Take a look at the following Commitment of Traders chart detailing the huge number of speculators that are positioned on the Long side of the US Dollar. There was a large amount of talk about the Dollar embarking on a Bull market not all that long ago and that combined with the Flight out of the Euro sent huge numbers of these specs rushing into the Dollar.

When the Europeans rained on their parade this week, the bottom dropped out of the Greenback as there was no one on the other side of the market to buy the Dollar from these specs who were all frantically selling it at the same time.

If the risk trades continue, the Dollar is going to come under additional selling pressure which will likely drop it down into a major support zone on the chart. If that gives way, there exists an enormous amount of speculators who are going to get hurt very badly and will be selling frantically which just might be the firepower to crack this major support zone which has been holding for the last two years.

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

Friday, October 28, 2011

Weekly Silver Chart

Silver had a very impressive weekly performance gaining more than $4 for the week and managing to squeak out a close above the 50 week moving average.

You will note that it still remains below both the 10 week and the 20 week moving averages which continue heading lower so silver is not out of the woods just yet. One would ideally want to see the metal get above both of these moving averages and see the shorter term 10 week turn higher. That would give us a shift from bearish to bullish on the WEEKLY CHART.

Also, note that downsloping line drawn on the chart that comes in very close to the 10 week moving average. That reinforces this level as resistance that the bulls need to overcome.

The MACD has been a pretty good indicator at measuring the direction and "trendiness" of this market nad it has turned up from a deeply oversold zone. While still bearish it is moving in the right direction.

A push by silver past $37 that can hold that level will turn the tide firmly in favor of the bulls and target $40 for starters.

You will note that it still remains below both the 10 week and the 20 week moving averages which continue heading lower so silver is not out of the woods just yet. One would ideally want to see the metal get above both of these moving averages and see the shorter term 10 week turn higher. That would give us a shift from bearish to bullish on the WEEKLY CHART.

Also, note that downsloping line drawn on the chart that comes in very close to the 10 week moving average. That reinforces this level as resistance that the bulls need to overcome.

The MACD has been a pretty good indicator at measuring the direction and "trendiness" of this market nad it has turned up from a deeply oversold zone. While still bearish it is moving in the right direction.

A push by silver past $37 that can hold that level will turn the tide firmly in favor of the bulls and target $40 for starters.

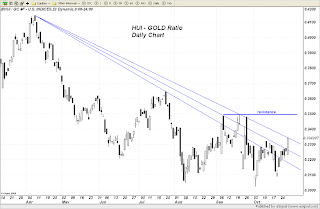

HUI technical chart

The HUI put on a spectacular showing this week gaining more than 65 points and taking out several overhead resistance levels on its price chart in the process. The catalyst seemed to be the positive response by the broader equity markets to news coming out of Europe regarding their bank recapitalization plan and their funding of the Stability Mechanism. While I am personally repulsed by such actions the facts are that the hedge fund community could not wait for the ink to dry on the press release before they began pouring money back into the Risk Trades.

The resultant rally in stocks fed into the gold mining shares with the HUI actually outperforming gold this week.

We will have to wait to see whether there is a continuance of these risk trades next week but from a technical perspective the strong price action bodes wells for additional gains early next week. That would put the index up against a strong overhead chart resistance level coming in near 595 and extending towards 600. The shares have been stymied near this level in the past so the bulls have a big test of resolve coming.

The push past the last Fibonacci Retracement level of note near 580 should allow the index to first test the level just a few point above today's high. Should the bulls take this out, then the run towards major resistance will commence.

If the index sets back, dip buyers should surface down near the 560 level and again near 545.

My thinking is if we are moving back towards a period when RISK TRADES are back in vogue, the HUI should continue to lead the metals and outperform gold in particular. Note on the chart it is close to decisively ending the downtrend against the gold price. If the shares are going to eventually take a leading role then the horizontal resistance level noted on this ratio chart will need to be bested.

As a side note, that we are seeing some companies in this sector raising their dividends is a good sign and indicates that their management feels that earnings are strong enough to do so and should remain so for the foreseeable future. In other words, they are optimistic on future price prospects for the metal. That is also a sign that we should expect to begin seeing or hearing about planned aquistions by some of the majors or even larger mid-tiers as they look to increase their reserves. That should support the juniors which are of high-quality. This might be occurring already based on the ratio of the GDX to the GDXJ (major to juniors).

Note that since May of this year the majors have been outperforming the juniors as a whole. Beginning late last month (September) that began to change. Apparently some are already sniffing this change and are thinking acquisitions based on the profitability of the larger miners in the sector.

The resultant rally in stocks fed into the gold mining shares with the HUI actually outperforming gold this week.

We will have to wait to see whether there is a continuance of these risk trades next week but from a technical perspective the strong price action bodes wells for additional gains early next week. That would put the index up against a strong overhead chart resistance level coming in near 595 and extending towards 600. The shares have been stymied near this level in the past so the bulls have a big test of resolve coming.

The push past the last Fibonacci Retracement level of note near 580 should allow the index to first test the level just a few point above today's high. Should the bulls take this out, then the run towards major resistance will commence.

If the index sets back, dip buyers should surface down near the 560 level and again near 545.

My thinking is if we are moving back towards a period when RISK TRADES are back in vogue, the HUI should continue to lead the metals and outperform gold in particular. Note on the chart it is close to decisively ending the downtrend against the gold price. If the shares are going to eventually take a leading role then the horizontal resistance level noted on this ratio chart will need to be bested.

As a side note, that we are seeing some companies in this sector raising their dividends is a good sign and indicates that their management feels that earnings are strong enough to do so and should remain so for the foreseeable future. In other words, they are optimistic on future price prospects for the metal. That is also a sign that we should expect to begin seeing or hearing about planned aquistions by some of the majors or even larger mid-tiers as they look to increase their reserves. That should support the juniors which are of high-quality. This might be occurring already based on the ratio of the GDX to the GDXJ (major to juniors).

Note that since May of this year the majors have been outperforming the juniors as a whole. Beginning late last month (September) that began to change. Apparently some are already sniffing this change and are thinking acquisitions based on the profitability of the larger miners in the sector.

Subscribe to:

Comments (Atom)