Here is a look at the current ( as of this Friday ) positioning of the players in the copper market. As the regular reader will already know, I pay very close attention to two key markets - Copper and Crude Oil, when trying to ascertain what the sentiment is of investors/traders towards overall economic growth.

I recently posted a chart detailing the performance of the S&P 500 versus the Goldman Sachs Commodity Index showing the vast underperformance of the commodity sector against equities in general. My conclusion, based on that chart, was that global growth was mediocre at best and that stock market strength is more a function of Yield Chasing by speculative forces in a near Zero interest rate environment rather than evidence of a robust growing economy.

The shift in speculators, especially the large hedge funds, into playing copper from the short side, confirms that view in my own mind.

Notice earlier this year how upbeat the hedge funds were on the future prospects of copper. July of this year saw them very optimistic. Here we are a mere two months later and they have completely reversed sides and have moved to a net bearish position. That dichotomy between the "other large reportables" category and themselves has evaporated ( although the former category is in the process of covering existing short positions ).

What to make of this?

Take a look at the copper chart and tell me what you see here.

Does this chart even remotely resemble one that is the least bit bullish? Of course it does not. Copper is continuing in its now 3 1/2 year old bear market.

Highs are progressively lower and lows are getting lower. What this tells us is that global demand for copper is not keeping pace with the increases in supply. Another way of saying that, is global growth is not strong enough to generate sufficient demand for the red metal that will allow it to eat through the available supply.

That is hardly the thing out of which strong, runaway inflation pressures are born.

By the way, here is an updated chart of the overall commodity sector as of the close of trading this week. Again, I am using the Goldman Sachs Commodity Index or GSCI.

The sector notched a 27 month low this week.

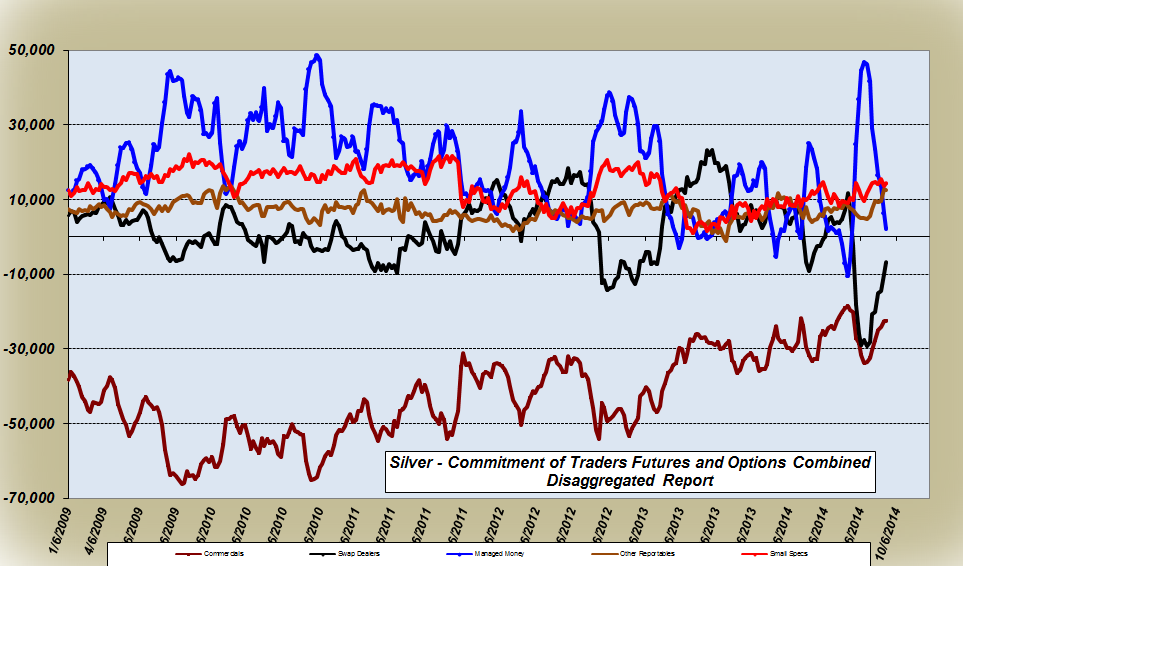

I have commented in the past that silver and copper tend to move in rather close sync.

Here is a chart of silver.

As you can see, the chart pattern is very similar to both the copper chart and the overall commodity sector, although silver has been bouncing around going nowhere for the last year.

What explains this lack of performance to the upside? Answer ' "Price manipulation" will scream the usual culprits. "The powers that be are actively working to manipulate the silver price lower!", they will breathlessly assert.

That is not the case however. Look at what the hedge funds are doing in there. They are abandoning the long side and beginning to move more towards the short side of this market as well, just like they have done with copper., and I might also add, a host of other individual commodity futures markets. I would guess, because this COT data only covers through Tuesday of this week and did not catch the fall through support near $18.60, that the hedge funds may now, as of this Friday, be net short in the market.

Keep these things in mind when you read outlandish predictions of roaring silver prices "any day now". Such claims are laughable at face value because they are based on NOTHING but someone's fevered imagination. Those who make such rash claims are exhibiting in full public, their apparent need for some sort of self-aggrandizement to make them stand out from the crowd. Serious traders will ignore such shills. Professionals DO NOT MAKE PREDICTIONS; they read the market and attempt to discern what it is saying.

For silver to turn around sharply, there will need to be some sort of catalyst in the form of a shift towards strong global growth, strong enough to generate inflation concerns and cause an inrush of money flows into the broader commodity sector. For the time being, that does not look to be on the radar screen.

How it handles this level near $18.60 will be critical. If it can hold near here, it will have a chance to reverse course and move back to try for a test of $20. Above that $21.50 stands as a huge hurdle to any further upside progress. At this point, the trend in silver is sideways to lower and unless we see something change on this chart, that is the way it looks as if it will continue.

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

There should be some sideways consolidation on Silver before the next range lower. $15 to $18 over the next few months looks highly likely.

ReplyDeleteThis comment has been removed by the author.

Deletehttp://stockcharts.com/h-sc/ui?s=slv&p=D&b=5&g=0&id=t61739848929&r=1408380799231&cmd=print

ReplyDeleteAlso, the 50 day is just begging to break through the 200 day here...

How do you know Bob? You say 'should be'. What has SHOULD got to do with it, and who is responsible for giving you this should? If you can predict these matters with such certitude you must be an incredibly rich man. What odds are 'highly likely? 75%? You can gamble everything you've got when you get a chance like that!

DeleteThis comment has been removed by the author.

DeleteThe trend is your friend. Look at the charts. Every 18 months we move to the next trading range lower on Silver since the 30% take-down in SI in late September of 2011 when 30% was Lost in 3 days! Then the April 2013 drop moved us into the most recent trading range and Now we are due for the next big drop. Look at the pattern...

DeleteI am not gambling every thing I got on this trend following through but I do plan on placing a trade when the charts tell me to put it on.

All things being equal, the BDI Logarithmic charts vs a host of commodities is pretty much a screaming buy or the commods are a screaming sell. Only mkt showing possible value is the beans, while definitely the most stretched is the S&P, now 66 months and counting. I guess we all play FOMC again next week. Enjoy your wknd everyone.

DeleteThe trend is your friend, but all things come to an end, especially when they are this mature. Better to get in early on in the trend, not when it is so advanced. Gold and silver could suddenly turn viciously upward without warning and for no discernible reason leaving you holding the bag.

DeleteSteve, I am inclined to agree with you, at least for next week. It looks very ominous indeed. If Ol' Yeller makes the slightest hint about interest rates rising soon all hell could break loose. But she knows that and might not be ready to take the risk, as a plunging stock market is the last thing she wants when the economy is so fragile. She has been testing the market's reaction to this through her minions and it doesn't look too happy.

DeleteBaltic Dry Index?

DeleteMike, http://www.investmenttools.com/futures/bdi_baltic_dry_index.htm

DeleteLdn shipping rates

Peter Dykes;

DeleteI am at a loss to explain why you are you bullish on the precious metals? They are grinding lower in a sideways to lower market. As far as a mature trend, neither one is in what I would call a sharp downtrend at the moment but rather a grinding move lower.

Make the case for a much weaker Dollar and the immediate concern shifting to fears of inflation and see if you can convince me.

For now, the charts point lower. There is no reason to buy either gold or silver based solely on the charts or on the fundamentals.

If things change, perhaps we can be astute enough to pick up on that.

Dan, I am not bullish. The short-term picture looks bad and the medium term I simply don't know. I am merely cautioning that the markets can be highly unpredictable, and just when you think you are on a cert, it comes round violently and slaps you in the face. I just sense (call it a hunch if you will and probably quite meaningless) that something rather nasty is about to happen.

DeleteLots of commodities crashed in price in the Great Depression. But gold was still revalued 40% higher.

ReplyDelete...until it was legislated in 1933 that all gold held by citizens had to be returned and sold to the US Treasury/Federal Reserve.

DeleteFor those of us holding bullion let's hope that doesn't happen again.

All the pols have to do is pass some type of emergency banking law or use the same type of pretext to do so when they invoked the "trading with the enemy act" in 1917 (or 1919).

If China tries to or successfully somehow converts the yuan into some type of gold backed currency (even if its actually never convertible into real gold) might they/China not someday fit that exact same "trading with the enemy act" stereotype that allows the US to once again legislate some type of new gold (and silver) act?

What if China someday seeks to weaken the USD and gold is somehow involved.

Wouldn't the US do anything they could (having already done so in 1933) to label China an enemy and then use the "trading with the enemy act" to stop people from selling their gold to anyone except the Treasury/Fed so that China has no possibility of ever buying US citizens gold through 3rd parties like Apmex etc?

I'm not labeling China an enemy but instead giving an example of potential US govt reasoning or excuses they might someday use to prohibit people from wildly profiting from their gold or silver bullion.

That's a lot of "if's" but the possibility the US uses some old and obscure "enemy trading act" at some point in the future seems probable.

Might it be about gold once again?

History tells us it's possible.

M, the crash came post WW1 and into the 20's for commods; actually the horrible Dust Bowl contributed to rallying prices for the grains and so forth, along with stks which bottomed in '32

DeleteGold chart and trading action is eerie of 1976 when gold made it's bottom:

ReplyDeletehttp://goldbugreport.wordpress.com/2014/04/10/is-history-repeating-today-like-1977/

Elijah;

DeleteThey are still way too many would be bulls in gold....

Trillions and trillions of dollars printed to try and create inflation and what does the Fed get as they taper it down but deflation again.

ReplyDeleteEither the Fed gives up and lets deflation win or the Fed is going to print more money then Bernanke ever did to try and create lasting inflation.

If USDX can stay capped at 85 then I'd say we have a 65% chance of a vicious rally in PM's along with copper.

ReplyDeleteHow far it goes I have no clue. What triggers it I have no clue.

But I'm putting my money with Dan and will proclaim "This is It! and It is Now for copper!", LOL.....Buy SCCO and FCX early next week.

If USDX gaps up and blows past 85 and gold goes even lower, then all bets are off.

Mark;

DeleteUS Dollar strength has confounded the gold perma bulls for some time now. They keep forgetting that the Dollar looks good when you compare it to the Euro, or the Yen, or for that matter, the Pound, if for some strange reason the Scots vote to secede.

The US is still the best place for money flows right now.

The Eurozone is a net creditor with no trade deficit. The ECB has expanded it's balance sheet by 11% since 2008. Fed is 70%. The EZ has 10,000 tons of gold.

DeleteThe Dollar is not the cleanest dirty shirt clearly. But we have to let this play out like usual

Lots of copper coming onstream from smaller mines and the big one in Indonesia is back in play after tax negotiations with the gov't.

DeleteAlso zinc, which the analysts have been very bullish on is going to lose the galvanized metal market in the auto ind. as trucks and suv's go to aluminum bodies.

M;

DeleteWhy is it that you seem to love to argue with the markets...?

It is about interest rate differentials.I have written about this so many times I have lost count. Money flows to where it obtains the best yield. The Eurozone is moving rates lower; The dollar zone is being prepared for higher rates. Whether we actually get those is an entirely different matter but it is sentiment which moves markets.

None of that stuff you mentioned means anything when it comes to trading currencies.

Why can you simply not just come here and learn something instead of arguing and being so bullheadedly wrong?

As far as gold going up when interest rates rise, that too is incorrect. Gold goes up when REAL INTEREST rates are falling. If the rate of inflation exceeds the return on risk free government Treasuries, then gold will rise. If not, gold will move lower when interest rates rise because the metal is a dead asset that pays no dividend.

That is not a difficult concept to grasp.

If the markets knew anything, the Fed wouldn't have had to bail Wall Street out. But they did. But now that they did that, a currency crisis is in the future. A currency crisis follows central bank balance sheet expansion like day follows night. This is a fact. There is no guess work here.

DeleteDuring that 10 year period of 1970-1980 the BoE increased it’s balance sheet (via the creation of money out of thin air) by some 300%. What effect did this have on the price of gold in the UK?

Gold went from £15 in 1980 to £371. This is a rise of 2500%.Now look at the Feds balance sheet. Tick tock tick tock

Just about everyday you can read about gold dropping because of rising interest rate fears. But wouldn't this be factored in by now..........why do they keep using this same reason every friggin' day???

ReplyDeletekjm;

Deleteit is about money flows... money is flowing out of gold and the precious metals in general. Look at what is happening with copper and with palladium as well.

It sounds like you are still long gold? Why? The chart is not telling you to be long.

Owning the physical metal is one thing but I hope you are not long at the Comex or in GLD.

Not one iota of money is flowing out of physical gold.

DeleteMoney is flowing out of wagers that the future of the price of gold will rise. And more people are wagering the price is falling. How much physical is changing hands ? Very little.

This comment has been removed by the author.

Delete"Not one iota of money is flowing out of physical gold."

DeleteThat's a big assumption on your part that NO ONE has or is selling physical gold.

How could you possibly know that as a fact?

M;

DeleteYou are proof positive of someone who is delusional when it comes to understanding markets.

Adios...

I gave you a chance to show some humility and learn something.

I am done with you at this site. all of your posts are to be subsequently deleted. One can not teach a fool wisdom.

Professionals DO NOT MAKE PREDICTIONS; they read the market and attempt to discern what it is saying.

ReplyDeleteHow to do this????????????

Who are we trying to kid here guys, deflation looks to have taken hold again around the world as QE ends as Dan's charts show, so the choices look to be quite obvious don't they?

ReplyDeleteIts Print more money or deflate. Is this incorrect?

Right now the US Fed is tapering as other countries are printing or easier, so US dollar is stronger.

Its just musical chairs between what country can print the most to devalue their currency it would seem.

Dan- looks like hedge funds are still long corn this week. Is that what you are seeing in the COT?

ReplyDeletehttp://www.barchart.com/chart.php?sym=ZC*0&style=technical&template=&p=DN&d=X&sd=&ed=&size=M&log=0&t=BAR&v=0&g=1&evnt=1&late=1&o1=&o2=&o3=&x=44&y=11&indicators=COTLC(13369344%2C26112%2C153)%3BCOTDLC(13369344%2C26112%2C153%2C16750848)&chartindicator_1_code=COTLC&chartindicator_1_param_0=13369344&chartindicator_1_param_1=26112&chartindicator_1_param_2=153&chartindicator_2_code=COTDLC&chartindicator_2_param_0=13369344&chartindicator_2_param_1=26112&chartindicator_2_param_2=153&chartindicator_2_param_3=16750848&addindicator=&submitted=1&fpage=&txtDate&sh=150=#jump

Trinity;

DeleteLook for my post on this.... I have not had a chance yet to get that up ( I was too busy trying to chase a view of the Northern Lights last evening ) but will soon...

By the way, those weather forecast guys with their predictions of excellent viewing conditions in my area of the country for the northern lights should be hung, drawn and quartered. Every single person up this way that lost sleep staying up until 1:30 Am to see them, saw nothing! They were not even visible over here.

Will do. I was living in AK for a while when working in the oil patch (the big oil patch) and enjoyed the seeing the Northern Lights.... The view is worth staying up for!

ReplyDeleteNo Dan, I don't own gold, physical or etf style, but I do like to maintain a core of miners and thus my interest in gold going up. There's not many sectors that can gallop to the upside like gold mining stocks when the conditions are right and there seems to always be at least one or two short lived rallies every year, so as long as I can discipline my self to cash out near the high, I will keep trading the miners. I keep a core of low cost producers for the insurance part.

ReplyDelete