing out an upmove of about $2.50 in that same time frame. In other words, SHORT COVERING by hedge funds, as well as some fresh buying took the metal higher. Once the short covering abated, the rally was sold with ferocity as brand new hedge fund shorting took the metal down to this week's 52 week low.

It has been this selling which has smashed the CCI, the Continuous Commodity Index lower. Interesting enough, the CCI as a whole had actually been faring a bit better than had silver this last week as the weather market that has seized the entirety of the grain complex, has enabled the index to move higher even as silver lingered near its lows this week. Were it not for the strength in the grains and the resultant spillover in the livestock markets, the CCI would have dropped lower as well.

Suffice it to say that the massive short covering rally that took place across the entirety of the commodity complex shoved the CCI sharply higher blowing it throught its 50 day moving average with ease and putting it in the position of challenging resistance at the 550 level. If next week rolls around and we still see these wild eyed hedge funds with an appetite for risk, that should be an easy matter. If that is the case, Silver will follow this index higher and will OUTPERFORM gold in percentage terms once again.

If risk is out the hedge funds turn sellers, then look for this index to drop lower with silver going along for the ride and losing ground against gold.

If silver is going to get anything going to the upside, it will first have to mount a successful challenge of today's high near $28. Above that, resistance lies near $29 and then another dollar higher at $30. If silver can get a handle of "3" on it and keep that, then we will have a chance of seeing some fireworks.

If that is the case, EXPECT bullion bank selling and swap dealer selling to meet this rally. This is when that segment of traders will sell the silver market, on the way up, not on the way down as some of these "blame everything on Morgan" advocates continue to assert. The bullion banks sell rallies - who do you think is on the opposite side of all those hedge fund buys attempting to absorb as many of those bids as they can to try to stem the rise of the metal? Answer - Bullion banks - nearly everyone else is buying!

Moving over to gold - if the metal can clear $1620 - $1630, which it is in position to test early next week, then it will make another run first at $1650 and then $1665 or so. I will be surprised if it can clear $1665 without any clear signs of QE coming from the Fed. The dose of liquidity coming from the Euro zone will be insufficient in itself to launch the gold market higher. It will need another jolt from this side of the Atlantic.

The thumping the US Dollar took today was pretty dramatic - Once again, for whatever the reason, (in Technical Analysis it is not important), it once again failed to manage TWO SUCCESSIVE CLOSES ABOVE the 83 level. That level is now reinforced on the charts as significant resistance. If the Dollar ever does mount those two closes above there, it is going reach for 85.

On the downside, even after today's massacre, it is still trading above the 50 day moving average. The key will be this red support line shown on the chart. If it breaches that line and fails to recover by day's end, it will drop as low as 80.50 initially where it will have a chance to bounce.

Monday, June 25, 2012

Comments on the Deciphering Silver article

To all;

Thanks for the comments and feedback on the recent article entitled "Deciphering Silver". Glad it was helpful.

To the skeptics - I would suggest you look far more closely at the comparison chart of silver and the CCI. It is evident you fail to understand just how hedge funds treat the risk on/risk off trades.

When the CCI moves lower, silver will GENERALLY move lower along with it. When the CCI moved higher, silver generally moved higher along with it, especially since September of last year when the chart pattern between the two has been almost identical.

The charts simply do not lie but it has been my experience that those with closed minds will never be convinced no matter what illustrations are shown them. For one to continue blaming Morgan for the downdraft in silver even as the CCI has been plummeting suggests that somehow MOrgan is responsible for taking the entirety of the commodity complex lower. Never mind the fact that hedge fund short positions are going up as the commodity sector goes lower -

By the way, have you noticed that the CCI is moving strongly higher today and SURPRISE, so too is silver.

Some of us old time traders well remember the link that used to be between silver and soybean prices. Typically when soybeans were moving higher in a weather market, silver would move higher as well. Guess what - Soybeans are in a full fledged weather market as the drought pattern worsens over the MidWest and the entire grain complex is soaring with new crop corn locked at the limit up price.

It sounds weird, but we traders back then would draw a connection between rising grain prices and inflationary pressures and would oftentimes buy silver as a result. Looks like the old link might still be there, even though the equity markets are moving lower today and there is some light strength in the US Dollar.

If grain prices start a strong trending move higher and begin gathering more upward momentum, it is going to impact the general price of food moving foward and that will be inflationary from a supply standpoint. The big question is what will happen to the demand side of the equation if high grain prices begin choking off demand, particularly in a rotten global economy. The battle royale between the macro picture and the various fundamentals across the commodity markets continues.

Hold on to your hats!

Thanks for the comments and feedback on the recent article entitled "Deciphering Silver". Glad it was helpful.

To the skeptics - I would suggest you look far more closely at the comparison chart of silver and the CCI. It is evident you fail to understand just how hedge funds treat the risk on/risk off trades.

When the CCI moves lower, silver will GENERALLY move lower along with it. When the CCI moved higher, silver generally moved higher along with it, especially since September of last year when the chart pattern between the two has been almost identical.

The charts simply do not lie but it has been my experience that those with closed minds will never be convinced no matter what illustrations are shown them. For one to continue blaming Morgan for the downdraft in silver even as the CCI has been plummeting suggests that somehow MOrgan is responsible for taking the entirety of the commodity complex lower. Never mind the fact that hedge fund short positions are going up as the commodity sector goes lower -

By the way, have you noticed that the CCI is moving strongly higher today and SURPRISE, so too is silver.

Some of us old time traders well remember the link that used to be between silver and soybean prices. Typically when soybeans were moving higher in a weather market, silver would move higher as well. Guess what - Soybeans are in a full fledged weather market as the drought pattern worsens over the MidWest and the entire grain complex is soaring with new crop corn locked at the limit up price.

It sounds weird, but we traders back then would draw a connection between rising grain prices and inflationary pressures and would oftentimes buy silver as a result. Looks like the old link might still be there, even though the equity markets are moving lower today and there is some light strength in the US Dollar.

If grain prices start a strong trending move higher and begin gathering more upward momentum, it is going to impact the general price of food moving foward and that will be inflationary from a supply standpoint. The big question is what will happen to the demand side of the equation if high grain prices begin choking off demand, particularly in a rotten global economy. The battle royale between the macro picture and the various fundamentals across the commodity markets continues.

Hold on to your hats!

Sunday, June 24, 2012

Deciphering Silver

The internet has been awash with comments recently about the downdraft in silver and the strong increase in Open Interest on last week's big down day. As usual, the chatter is about an orchestrated attempt by JP Morgan to smash the price of silver lower so that they can cover their "losing short position".

Let me first state that I am a firm believer in the view that the US government has a vested interest in controlling the price of gold. Being a good friend of GATA, we both have ridden through the ups and down of this together for the last decade. However, that being said, not every move lower, particularly in the Silver market, is the result of efforts by Morgan.

Part of the problem that some of the authors have, authors whom I might add see every single move lower in silver the result of price capping by Morgan, is that they do not understand how traders, particularly large traders, react to changes in sentiment and how they will adopt defensive strategies to cushion themselves against further losses until they can better sort out what they want to do next. These would do well to understand the nature of spreads and the ability to use spreads as part of a strategy to cushion against losses while in a defensive posture.

Take a look at the following chart of the CCI, the Continuous Commodity Index, versus the price of Silver. I mentioned not all that long ago, that silver was not going to go anywhere until the chart of the CCI turned solidly bullish. Why? Because Silver, for all of its history as a monetary metal in many places around the globe, is still regarded by large hedge funds and other large investors, as a RISK ASSET; one that performs strongly during periods in which INFLATION is the main concern.

Look at the solid black line which is the CCI. Notice how it has been moving relentlessly lower ever since it topped out near 700 back in April 2011. Now look at the solid red line, which is the closing price of silver. It topped out that same month near $50 and has been headed relentlessly lower also. Why? Because traders increasingly became convinced that the global economy was slowing, being impacted by woes out of Europe as well as near stagnant conditions across the US and elsewhere.

As a matter of fact, the chart patterns between the two, are very similar and have been almost identical since September of last year.

Now take a look at the following chart detailing the Commitments of Traders report.

If we draw out the chart a bit longer, it becomes quite insightful. Notice back to the summer of 2008 when the credit crisis first erupted. The outright short position of the hedge funds is now even larger than it was at that point.

If you combine this with the fact that even as hedge funds are LIQUIDATING long positions in silver there is at the same time, some funds in this category whom are now building SHORT positions, it does not take much market understanding to realize why the price of silver is moving lower. It DOES NOT TAKE JP MORGAN 'smashing silver' to knock the price of silver lower. If anything MORGAN is using this hedge fund activity to actually cover their NOT LOSING short positions as some of these commentators keep telling us, but their EXTREMELY PROFITABLE SHORT POSITIONS.

For the sake of time I am not going to put up a chart of the Commitment of Traders of Copper, but suffice it to say, that hedge funds have begun building short copper positions in there this year also. Note the Copper peaked in February of this year, the exact same month as Silver peaked. Was JP Morgan "smashing copper lower to cover their losing short bets"? The answer is obvious - of course they were not - the hedge funds are taking copper lower just as they have been taking silver lower. Why? Because Copper is also viewed primarily as a RISK ASSET, just like silver, and a harbinger of the rate of growth expected in the global economy.

Silver has been finding good buying near and just above the $26 level from some big players. This buying has been of sufficient size that it has been able to absorb this speculative type selling originating not from Morgan, but from the hedge fund community in general. As long as these buyers continue to see this level as a good VALUE, silver will hold. If they pull back for any reason, hedge fund selling is going to take this market lower. It will not be Morgan that does it.

The conclusion to all of this is simple - as long as the environment persists in which traders are more concerned about slowing global growth and/or deflationary pressures, both silver and copper for that matter, will find it difficult to mount any sort of sustained upside activity. Note that I said, "Sustained". That means that we can and will get occasional upside moves higher when sentiment temporarily shifts and traders expect Central Bank actions to be of sufficient size and scope to counter the deflationary forces building in the global economy or economic data looks positive in some instances. But until we get something that occurs that will ACTUALLY produce a more lasting impact in that regards, hedge funds will be selling rallies.

Once again, the ball is firmly in the court of the Central Banks.

Let me first state that I am a firm believer in the view that the US government has a vested interest in controlling the price of gold. Being a good friend of GATA, we both have ridden through the ups and down of this together for the last decade. However, that being said, not every move lower, particularly in the Silver market, is the result of efforts by Morgan.

Part of the problem that some of the authors have, authors whom I might add see every single move lower in silver the result of price capping by Morgan, is that they do not understand how traders, particularly large traders, react to changes in sentiment and how they will adopt defensive strategies to cushion themselves against further losses until they can better sort out what they want to do next. These would do well to understand the nature of spreads and the ability to use spreads as part of a strategy to cushion against losses while in a defensive posture.

Take a look at the following chart of the CCI, the Continuous Commodity Index, versus the price of Silver. I mentioned not all that long ago, that silver was not going to go anywhere until the chart of the CCI turned solidly bullish. Why? Because Silver, for all of its history as a monetary metal in many places around the globe, is still regarded by large hedge funds and other large investors, as a RISK ASSET; one that performs strongly during periods in which INFLATION is the main concern.

Look at the solid black line which is the CCI. Notice how it has been moving relentlessly lower ever since it topped out near 700 back in April 2011. Now look at the solid red line, which is the closing price of silver. It topped out that same month near $50 and has been headed relentlessly lower also. Why? Because traders increasingly became convinced that the global economy was slowing, being impacted by woes out of Europe as well as near stagnant conditions across the US and elsewhere.

As a matter of fact, the chart patterns between the two, are very similar and have been almost identical since September of last year.

Now take a look at the following chart detailing the Commitments of Traders report.

I have noted the various categories of traders on the Legend below the chart. Look particularly at the blue line in the positive section of the graph. It is important to note here that this is the NET LONG position of the hedge funds. Note how it peaked and then turned lower in September of last year, then moved solidly lower until the beginning of the year when it began to turn higher once again. What was that all about? Once silver peaked near $50 the sentiment shifted across the entire commodity complex and soured all the way into the end of last year. Then, at the beginning of this year, traders began to expect action in the Euro Zone from the ECB with some help from the Fed. They thus started to rebuild long side exposure to the entire commodity complex. That buying drove silver prices $10 higher to start the first two months of this year pushing it to near $37.50 in February. That was it - from then on, it has moved steadily lower on a monthly basis tracking the CCI nearly tick for tick.

What does not show up on this above graph however, is the actual NAKED SHORT POSITION of this same category of traders. For that, take a look at the following graphic. Can you see what is taking place? Hedge funds are building short side exposure to silver. I have only included the last 18 months worth of data but as you see, a mere month ago and this category of traders has been as bearish as they have been in a good while.

If you combine this with the fact that even as hedge funds are LIQUIDATING long positions in silver there is at the same time, some funds in this category whom are now building SHORT positions, it does not take much market understanding to realize why the price of silver is moving lower. It DOES NOT TAKE JP MORGAN 'smashing silver' to knock the price of silver lower. If anything MORGAN is using this hedge fund activity to actually cover their NOT LOSING short positions as some of these commentators keep telling us, but their EXTREMELY PROFITABLE SHORT POSITIONS.

For the sake of time I am not going to put up a chart of the Commitment of Traders of Copper, but suffice it to say, that hedge funds have begun building short copper positions in there this year also. Note the Copper peaked in February of this year, the exact same month as Silver peaked. Was JP Morgan "smashing copper lower to cover their losing short bets"? The answer is obvious - of course they were not - the hedge funds are taking copper lower just as they have been taking silver lower. Why? Because Copper is also viewed primarily as a RISK ASSET, just like silver, and a harbinger of the rate of growth expected in the global economy.

Silver has been finding good buying near and just above the $26 level from some big players. This buying has been of sufficient size that it has been able to absorb this speculative type selling originating not from Morgan, but from the hedge fund community in general. As long as these buyers continue to see this level as a good VALUE, silver will hold. If they pull back for any reason, hedge fund selling is going to take this market lower. It will not be Morgan that does it.

The conclusion to all of this is simple - as long as the environment persists in which traders are more concerned about slowing global growth and/or deflationary pressures, both silver and copper for that matter, will find it difficult to mount any sort of sustained upside activity. Note that I said, "Sustained". That means that we can and will get occasional upside moves higher when sentiment temporarily shifts and traders expect Central Bank actions to be of sufficient size and scope to counter the deflationary forces building in the global economy or economic data looks positive in some instances. But until we get something that occurs that will ACTUALLY produce a more lasting impact in that regards, hedge funds will be selling rallies.

Once again, the ball is firmly in the court of the Central Banks.

Saturday, June 23, 2012

Gold Chart and Comments

Gold did not have a good week ending down $61 or 3.7% from the prior week's closing print. As we all know by now, disappointment by bulls who had bought out ahead of the FOMC meeting and statement, was quickly reflected in the initial drop lower when the statement hit the wires. However, during that same day, there was a reconsideration after parsing the statement and the price rebounded taking back most of the losses. After further reflection overnight, the sentiment once again soured and down it went plunging through $1600 in the process and closing near the low of the week and the session.

Quite frankly, until traders become convinced that some sort of policy move by Central Bank Planners which will stem the downward economic spiral is forthcoming, they are not going to buy. It will be up to the big physical market buyers, mainly the Asian Central Banks, who are valued based buyers, to put a floor under the gold market.

Many keep pointing to the amount of money that has already been injected into the system in expectation that inflation issues are mere moments away. Unfortunately, if that were the case, we would already be seeing soaring commodity prices and of course a soaring gold price. The problem is that the rate at which this money is turning over or changing hands in the economy, the VELOCITY OF MONEY, continues to plummet.

Notice the following chart detailing the VELOCITY OF MONEY. I have charted the simplest measure of money supply (M1) as well as the more complex measure (MZM). No matter which one we take, VELOCITY is trending lower. What this means is that while the Fed has been busy injecting liquidity into the system, it really is not going anywhere (besides into the US equity markets by the Big Banks). The result is that while the FUEL FOR INFLATION is in place, the WIND TO FAN THE FLAMES is currently missing. People and business are simply not spending money at a fast enough pace to fan the fires of inflation.

Quite frankly, until traders become convinced that some sort of policy move by Central Bank Planners which will stem the downward economic spiral is forthcoming, they are not going to buy. It will be up to the big physical market buyers, mainly the Asian Central Banks, who are valued based buyers, to put a floor under the gold market.

Many keep pointing to the amount of money that has already been injected into the system in expectation that inflation issues are mere moments away. Unfortunately, if that were the case, we would already be seeing soaring commodity prices and of course a soaring gold price. The problem is that the rate at which this money is turning over or changing hands in the economy, the VELOCITY OF MONEY, continues to plummet.

Notice the following chart detailing the VELOCITY OF MONEY. I have charted the simplest measure of money supply (M1) as well as the more complex measure (MZM). No matter which one we take, VELOCITY is trending lower. What this means is that while the Fed has been busy injecting liquidity into the system, it really is not going anywhere (besides into the US equity markets by the Big Banks). The result is that while the FUEL FOR INFLATION is in place, the WIND TO FAN THE FLAMES is currently missing. People and business are simply not spending money at a fast enough pace to fan the fires of inflation.

Let's zoom in a bit closer to see some more detail. Notice that it was not until the first round of QE1 was underway in early 2009 that VELOCITY began to increase. It had collapsed as the credit crisis erupted in the middle of 2008 and the Fed came charging in to arrest that ominous trend. Of course it was no coincidence to see gold rally from a low of 680 prior to the first round of QE all the way to near $1250 during the same time period that the slope of the Velocity line turned higher.

Gold continued to rally higher even despite the fact that the graph turned lower as traders still believed that the total sum of near $2.5 TRILLION in combined QE would set the stage for soaring inflationary issues. Commodity prices roared higher and the US Dollar sank lower. After all, we were talking about an unprecedented amount of money creation. Alas, it was all to no avail as the issues with the enormous amounts of indebtedness swallowed it all up with woes out of Europe further complicating issues.

From where I stand, it seems to me that if the Fed is eventually going to launch another round of stimulus, not that it will accomplish anything of LASTING significance, it is not going to have any desired impact unless it is of sufficient size that it turns this VELOCITY chart higher. It seems that the law of diminishing returns may well be at work with the market dismissing any QE package that is not at least as large as the prior ones and that means a minimum size of $900 billion as was QE2 ($600 billion in Treasuries and $300 billion in Agency debt).

Quite frankly, it would be downright terrifying if the Fed were to announce a new round of QE of say, $500 billion, and the markets, after an initial knee jerk response higher, were to sell off. Imagine the size that would then be needed. Perhaps this is one of the reasons that they are reluctant at this point to pull the trigger on the next round of QE. Maybe they are fearful of the reaction if the markets are disappointed? Then what would they do - buy stocks directly??? Personally I keep waiting for them to cut a check to every individual taxpayer. Now that is my kind of stimulus! For that matter, why not just cancel the income tax altogether - after all, who need revenue when you are spending yourself into oblivion anyway.

One last chart - that of gold itself - it has been rejected from the resistance level near $1620 - $1625 shown on the chart. That level was the bottom of the former consolidation range. It is now moving lower again down towards the bottom of its NEW congestion zone with $1550 - $1525 on the bottom. This is the zone into which Asian Central Bank buying has been very strong in the past. Hopefully this will continue.

This sort of value-based buying is what carves out floors in markets. However, to see strong uptrending moves, particularly in gold, we are going to need to see a sentiment shift in the minds of traders away from fearing slowing global growth and deflationary pressures towards one of fearing rising prices and inflationary pressures. That is going to require some sort of catalyst. What form that takes and when exactly it occurs is unclear but considering the amount of liquidity that has been injected into the system, when the VELOCITY chart does indeed change, it will be no mean or small event when it does!

Trader Dan on King World News Markets and Metals Wrap

Please click on the following link to listen in to my weekly radio interview with Eric King on the KWN Markets and Metals Wrap.

Friday, June 22, 2012

HUI Chart Pattern Needs Some Help

As has been the case with the mining shares for some time, (going back as far as the first round of QE in late 2008), they require a shift in trader sentiment away from a DEFLATIONARY scenario towards one of INFLATION. The latter is what has resulted from each round of stimulus launched by the Federal Reserve.

This week's lack of an imminent launch of a QE3, has set mining shares, as well as bullion, back on their heels as traders have made the shift back towards expecting a further slowdown in global growth and more of a deflationary environment.

This shift is showing up in the decidedly bearish chart pattern now forming in the HUI once again.

If you take a look at the Fibonacci Retracement Levels noted as well as the horizontal support and resistance levels I have marked on this chart, you can see just how closely both correspond with the other.

In the middle of May, price rebounded sharply from the decline that began in late February as the gold shares reached levels of valuation that many believed were excessively low. That brought in some very strong buying which took price to near the 460 mark, a level which happens to be both the bottom of a former consolidation range and the exact HALFWAY or 50% Fibonacci Retracement Level of the entire decline.

Price then retreated as expected with dip buyers coming back in and taking the index back up to 460 once again. This time however, instead of continuing to power higher, the index fell back sharply when the lack of QE3 hit traders between the eyes.

The index failed to hold support near the 440 level, a level which formerly had been resistance on the way up and now became support on the way down. It also corresponded to exactly the 38.2% Fibonacci Retracement Level of that same decline that began in late February.

Technical Analysis's REVERSE POLARITY PRINCIPLE tells us that it should have held if the market were going to continue with a bullish posture. Its failure to do so is therefore bearish for the short term.

The index will now probe lower as it seeks to uncover buying support once again. There looks to be the potential for that support to have emerged near 420 but it is too early to say so with an certainty. Confirmation will only occur if the price moves back ABOVE 442 and holds.

If not, the path of least resistance on this index is lower with the level near 410 the next region where some buying should emerge. Failure to hold there and the index faces the real possibility of heading down towards first 390 and then the recent low near 370.

The onus is firmly on the back of the bulls to perform.

This week's lack of an imminent launch of a QE3, has set mining shares, as well as bullion, back on their heels as traders have made the shift back towards expecting a further slowdown in global growth and more of a deflationary environment.

This shift is showing up in the decidedly bearish chart pattern now forming in the HUI once again.

If you take a look at the Fibonacci Retracement Levels noted as well as the horizontal support and resistance levels I have marked on this chart, you can see just how closely both correspond with the other.

In the middle of May, price rebounded sharply from the decline that began in late February as the gold shares reached levels of valuation that many believed were excessively low. That brought in some very strong buying which took price to near the 460 mark, a level which happens to be both the bottom of a former consolidation range and the exact HALFWAY or 50% Fibonacci Retracement Level of the entire decline.

Price then retreated as expected with dip buyers coming back in and taking the index back up to 460 once again. This time however, instead of continuing to power higher, the index fell back sharply when the lack of QE3 hit traders between the eyes.

The index failed to hold support near the 440 level, a level which formerly had been resistance on the way up and now became support on the way down. It also corresponded to exactly the 38.2% Fibonacci Retracement Level of that same decline that began in late February.

Technical Analysis's REVERSE POLARITY PRINCIPLE tells us that it should have held if the market were going to continue with a bullish posture. Its failure to do so is therefore bearish for the short term.

The index will now probe lower as it seeks to uncover buying support once again. There looks to be the potential for that support to have emerged near 420 but it is too early to say so with an certainty. Confirmation will only occur if the price moves back ABOVE 442 and holds.

If not, the path of least resistance on this index is lower with the level near 410 the next region where some buying should emerge. Failure to hold there and the index faces the real possibility of heading down towards first 390 and then the recent low near 370.

The onus is firmly on the back of the bulls to perform.

Thursday, June 21, 2012

Gold Bulls React to FOMC Statement after Overnight Reflections

What a difference one day can apparently make in the minds of traders! Yesterday, following an initial sharp downside knee jerk reaction to the lack of an imminent QE3, Gold (and Silver) both rebounded well off their lows as traders became convinced that the Fed had surely left the door open to a round of QE should there be one more month of disappointing payrolls numbers.

That sentiment sure proved fleeting, not only in the precious metals markets, but across the entire spectrum of commodities, as well as the bond markets.

Die-hard equity bulls, who were consoling themselves that if they did not get their dearly beloved and eagerly anticipated round of drugs yesterday, would surely get it from their dope-dealing masters at the Fed soon, were throwing away everything that they had purchased yesterday at a big, fat, whopping loss. As mentioned in my piece on King World News, the equity markets DIED a long time ago as far as being any source of efficient allocation of precious capital. The entire structure is now being GAMED. Instead of XBOX or NINTENDO, (the younger kids and early adult are playing those), we have GAMERS trying to time the Fed and any other official monetary sector authorities. INVESTING is DEAD. What lives is who is fastest on the power key combination of their "ENTER" button to slam orders down the wires into the exchanges.

Whoops, another stumbling block - numbers out of China this AM reinforced the slowing global economy theme. Then, as if that were not enough, the Philly Fed readings confirmed more of the same. Further piling on were former Fed Chairman Alan Greenspan's comments that the economy was "very sluggish".

Bonds took back most of yesterday's losses with the yield on the Ten Year dropping back down towards the 1.6 level.

In short, DEFLATION was the theme of today's session as traders simply do not see any source of inflationary pressures without another quick round of liquidity injections, compliments of the Fed. That means that they are going to be selling commodities. Just take a look at crude oil which is imploding as it has now broken down through the bottom of chart support.

Gold has failed to break through the shorter term downtrending line noted on the chart that formed within the recent congestion zone. It has also failed to sustain its footing above psychological support at $1600. It now looks as it it is going to be up to the Eastern Central Banks to rescue the metal from hedge fund computer algorithms as it moves back down to its solid support zone noted on the chart.

That sentiment sure proved fleeting, not only in the precious metals markets, but across the entire spectrum of commodities, as well as the bond markets.

Die-hard equity bulls, who were consoling themselves that if they did not get their dearly beloved and eagerly anticipated round of drugs yesterday, would surely get it from their dope-dealing masters at the Fed soon, were throwing away everything that they had purchased yesterday at a big, fat, whopping loss. As mentioned in my piece on King World News, the equity markets DIED a long time ago as far as being any source of efficient allocation of precious capital. The entire structure is now being GAMED. Instead of XBOX or NINTENDO, (the younger kids and early adult are playing those), we have GAMERS trying to time the Fed and any other official monetary sector authorities. INVESTING is DEAD. What lives is who is fastest on the power key combination of their "ENTER" button to slam orders down the wires into the exchanges.

Whoops, another stumbling block - numbers out of China this AM reinforced the slowing global economy theme. Then, as if that were not enough, the Philly Fed readings confirmed more of the same. Further piling on were former Fed Chairman Alan Greenspan's comments that the economy was "very sluggish".

Bonds took back most of yesterday's losses with the yield on the Ten Year dropping back down towards the 1.6 level.

In short, DEFLATION was the theme of today's session as traders simply do not see any source of inflationary pressures without another quick round of liquidity injections, compliments of the Fed. That means that they are going to be selling commodities. Just take a look at crude oil which is imploding as it has now broken down through the bottom of chart support.

Silver is in serious trouble based on its technical chart. It MUST HOLD ABOVE THE RED SUPPORT LEVEL SHOWN or it is heading to $24.50 or even lower to $24 unless the bulls perform immediately. As you can see, going all the way back to September of last year, every time the metal has come down towards $26, it has not stayed there long. Buyers have always shown up. THose buyers had better be here.

The HUI Has further reinforced the 460 level as that level which MUST BE TAKEN OUT if the shares are going to sustain any sort of upward trending move. They are currently sitting right on the next level of chart support. If the buyers do not show up later today and tomorrow, there is a good chance that we will see the index drop to the next red line further down.

Gold has failed to break through the shorter term downtrending line noted on the chart that formed within the recent congestion zone. It has also failed to sustain its footing above psychological support at $1600. It now looks as it it is going to be up to the Eastern Central Banks to rescue the metal from hedge fund computer algorithms as it moves back down to its solid support zone noted on the chart.

Monday, June 18, 2012

Gold Stocks Recover from Late Friday Afternoon Mauling

AS many of you no doubt are aware, there appeared to have been some sort of coordinated bear raid on many of the smaller gold companies late Friday afternoon, particularly in the aftermarket hours when trading conditions are at their absolute thinnest.

The entire sector however is getting a firm bid in today's session even with the metals initially lower. Their strength seems to be pulling both gold and silver higher.

The HUI is closing in on very stubborn chart resistance in the 460 region. This region marked the bottom of a consolidation period back in March of this year and is now serving as a line for sellers to short against. If the leaders in the sector can manage to attract additional buying going into tomorrow's session, it should drag the entire index right back up towards 460 once again.

IF, and this is a big "IF", the bulls can force enough of these hedge fund shorts to cover and in the process take the index through 460 and keep it above this level, we should see additional short covering and fresh buying emerge to take the index all the way to the top of that same former consolidation range. That region lies near 480. That will be the next big test.

The entire sector however is getting a firm bid in today's session even with the metals initially lower. Their strength seems to be pulling both gold and silver higher.

The HUI is closing in on very stubborn chart resistance in the 460 region. This region marked the bottom of a consolidation period back in March of this year and is now serving as a line for sellers to short against. If the leaders in the sector can manage to attract additional buying going into tomorrow's session, it should drag the entire index right back up towards 460 once again.

IF, and this is a big "IF", the bulls can force enough of these hedge fund shorts to cover and in the process take the index through 460 and keep it above this level, we should see additional short covering and fresh buying emerge to take the index all the way to the top of that same former consolidation range. That region lies near 480. That will be the next big test.

Saturday, June 16, 2012

Dollar Bulls Leaning Heavily on the Long Side of the Boat

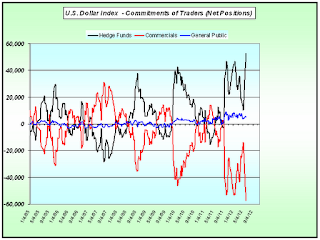

Bullish bets on the US Dollar have reached at least a 7 year high as the crisis in the Euro Zone and the slowing global economy has sent money flows careening wildly into the Greenback.

As you look at the Commitment of Traders chart shown below, you can see that this LONG DOLLAR trade is extremely crowded. Markets in this condition, while they can most certainly continue heading higher, are very unstable and quite susceptible to violent downside action should a technical trigger force a bout of long liquidation.

Friday, we got a bit of a hint as to what might happen to the Dollar should sentiment shift. It was hit rather hard heading into the weekend ahead of the crucial Greece vote as traders began reacting to the possibility of coordinated Central Bank activity early next week. The eager buyers from Monday and Tuesday all ended up as panicky sellers with the market completely erasing its gains early in the week.

Note that the selling did stop at the 38.2% Fibonacci Retracement Level of the rally that began in May.

If, and this is a BIG "IF", the Central Banks do indeed announce a coordinated liquidity infusion, this massive speculative long position may very well be vulnerable. While certainly the problems afflicting the Euro Zone are not going to be cured by any such Central Bank action, traders will, at least for the short term, view such action as lessening the need for a safe haven. That is when things could get interesting to say the least. I would expect an initial drop down to the 50% retracement level where the mettle of the bulls will be tested.

Longer term, one can still make the case that as soon as further problems begin flaring up over in the Euro Zone, the Dollar will head higher once again but keep in mind, today's markets are dominated by computer algorithms and if those things say "SELL" in regards to the Dollar based on any downside support levels being violated, there is an ENORMOUS amount of longs who are going to get their heads handed to them.

As you look at the Commitment of Traders chart shown below, you can see that this LONG DOLLAR trade is extremely crowded. Markets in this condition, while they can most certainly continue heading higher, are very unstable and quite susceptible to violent downside action should a technical trigger force a bout of long liquidation.

Friday, we got a bit of a hint as to what might happen to the Dollar should sentiment shift. It was hit rather hard heading into the weekend ahead of the crucial Greece vote as traders began reacting to the possibility of coordinated Central Bank activity early next week. The eager buyers from Monday and Tuesday all ended up as panicky sellers with the market completely erasing its gains early in the week.

Note that the selling did stop at the 38.2% Fibonacci Retracement Level of the rally that began in May.

If, and this is a BIG "IF", the Central Banks do indeed announce a coordinated liquidity infusion, this massive speculative long position may very well be vulnerable. While certainly the problems afflicting the Euro Zone are not going to be cured by any such Central Bank action, traders will, at least for the short term, view such action as lessening the need for a safe haven. That is when things could get interesting to say the least. I would expect an initial drop down to the 50% retracement level where the mettle of the bulls will be tested.

Longer term, one can still make the case that as soon as further problems begin flaring up over in the Euro Zone, the Dollar will head higher once again but keep in mind, today's markets are dominated by computer algorithms and if those things say "SELL" in regards to the Dollar based on any downside support levels being violated, there is an ENORMOUS amount of longs who are going to get their heads handed to them.

Trader Dan on King World News Markets and Metals Wrap

Please join Eric, Bill and I as we discuss the gold, silver and other pertinent market price action of the past week on the KWN Markets and Metals Wrap by clicking on the following link.

Friday, June 15, 2012

"Heads - I Win; Tails - You Lose"

That's the attitude that gold bulls have apparently adopted heading into this weekend's crucial Greece vote. Whereas yesterday seemed to be a day of caution among traders, today seems to have morphed into a day of expectations of the punch bowl, complete with accompanying hard liquor, being filled to capacity by the Central Banks of the West.

If the Greece vote turns out to be one which threatens the stability of the Euro and sends shock waves through the foreign exchange markets, traders are convinced that a large bouquet of liquidity is coming their way early next week. If the Greece vote turns out to be one in which the party favoring the austerity measures imposed upon the country, then the market will give a collective sigh and the RISK ON trades will be back in vogue - at least until Spain or Italy go kaput.

Either way, we seem to have generated buying in the gold market. Not that I am complaining, being a friend of gold, but I must honestly admit, the entire scenario seems repugnant to me in just stepping back and observing what our economic system, not only nationally, but globally, has degenerated into.

I know the drug addict comparison is old and worn out by now, but it sure as hell seems to me to be the best description of today's financial markets. The problem for the druggie is not that he or she is showing withdrawal symptoms - that is the evidence of an addiction. Their body has grown so accustomed to the presence of this substance that it can no longer functionally normally without it. In other words, the withdrawal symptoms, the shakings, the convulsions, the pain, the distress, are merely the outward evidence of an internal problem - addiction.

So it is in the case of today's financial markets - the symptoms of distress may perhaps be ameliorated by the infusion of additional liquidity - but those are merely the symptoms of an internal problem. That problem is EXCESSIVE DEBT.

For far too long many of the governments of the Euro Zone have lived way beyond their means, spending money with reckless abandon, borrowing more and more, spending more and more, until they have now reached the point at which, just like the addict, more of the drug will eventually kill them. Yet that is EXACTLY what the financial markets want - more of the drug - in essence absolving them of the consequences of their stupidity for spending money they never had in the first place.

Consider the folly of this - the worse the economic news becomes, not only in the Euro Zone, but also here in the US, the better the equity markets perform. Is that not madness? What unbiased observer in the future reading about this insanity will not shake his or her head in astonishment as they marvel that otherwise clear-headed human beings could have been conditioned to behave in such a manner?

Our financial markets are supposed to be a means of allocating precious capital towards segments or industries where goods or services that better our lives can be produced. Instead, they seem to have taken on a life of their own with the roles reversed - in essence the slave has become the master. No attempt can be judged to be incorrect or misquided as long as it serves to resuscitate the price of equities in general. Credit markets must not be allowed to lock up, equity prices must not be allowed to fall sharply, large banks must not be permitted to pay the price for their poor investment decisions - nope - the show must go on, even if in the process we are making fools out of ourselves and deluding ourselves into thinking that Central Banks are the ENGINES of PROSPERITY instead of entrepreneurs and risk takers.

Enough of this display of contempt for now - back to the gold price action - Gold has moved higher on hopes of this aforementioned liquidity coming soon next week. It has pushed through the top of the resistance zone between $1620 - $1630 and is attempting to power past the bullion bank capping efforts at today's high of $1635. Clearing this level will set the market on a path to $1650.

Notice the following 8 hour chart where you can see that it is flirting with the downtrend line formed within the recent congestion zone as well as having moved into the bottom of that zone which was carved out by a top between $1680-$1700 and a bottom near $1625.

If the liquidity punch bowl does indeed come next week in a BIG WAY, look for gold to move initially to $1650 and then, if it can best that level, on to $1680 for a test of that region.

Downside support remains near and just above the $1600 mark.

If the Greece vote turns out to be one which threatens the stability of the Euro and sends shock waves through the foreign exchange markets, traders are convinced that a large bouquet of liquidity is coming their way early next week. If the Greece vote turns out to be one in which the party favoring the austerity measures imposed upon the country, then the market will give a collective sigh and the RISK ON trades will be back in vogue - at least until Spain or Italy go kaput.

Either way, we seem to have generated buying in the gold market. Not that I am complaining, being a friend of gold, but I must honestly admit, the entire scenario seems repugnant to me in just stepping back and observing what our economic system, not only nationally, but globally, has degenerated into.

I know the drug addict comparison is old and worn out by now, but it sure as hell seems to me to be the best description of today's financial markets. The problem for the druggie is not that he or she is showing withdrawal symptoms - that is the evidence of an addiction. Their body has grown so accustomed to the presence of this substance that it can no longer functionally normally without it. In other words, the withdrawal symptoms, the shakings, the convulsions, the pain, the distress, are merely the outward evidence of an internal problem - addiction.

So it is in the case of today's financial markets - the symptoms of distress may perhaps be ameliorated by the infusion of additional liquidity - but those are merely the symptoms of an internal problem. That problem is EXCESSIVE DEBT.

For far too long many of the governments of the Euro Zone have lived way beyond their means, spending money with reckless abandon, borrowing more and more, spending more and more, until they have now reached the point at which, just like the addict, more of the drug will eventually kill them. Yet that is EXACTLY what the financial markets want - more of the drug - in essence absolving them of the consequences of their stupidity for spending money they never had in the first place.

Consider the folly of this - the worse the economic news becomes, not only in the Euro Zone, but also here in the US, the better the equity markets perform. Is that not madness? What unbiased observer in the future reading about this insanity will not shake his or her head in astonishment as they marvel that otherwise clear-headed human beings could have been conditioned to behave in such a manner?

Our financial markets are supposed to be a means of allocating precious capital towards segments or industries where goods or services that better our lives can be produced. Instead, they seem to have taken on a life of their own with the roles reversed - in essence the slave has become the master. No attempt can be judged to be incorrect or misquided as long as it serves to resuscitate the price of equities in general. Credit markets must not be allowed to lock up, equity prices must not be allowed to fall sharply, large banks must not be permitted to pay the price for their poor investment decisions - nope - the show must go on, even if in the process we are making fools out of ourselves and deluding ourselves into thinking that Central Banks are the ENGINES of PROSPERITY instead of entrepreneurs and risk takers.

Enough of this display of contempt for now - back to the gold price action - Gold has moved higher on hopes of this aforementioned liquidity coming soon next week. It has pushed through the top of the resistance zone between $1620 - $1630 and is attempting to power past the bullion bank capping efforts at today's high of $1635. Clearing this level will set the market on a path to $1650.

Notice the following 8 hour chart where you can see that it is flirting with the downtrend line formed within the recent congestion zone as well as having moved into the bottom of that zone which was carved out by a top between $1680-$1700 and a bottom near $1625.

If the liquidity punch bowl does indeed come next week in a BIG WAY, look for gold to move initially to $1650 and then, if it can best that level, on to $1680 for a test of that region.

Downside support remains near and just above the $1600 mark.

Tuesday, June 12, 2012

Gold Market Continues to Reflect Currency Turmoil

Simply put - as the situation in Europe further deteriorates (yesterday the market YAWNED at the $125 billion Spain bailout), Italy is now coming into focus. Strangely enough, the US equity markets somehow think all of this is inconsequential as the bulls there continue to be giddy with delight.

Their attitude is best described by an old Steve Wariner song, "Some Fools Never Learn". You play with the fire, you're gonna get burned".

Considering just how tenuous things are, the degree of complacency that exists among equity bulls is nothing short of astonishing. The situation can best be described by looking at a chart of the VIX, or Volatility Index.

While the index has indeed risen from some of its lowest levels down near 14, it is still generating relatively low readings. Apparently traders could care less about potential headwinds; either that or they have already factored in what in their minds is a worse-case scenario. Personally, I think it is symptomatic of the Pavlovian response by this generation of short-sighted economic ignoramuses who believe in the allmighty power of modern Central Bank money creation to plaster over everything that dares arise that might challenge the comfort of the casino players, aka, hedge funds.

I suppose it will work until it just stops working one day and that will be that. Then maybe we will see some economic sanity prevail.

Back to gold however... The metal was intially weaker early in the session but uncovered a strong surge of buying that some say was linked to the ETF. Regardless of the reason, the fact is that the metal is moving higher and once again looks like it is setting up a challenge of that tough overhead resistance level that comes in near $1620. If it can overcome the bullion bank selling at this level, it should once again make a run towards $1650 and test to see whether it can this time mount a breakout.

Downside support still looks firm.

Their attitude is best described by an old Steve Wariner song, "Some Fools Never Learn". You play with the fire, you're gonna get burned".

Considering just how tenuous things are, the degree of complacency that exists among equity bulls is nothing short of astonishing. The situation can best be described by looking at a chart of the VIX, or Volatility Index.

While the index has indeed risen from some of its lowest levels down near 14, it is still generating relatively low readings. Apparently traders could care less about potential headwinds; either that or they have already factored in what in their minds is a worse-case scenario. Personally, I think it is symptomatic of the Pavlovian response by this generation of short-sighted economic ignoramuses who believe in the allmighty power of modern Central Bank money creation to plaster over everything that dares arise that might challenge the comfort of the casino players, aka, hedge funds.

I suppose it will work until it just stops working one day and that will be that. Then maybe we will see some economic sanity prevail.

Downside support still looks firm.

Saturday, June 9, 2012

Gold Chart and Comments

I have provided an 8 hour gold chart today as it provides a very good glimpse into the technical composition of that market's recent price action.

Note that you can clearly see the solid zone of buying support extending from just slightly above the $1550 level on down towards $1520. It has been at these levels that strong buying has continued to emerge over the last month. I suspect that it is in this zone that Asian Central Banks are gobbling up the metal. Remember, they will not chase the metal higher - only the hedge fund managers buy high and hope to buy even higher before selling. By keeping an eye on this chart we can therefore get a sense of at just what level these buyers believe gold has "value". It is this sort of buying that provides a base for a market upon which it will eventually launch a rally.

For gold, that spark is not there just yet as the absence of an "immediate or forthcoming" QE event means that we lack the ingredient to make the dough rise. However, the continued ultra low interest rate environment, in many instances resulting in negative REAL rates of return, is strongly friendly towards gold as there is little opportunity cost in holding the metal with yields this low. Also, this feeds into the concerns of those who fear continued currency turmoil.

You can also see on this chart that band of congestion or range trade that was bounded by $1700 on the top and checked by $1620 or so on the bottom. Gold had been in that range beginning back in late February/early March with the top of the range retreating down towards $1680 as Europe worsened.

If you notice, this recent rally off the lows near and under $1550 ran right back into this former congestion range before encountering selling pressure from the bullion banks forcing a retreat.

It will take news of a QE launch to take gold up through the top of that former congestion zone and send this market into a strong uptrend.

Note that you can clearly see the solid zone of buying support extending from just slightly above the $1550 level on down towards $1520. It has been at these levels that strong buying has continued to emerge over the last month. I suspect that it is in this zone that Asian Central Banks are gobbling up the metal. Remember, they will not chase the metal higher - only the hedge fund managers buy high and hope to buy even higher before selling. By keeping an eye on this chart we can therefore get a sense of at just what level these buyers believe gold has "value". It is this sort of buying that provides a base for a market upon which it will eventually launch a rally.

For gold, that spark is not there just yet as the absence of an "immediate or forthcoming" QE event means that we lack the ingredient to make the dough rise. However, the continued ultra low interest rate environment, in many instances resulting in negative REAL rates of return, is strongly friendly towards gold as there is little opportunity cost in holding the metal with yields this low. Also, this feeds into the concerns of those who fear continued currency turmoil.

You can also see on this chart that band of congestion or range trade that was bounded by $1700 on the top and checked by $1620 or so on the bottom. Gold had been in that range beginning back in late February/early March with the top of the range retreating down towards $1680 as Europe worsened.

If you notice, this recent rally off the lows near and under $1550 ran right back into this former congestion range before encountering selling pressure from the bullion banks forcing a retreat.

It will take news of a QE launch to take gold up through the top of that former congestion zone and send this market into a strong uptrend.

We are Back - The King World News Markets and Metals Wrap

Trader Dan has been taking a bit of a break away from writing as the volatility in the market tends to wear down even the veterans at times and requires a great deal of undistracted attention to survive.

I am back for the regular weekly radio interview with Eric King at King World News. Join, Eric, Bill (who always provides a terrific insight into what is going on in the world of real gold and real silver transactions) and myself on the Markets and Metals Wrap.

I am back for the regular weekly radio interview with Eric King at King World News. Join, Eric, Bill (who always provides a terrific insight into what is going on in the world of real gold and real silver transactions) and myself on the Markets and Metals Wrap.

I hope to be able to provide some charting and analyis this coming week. To those who wrote, expressing concern, thanks for that. All is well - just busy, busy, busy, bzzzzzzzzzzzzz.

Oh and by the way, it is SWARMING season for the honeybees up in this neck of the woods. Chasing those down requires time away from the computer screen, which is a welcome relief to be honest! After all, life does exist outside of the markets and accompanying madness!

Oh and by the way, it is SWARMING season for the honeybees up in this neck of the woods. Chasing those down requires time away from the computer screen, which is a welcome relief to be honest! After all, life does exist outside of the markets and accompanying madness!

Saturday, June 2, 2012

Trader Dan on King World News Markets and Metals Wrap

Please click on the following link to listen in to my regular weekly radio interview with Eric King of King World News on the Markets and Metals Wrap program as we discuss this past week's action in the gold and silver markets.

http://tinyurl.com/8yaqlgs

http://tinyurl.com/8yaqlgs

Friday, June 1, 2012

The Futility of QE

This is an attempt to explain what I believe will be the futility of another round of Quantitative Easing on the part of the Federal Reserve to do anything more than to merely provide another TEMPORARY boost to paper assets and by consequence, a short-lived blip in consumer confidence. As such, it is going to be much to the point without any rhetorical flourishes or attempts at refined writing.

I do wish to start this brief piece by noting that I believe the Fed is indeed going to act, sooner rather than later, unless they want to witness a meltdown of the equity markets. Practically, for them to stand idly by and do nothing to prevent it would be irresponsible. Yet for all this, the effort is doomed to failure.

Consider the original purpose behind the Quantitative Easing programs – QE1 was designed to purchase Mortgage Backed Securities which had plummeted in value resulting in a serious degradation of the balance sheets of the major banks and firms that held them as assets.

These “assets” had been originally valued on the balance sheets by marking to model. When the credit crisis began in earnest in the summer of 2008, the world quickly learned that these model-based values were a fiction. The real “market” value of this paper was a fraction of what the banks were claiming.

In order to prevent the credit markets from locking up due to insufficient capital on the part of these large lenders, the Federal Reserve decided to be the buyer of last resort and provide a market for these securities, taking them off the books of the banks and substituting high-quality Treasuries in their place. The idea was to shore up the balance sheets of the banks and give them the ability to lend into the economy for both business and consumer needs.

At the time QE1 was embarked upon, the yield on the Ten Year note had fallen as low as 2.03%. The investment world reacted to QE1 by bidding up the price of both commodities and stocks and actually sending interest rates higher as the impact from this novel program was expected to be an inflationary one. Yields eventually reached 4% before falling back as the impetus from this first round of QE began to fade.

Fast forward to late 2010 – with the economy still sputtering and growth lagging, the Fed announced another round of Quantitative Easing, this time to the tune of approximately $900 billion. The express intention of this plan was to deliberately push down LONG TERM interest rates and increase the money supply in the hopes that it too would serve to stimulate business and consumer spending and borrowing.

At the time just prior to the commencement of QE2, the yield on the Ten Year had fallen as low as 2.33% as deflation fears were running wild once again. The S&P had lost 16% of its value in the matter of a few months time during the middle of 2010 leaving investors desperately seeking some sort of further action on the part of the Fed.

Oblige they did and once again the equity markets rallied as did the yield on the Ten Year which pushed back towards the ceiling of 4% as once again investors were anticipating an inflationary impact from the policy – which by the way it was deliberately designed to do. However, that was the peak in yields which began falling once again in early 2011 this time dropping below 2.0% before bouncing in a narrow range for a period of 7 months. The catalyst for this downward trend in rates was the knowledge by the entire investment world that the Fed was going to end QE2 in the month of June 2011. In other words, this was all it was going to get – look for nothing else.

Moving to the present time, as the European Sovereign debt crisis has worsened and the contagion effect has spread to China

Here is the point – the purpose behind both QE’s was to improve bank balance sheets thereby facilitating lending, keep longer term interest rates low to stimulate borrowing and ramp up the money supply to produce an inflationary impact to offset the deflationary impact of excessive levels of debt.

One could say that it worked; however, it was only temporary. Operation Twist, which was the last pseudo QE that consisted of rolling the proceeds from maturing short-term Treasuries into longer dated Treasuries, has been an enormous flop as it has provided next to nothing in the form of any inflationary impact.