Yesterday my pal, Turd Ferguson, the owner and proprietor of TF Metals Report site, was gracious enough to do one of his now famous podcast interviews, with yours truly as his latest victim ( excuse me - that was a typo Turd - I was supposed to write 'guest' :o) ).

Seriously - the interview was a lot of fun for me personally but more importantly, we both hope it is helpful to those who are perhaps interested in some of the pitfalls that would-be traders face as they attempt to navigate through today's wildly volatile markets.

We covered quite a bit of ground about trading in general as well as sharing some personal thoughts about the problems facing the United States as we move forward into the future.

Stop by Turd's site and check out the interview when you can or click on the following link which will take you directly there.

http://www.tfmetalsreport.com/podcast/3537/tfmr-podcast-15-trader-dan-norcini

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

Friday, March 16, 2012

Thursday, March 15, 2012

Gold holding near $1640

The Yellow Metal attracted some short covering and some buying related to bargain hunting in today's session as apparently buying was of sufficient size to convince some of the shorts that the market was through going down for right now. After a drop of $85 in a few days, some decided that it was time to ring the cash register and grab a few profits.

It looks like a few light stops were run once the market took out $1660 but after those were filled, price retreated a bit lower and is currently below that level.

For me to become convinced that a short term bottom is in this market, we will need to see the price close back through the $1680 level once again. You might remember from yesterday's charts posted over at King World News within my recent interview, the 200 day moving average comes in very near that level.

For the time being I am hesitant to read too much into a single day's action.

The Dollar is moving lower today and I want to see whether or not this is a one day wonder or if it is going to try to mount a push back towards 82 on the USDX.

The S&P 500 continues on its near one-way trek higher scoring another fresh 52 week high in the process. I do not know about you, but I for one am glad that it was so easy to fix everything ailing the US economy by keeping interest rates near zero. I am waiting for the day when the Fed announces it is going to distribute checks to all taxpaying citizens in the amount of $10,000 each as part of its efforts to combat deflationary pressures.

The HUI continues getting beaten up as it is lower on the day even while the rest of the equity market leaves it in the dust. The sector is so undervalued against the broader market that it screams for someone to buy it but the discouragement is so strong that hardly any want to touch the miners for fear of further losses. The ratio of the HUI to the S&P 500 touched a nearly three year low today!

Silver

It looks like a few light stops were run once the market took out $1660 but after those were filled, price retreated a bit lower and is currently below that level.

For me to become convinced that a short term bottom is in this market, we will need to see the price close back through the $1680 level once again. You might remember from yesterday's charts posted over at King World News within my recent interview, the 200 day moving average comes in very near that level.

For the time being I am hesitant to read too much into a single day's action.

The Dollar is moving lower today and I want to see whether or not this is a one day wonder or if it is going to try to mount a push back towards 82 on the USDX.

The S&P 500 continues on its near one-way trek higher scoring another fresh 52 week high in the process. I do not know about you, but I for one am glad that it was so easy to fix everything ailing the US economy by keeping interest rates near zero. I am waiting for the day when the Fed announces it is going to distribute checks to all taxpaying citizens in the amount of $10,000 each as part of its efforts to combat deflationary pressures.

The HUI continues getting beaten up as it is lower on the day even while the rest of the equity market leaves it in the dust. The sector is so undervalued against the broader market that it screams for someone to buy it but the discouragement is so strong that hardly any want to touch the miners for fear of further losses. The ratio of the HUI to the S&P 500 touched a nearly three year low today!

Silver

Wednesday, March 14, 2012

Bond Collapse Continues

Much to the chagrin of the Federal Reserve, bond traders are taking that FOMC statement from yesterday and taking no prisoners as they literally hammer the long bond into submission. I find it a bit ironic (to be honest I am gleeful about it) that the Fed, which continues its attempts to manipulate hedge fund behavior by herding them into the equity markets, has opened an enormous can of worms and awakened the heretofore comatose bond vigilantes as an undesirable chain reaction to their "peachy" statement about the state of the US economy.

Bond traders are already moving the Fed Funds Futures to indicate interest rate hikes in early 2014, and not the latter part of 2014 as those minutes revealed yesterday. Worse, the yield on the Ten Year has spiked. It started off the week at 2.04% and ended today at 2.27%. As for the long bond, forgettaboutit; it was absolutely pummelled today now having dropped over 3 1/2 points the last two days.

What has happened is very simple - the happy talk about the US economy coming out of the FOMC minutes has traders jettisoning safe haven trades and even short term Treasuries in favor of the bull train leaving the station in the US equity markets. The problem? The last thing that the Fed and the US government needs or wants is a rising interest rate environment.

Oh sure, they can stand a bit of a move higher, but if any of this begins filtering into the mortgage market and the cost of home mortgages, autos, etc. begins moving higher, it will nip whatever nascent recovery there might be in the bud. And don't forget - there is that pesky "LITTLE" issue of the US national debt which will cost more federal tax revenue to service in a rising interest rate environment. Remember, even with its more upbeat assessment of the US economy yesterday, the FOMC certainly did not suggest that the recovery was robust or was it healthy. What they basically said, if I might paraphrase, was that it was showing modest improvement but was not out of the woods.

Doesn't matter - the bond market is focused on the "modest improvement" part and is interpreting that, either rightly or wrongly, that the Fed is not going to be doing any QE in the immediate future. After all, if things are supposedly so firmly on the right track, why the heck does anyone want to be in a "SAFE HAVEN" Treasury when everything is peachy keen, particularly if those paper IOU's are paying out squat.

The Fed has basically undercut it own low interest rate policy by giving investors the greenlight to sell bonds in order to deploy those funds into the equity markets. See what happens when you engineer a stock market rally?

I suspect that the Fed is going to be getting increasingly nervous if this sell off in the bonds, particularly the long end, continues unabated. Let's see how far the bond bears will push them.

By the way, I am not posting any gold or silver charts today as Eric King over at King World News, was gracious enough to interview me on both markets today asking about the technicals on the metals. You can find charts there with my usual annotations where support and resistance can be located. Here is the link to that particular interview:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/3/14_Norcini_-_Rough_Day_for_Gold_%26_Silver,_But_Heres_Good_News.html

Bond traders are already moving the Fed Funds Futures to indicate interest rate hikes in early 2014, and not the latter part of 2014 as those minutes revealed yesterday. Worse, the yield on the Ten Year has spiked. It started off the week at 2.04% and ended today at 2.27%. As for the long bond, forgettaboutit; it was absolutely pummelled today now having dropped over 3 1/2 points the last two days.

What has happened is very simple - the happy talk about the US economy coming out of the FOMC minutes has traders jettisoning safe haven trades and even short term Treasuries in favor of the bull train leaving the station in the US equity markets. The problem? The last thing that the Fed and the US government needs or wants is a rising interest rate environment.

Oh sure, they can stand a bit of a move higher, but if any of this begins filtering into the mortgage market and the cost of home mortgages, autos, etc. begins moving higher, it will nip whatever nascent recovery there might be in the bud. And don't forget - there is that pesky "LITTLE" issue of the US national debt which will cost more federal tax revenue to service in a rising interest rate environment. Remember, even with its more upbeat assessment of the US economy yesterday, the FOMC certainly did not suggest that the recovery was robust or was it healthy. What they basically said, if I might paraphrase, was that it was showing modest improvement but was not out of the woods.

Doesn't matter - the bond market is focused on the "modest improvement" part and is interpreting that, either rightly or wrongly, that the Fed is not going to be doing any QE in the immediate future. After all, if things are supposedly so firmly on the right track, why the heck does anyone want to be in a "SAFE HAVEN" Treasury when everything is peachy keen, particularly if those paper IOU's are paying out squat.

The Fed has basically undercut it own low interest rate policy by giving investors the greenlight to sell bonds in order to deploy those funds into the equity markets. See what happens when you engineer a stock market rally?

I suspect that the Fed is going to be getting increasingly nervous if this sell off in the bonds, particularly the long end, continues unabated. Let's see how far the bond bears will push them.

By the way, I am not posting any gold or silver charts today as Eric King over at King World News, was gracious enough to interview me on both markets today asking about the technicals on the metals. You can find charts there with my usual annotations where support and resistance can be located. Here is the link to that particular interview:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/3/14_Norcini_-_Rough_Day_for_Gold_%26_Silver,_But_Heres_Good_News.html

Tuesday, March 13, 2012

Platinum regains its premium to Gold

For the last six months or so, platinum has been trading at a discount to gold. This is a rare occurrence as one can see from a glance at the monthly chart going back to 1990. Only in 1991 did platinum trade at a discount to the price of gold. Late last year and early into this year, an ounce of the white metal was over $200 cheaper than an ounce of gold!

This came about due to fears that the global economy would slow down as European sovereign debt woes sent out a type of contagion rippling across the planet. Auto sales especially would be hit and since platinum is heavily used in catalytic converters, ideas spread that demand for the metal would falter.

If you notice however, platinum has been steadily gaining ground against gold as investors began anticipating Central Bank liquidity injections to deal with the pesky debt issues plaguing Europe, not to mention an ultra low interest rate environment which was intended to spur both borrowing and lending and by consequence, growth.

It also did not hurt that a major strike in an important platinum mine popped up cutting off supply from the world market.

This is another one of those combination indicators that can be used to gauge investor sentiment towards the global economy in general. As long as traders feel that there is little to fear as impediements to growth, they will bid this spread higher in favor of platinum.

This came about due to fears that the global economy would slow down as European sovereign debt woes sent out a type of contagion rippling across the planet. Auto sales especially would be hit and since platinum is heavily used in catalytic converters, ideas spread that demand for the metal would falter.

If you notice however, platinum has been steadily gaining ground against gold as investors began anticipating Central Bank liquidity injections to deal with the pesky debt issues plaguing Europe, not to mention an ultra low interest rate environment which was intended to spur both borrowing and lending and by consequence, growth.

It also did not hurt that a major strike in an important platinum mine popped up cutting off supply from the world market.

This is another one of those combination indicators that can be used to gauge investor sentiment towards the global economy in general. As long as traders feel that there is little to fear as impediements to growth, they will bid this spread higher in favor of platinum.

Complacency Index hits 45 month low in today's trade

I like to term the VIX or the CBOE Volatility Index, the Complacency Index, because it is an excellent gauge of whether or not traders are complacent or fearful. The higher the reading, the more fearful or worried they have become. The lower this index reads, the more complacent or careless they generally are.

One has to go back a period of 45 MONTHS (June 2007) to find investor psychology at these levels of complacency in regards to the broad stock market as indicated by the S&P 500. I should point out that this was one year prior to the credit meltdown of the summer of 2008. It would currently seem that hardly anyone on the planet is the least bit concerned about the level of the US equity markets due to the enormous amounts of Central Bank supplied liquidity.

I intend to keep posting this index at regular periods to keep an eye on this as I believe investors are growing very careless in regards to the potential for an apple cart upsetting event.

Something about this just does not "feel" right to me. While one cannot argue with the tape, or in this case, the charts, the fact that all of the woes tied to the enormous amounts of indebtedness in the West have essentially been papered over, is extremely disconcerting.

One has to go back a period of 45 MONTHS (June 2007) to find investor psychology at these levels of complacency in regards to the broad stock market as indicated by the S&P 500. I should point out that this was one year prior to the credit meltdown of the summer of 2008. It would currently seem that hardly anyone on the planet is the least bit concerned about the level of the US equity markets due to the enormous amounts of Central Bank supplied liquidity.

I intend to keep posting this index at regular periods to keep an eye on this as I believe investors are growing very careless in regards to the potential for an apple cart upsetting event.

Something about this just does not "feel" right to me. While one cannot argue with the tape, or in this case, the charts, the fact that all of the woes tied to the enormous amounts of indebtedness in the West have essentially been papered over, is extremely disconcerting.

Gold crashes through support at $1680

With the mass exodus out of safe haven trades today and into stocks, gold is being sold off with the idea of taking those funds and plowing them into the equity markets to catch the rising tide.

The result of this long liquidation has been a breach of a very important downside support level near $1680 on the charts. The market is holding within the support zone noted that extends down past this level but it will be critical to the metal to hold today's low and last week's low if it is to prevent a further bout of long liquidation that could very quickly take it down to $1620 or even lower.

Keep in mind that the short term oriented traders are now looking at getting long the broader equity markets, particularly tech, and are thus reducing exposure to gold. It is going to be a challenge for the metal to maintain its footing as long as the "GET LONG EQUITIES" mentality is in vogue.

The Dollar is a bit higher today but that is not the main driver for gold in this session; rather it is the theme of getting long equities that is dominating. The Fed has been successful, FINALLY, in herding the hedge funds and other large institutions into equities and they are going to ride this bull as long as they possibly can. Those fearing contagion effects from European Sovereign Debt woes have been overrun by the sheer amounts of liquidity being provided.

As it stands now, even the massive build in overall US indebtedness is no where remotely near the forefront of traders' minds.

The result of this long liquidation has been a breach of a very important downside support level near $1680 on the charts. The market is holding within the support zone noted that extends down past this level but it will be critical to the metal to hold today's low and last week's low if it is to prevent a further bout of long liquidation that could very quickly take it down to $1620 or even lower.

Keep in mind that the short term oriented traders are now looking at getting long the broader equity markets, particularly tech, and are thus reducing exposure to gold. It is going to be a challenge for the metal to maintain its footing as long as the "GET LONG EQUITIES" mentality is in vogue.

The Dollar is a bit higher today but that is not the main driver for gold in this session; rather it is the theme of getting long equities that is dominating. The Fed has been successful, FINALLY, in herding the hedge funds and other large institutions into equities and they are going to ride this bull as long as they possibly can. Those fearing contagion effects from European Sovereign Debt woes have been overrun by the sheer amounts of liquidity being provided.

As it stands now, even the massive build in overall US indebtedness is no where remotely near the forefront of traders' minds.

S&P breaks out to new 52 week high while Bonds plummet

Last week I posted a chart of the S&P 500 wondering if a top was in this market. Apparently not, said the bulls, who have proceeded to take this market higher for the last 5 days in a row. Today they took the price to a new 52 week high. Isn't it amazing what a "bit" of Central Bank supplied liquidity can get ya?

Unfortunately for the Fed, bond traders are not being particularly cooperative today as they are slamming the long bond lower, particularly as they digest the day's FOMC statement which repeated, once again, the committee's intent on keeping short term rates extremely low until late in 2014!

Money is thus fleeing out of the longer term Treasury market and plowing into stocks as investors are all gleefully leaping onto the equity bull train before it leaves the station without them. With extremely low yields as far as the eye can see and the Central Banks papering over all that ails the global economy, traders are being herded into stocks, which is exactly where the monetary authorities want them to be!

Money has also been flowing out of the gold market today as safe haven trades involving gold are being taken off as well. Apparently the theme today is "GO FOR THE GROWTH". Copper is certainly acting as if traders are convinced the global economy is back on its feet and blue skies lie ahead.

I should note that the Dollar is moving higher today not based on the risk aversion trades (the Japanese Yen is getting blasted lower which would not be the case if the risk aversion trades were back on) but rather on the idea that the US economy is going to be stronger than Euroland or Japan.

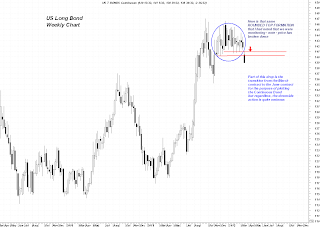

The bond breakdown is extremely significant in my opinion. A while ago I posted a MONTHLY CHART of the LONG BOND detailing some technical action. I am reposting that same chart with the current action now charted. Whether the monetary authorities like it or not, long term interest rates have begun rising. If they close the week out below the technical support levels noted, momentum players will begin taking on short positions in an attempt to drive the bonds even lower. There are an awful lot of players on the LONG SIDE of the bond market who have been counting on the Fed to put a floor in this market. It is going to be one nifty trick for the monetary masters to keep the equities soaring higher and preventing the bonds from falling apart.

Unfortunately for the Fed, bond traders are not being particularly cooperative today as they are slamming the long bond lower, particularly as they digest the day's FOMC statement which repeated, once again, the committee's intent on keeping short term rates extremely low until late in 2014!

Money is thus fleeing out of the longer term Treasury market and plowing into stocks as investors are all gleefully leaping onto the equity bull train before it leaves the station without them. With extremely low yields as far as the eye can see and the Central Banks papering over all that ails the global economy, traders are being herded into stocks, which is exactly where the monetary authorities want them to be!

Money has also been flowing out of the gold market today as safe haven trades involving gold are being taken off as well. Apparently the theme today is "GO FOR THE GROWTH". Copper is certainly acting as if traders are convinced the global economy is back on its feet and blue skies lie ahead.

I should note that the Dollar is moving higher today not based on the risk aversion trades (the Japanese Yen is getting blasted lower which would not be the case if the risk aversion trades were back on) but rather on the idea that the US economy is going to be stronger than Euroland or Japan.

The bond breakdown is extremely significant in my opinion. A while ago I posted a MONTHLY CHART of the LONG BOND detailing some technical action. I am reposting that same chart with the current action now charted. Whether the monetary authorities like it or not, long term interest rates have begun rising. If they close the week out below the technical support levels noted, momentum players will begin taking on short positions in an attempt to drive the bonds even lower. There are an awful lot of players on the LONG SIDE of the bond market who have been counting on the Fed to put a floor in this market. It is going to be one nifty trick for the monetary masters to keep the equities soaring higher and preventing the bonds from falling apart.

One last chart - yes, you did just dream that the US underwent a credit crisis - relax - everything that led to that has been fixed!

Monday, March 12, 2012

Market Complacency is on the Rise

The following chart is of the CBOE's Volatility Index, or the VIX as it is generally referred to by traders and investors. It is used to gauge investor sentiment in general. Sharp spikes are evidence of RISING FEAR associated with global or domestic economic concerns while low readings indicate a relative state of complacency among investors. In the past these spikes higher have proved to have been good buying opportunities since they have heralded the onset of Central Bank LIQUIDITY MEASURES to combat deflationary headwinds.

While this indicator is generally not very good for picking tops (notice how long it remained mired below 15 during 2005 - 2007) it does serve to show how quickly Central Bank actions have eased investor worries. Notice the periods during which QEI and then QEII were underway and how that monetary easing sent the index lower. Investors were willing to ignore all the deep-seated structural issues ailing the Western economies (DEBT, DEBT and MORE DEBT, low employment, falling real estate prices, rising costs, etc.) as long as the Fed was keeping the money spigots open. NO WORRIES MATE - the FED HAS OUR BACK was the motto.

It will be interesting to see how this index responds as we move further into the year and as events unfold. It is generally true that there is a lull before the storm - we'll see.

Subscribe to:

Posts (Atom)