"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

Tuesday, March 15, 2011

Nikkei Futures are moving off their Worst levels

While the Nikkei is not yet open for trading for Wednesday's session, the futures market is moving up off of the 8400 level.

It has obviously plummeted as it discounts the massive hit to the Japanese economy but it could be that traders are saying, "enough" for now. Of course, if the situation regarding the nuclear reactors were to worsen further, all bets are off; however, if the interprid Japanese can get those reactors under control, the Nikkei will probably commence a short covering rally with shorts booking profits under the idea that they have discounted the worse case scenario.

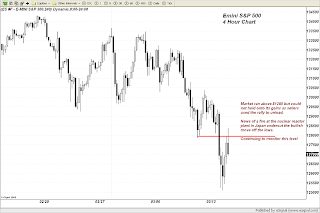

Were that to occur it would pull up the US equity markets and probably send money flowing back into the commodity complex as longer term, demand for many commodities is going to be on the rise due to the amounts required for reconstruction purposes. Food stocks will also have to be replenished.

Gold and silver would then rebound sharply. Stay tuned as events unfold.

It has obviously plummeted as it discounts the massive hit to the Japanese economy but it could be that traders are saying, "enough" for now. Of course, if the situation regarding the nuclear reactors were to worsen further, all bets are off; however, if the interprid Japanese can get those reactors under control, the Nikkei will probably commence a short covering rally with shorts booking profits under the idea that they have discounted the worse case scenario.

Were that to occur it would pull up the US equity markets and probably send money flowing back into the commodity complex as longer term, demand for many commodities is going to be on the rise due to the amounts required for reconstruction purposes. Food stocks will also have to be replenished.

Gold and silver would then rebound sharply. Stay tuned as events unfold.

FED on Track for more QE2

The big non-news of the day outside of the developments in Japan was the FOMC's press statement maintaining the status quo of low interest rates and a continuation of the QE2 purchases through the end of June.

Given the fact that there is a lag between the time of their meeting and the actual release of the FOMC minutes, it is safe to say that events in Japan now totally overwhelm whatever the FOMC was looking at prior to the horrific earthquake that has shattered the lives of so many of those suffering on the battered island.

While the Fed has seen the US bond market rally sharply as a result of both the events in MENA and those in Japan, the falling interest rates that have resulted are not especially what they were hoping for given the collapse in global equity markets.

With many tossing out 2008 as a comparison to what could happen to prices in general if the hedge funds continue their barrage of selling, the Fed will no doubt be closely watching the level of the US stock market. They are probably a bit pleased to see the mauling occuring in the commodity sector but not with the plunge in the equities. They will not let a repeat of 2008 occur on their watch and will do whatever is necessary to provide sufficient liquidity to prevent it.

Given the fact that there is a lag between the time of their meeting and the actual release of the FOMC minutes, it is safe to say that events in Japan now totally overwhelm whatever the FOMC was looking at prior to the horrific earthquake that has shattered the lives of so many of those suffering on the battered island.

While the Fed has seen the US bond market rally sharply as a result of both the events in MENA and those in Japan, the falling interest rates that have resulted are not especially what they were hoping for given the collapse in global equity markets.

With many tossing out 2008 as a comparison to what could happen to prices in general if the hedge funds continue their barrage of selling, the Fed will no doubt be closely watching the level of the US stock market. They are probably a bit pleased to see the mauling occuring in the commodity sector but not with the plunge in the equities. They will not let a repeat of 2008 occur on their watch and will do whatever is necessary to provide sufficient liquidity to prevent it.

The Dollar as a Safe Haven?

Given all the turmoil and market uncertainty associated with the tragedy in Japan, not to mention continued unrest across the MENA, it is again very telling that the US Dollar cannot seem to maintain any sort of strong safe haven bid.

Instead it is the Swiss Franc that is the main beneficiary of such flows.

We keep seeing this type of pattern during periods in which risk aversion is the order of the day. The Dollar initially gets the knee jerk safe haven bid and then runs out of steam as sellers look to take advantage of the rally. I am hesistant to be too dogmatic with all this insane volatility but I am wondering if we are already beginning to see the global investment community voting with their feet against the Dollar remaining as the sole reserve currency.

Instead it is the Swiss Franc that is the main beneficiary of such flows.

We keep seeing this type of pattern during periods in which risk aversion is the order of the day. The Dollar initially gets the knee jerk safe haven bid and then runs out of steam as sellers look to take advantage of the rally. I am hesistant to be too dogmatic with all this insane volatility but I am wondering if we are already beginning to see the global investment community voting with their feet against the Dollar remaining as the sole reserve currency.

Silver also hit by Hedge Fund money flows

Volume is enormous indicating the extent of the blind panic like selling. It is reminiscent of 2008 when hedge fund algorithms threw everything including the kitchen sink away.

I suspect those who were proclaiming the end of QE will be a lot quieter for a while.

I suspect those who were proclaiming the end of QE will be a lot quieter for a while.

Gold Temporary Victim of Hedge Fund Money Flows

Don't be unecessarily alarmed by the behavior of gold today. We have seen this before during times of hedge fund algorithms gone wild. It is the result of money flows, pure and simple. Once the machines are done their thing, the price will immediately rebound. There are very strong buyers who are more than content to let the funds sell into their hands.

Let's see if the support level down near $1380 can hold old yeller on the downside.

Let's see if the support level down near $1380 can hold old yeller on the downside.

Subscribe to:

Comments (Atom)