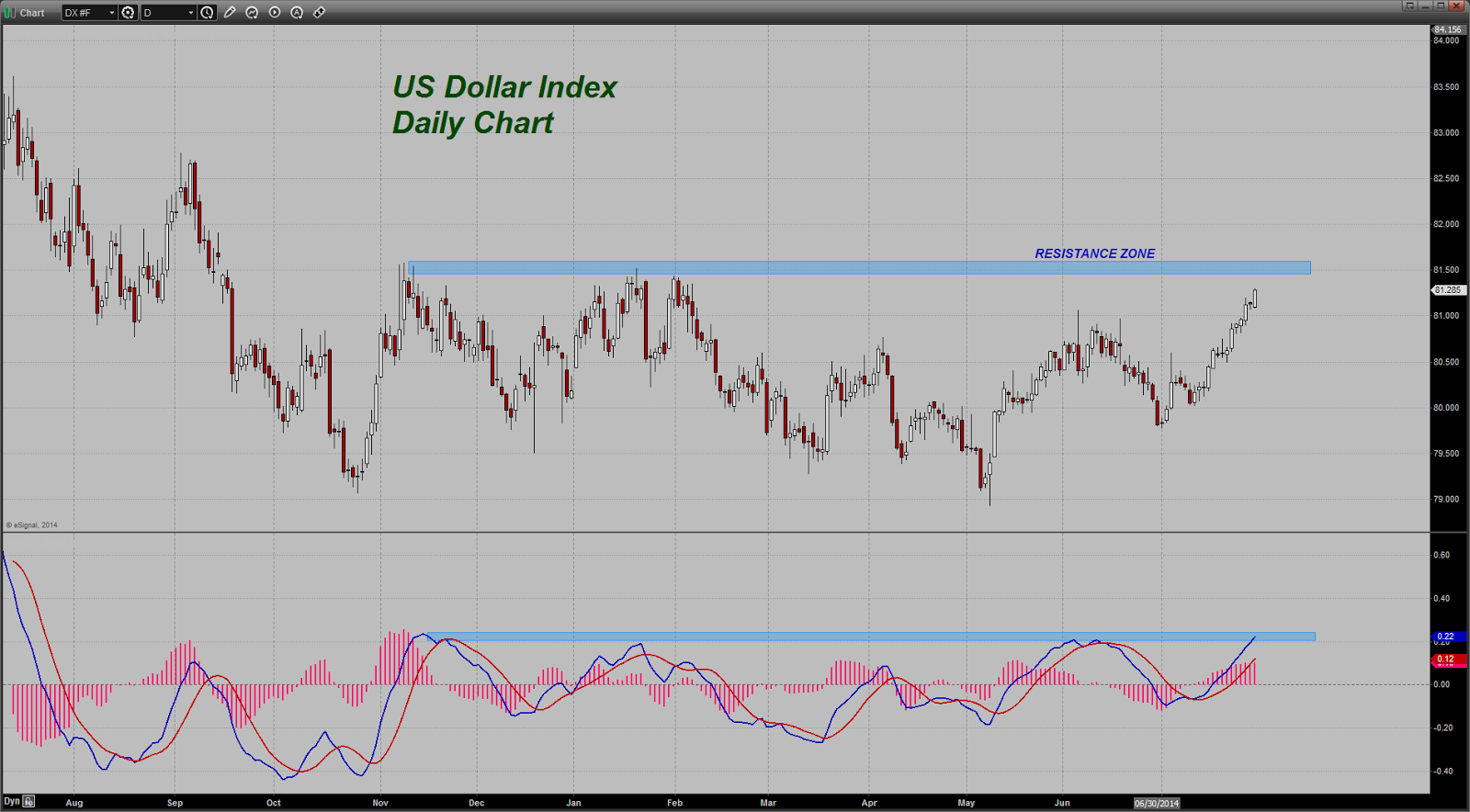

Since November of last year, the US Dollar has been thwarted from beginning any sort of upward trending move by the region near 81.50 on the USDX. It is once again moving towards a showdown with this critical chart region. Can the Greenback blast through and start a stronger trending move or will it merely bounce off and move lower once more? Stay tuned.

Seeing that the Euro comprises over half of the USDX, we are keeping a close eye on the currency. Ever since Draghi began his campaign of talking it down when it was near 1.40, the Euro has struggled to maintain any sort of bullish momentum for long. The reason has to do with interest rates - traders are convinced that the next move by the Fed in raising rates will be well ahead of any move by the ECB to raise rates in the Eurozone. Simply put, while the Fed is talking about curbing monetary liquidity measures over here in the US, the conversation in the Euro zone has been whether to become more aggressive over monetary liquidity measures over there. Such sentiment favors the Dollar over the Euro.

The currency is approaching a psychological round number support zone near 1.340. Failing to hold here would set it up for a further drop down towards 1.330.

The ADX is above the key 30 level and is continuing to rise indicating the presence of a strong trending move lower at this time.

One has to wonder if gold would be able to hold $1280 should the Euro fall accelerate. In my view the only thing currently holding gold higher is geopolitical tension. Were it not for those events ( and who knows how all this is going to end) gold would be lower, especially with the Dollar strength we are witnessing. Those events should continue to bring some safe haven buying into the yellow metal for the time being which will work to mitigate any sharp drops in price that could occur.

Meanwhile, the commodity sector ( overall ) continues to display weakness. Falling crude oil prices ( it has been unable to break out above former resistance near $105), falling grain prices ( for today), and weakness in some of the softs and hogs, are pulling it lower. Silver is bucking the lower trend in commodities today for some reason. Frankly, I do not know why nor do I care. That metal tends to live it in its own little world. There might be some copper/silver spreads being unwound which is benefitting it today at the expense of copper.

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

omg, Bo Polny was wrong again... :)

ReplyDeleteit can not be ….

ReplyDeleteimagine you already paid him 20.000 $. What do you do now? lol :)

DeleteBetter subscribe twice to the WSOP Poker, right?

and Hubert, your friend Armstrong must have made another typo in a recent post because he is charging $950 for his latest World Conference Deal. I thought he said he doesn't need any $. Oh well, oh well

Deletebut Steve, it includes a powerpoint slide presentation.

DeleteBah look, it's the business world : after all, in every domain, you have such events with participation to a seminar, conference, etc... and usually for even much more than 1000 $.

As long as he keeps his blog for free, I won't criticize his attempt to make some money above it. Simply let him stop pretending it's because of the food expenses (surely the shrimps :)) and he makes no money from it :)

Eur Usd at 1.34 and imho pretty close to a short term upwards correction of the 1.36-1.34 move down imho. But with daily ema15 and ma20 heading down quickly, it's a confortable position.

Hubert, I agree with you on Armstrong. He has opinions on everything under the sun and often I agree with his thoughts, but in terms of that translating into good trades I would not be so confident. Your Euro trade looks right. One thing I do believe in is that if the ptb want to bury their currencies, they WILL. Witness Abe and the Yen dropping from 1.30 futures to current .98 and going sideways all year now. Like I said years ago when I first talked to you, the Euro may go away entirely. Good luck today!!

Delete"Silver is bucking the lower trend in commodities today for some reason. Frankly, I do not know why nor do I care. That metal tends to live it in its own little world."

ReplyDeleteThat is classic Dan. Norcini. You are the best! I love your blog.

Abbey;

Deletethank you Abbey!

Dan

Dan,

ReplyDeleteAre you sensing the move in the Dollar not just vs the EUR but other majors too that we may be on the cusp of a major risk off move in the markets? It's about time we have one of these...

JL

Jesse L;

DeleteI honestly do not know. The long bond has been slowly working higher suggesting that if there is any concern about inflation, it sure ain't in the bond market. Money could be rotating out of equities and into bonds but right now I cannot see it with the S&P a mere 20 points off its all time high. Commodity indices moving lower so no inflation on that front.

A big risk off move would see selling hit the equities in a larger way I would think. Also, I think we will see it reflected in the Yen in a strong upward pop. For some reason that currency has now become a safe haven. If you look at its chart, it is essentially grinding sideways since February of this year.

When we had the big risk aversion panic back in 2008, the Aussie got slammed hard. If you look at that chart as well, it too is not showing much movement.

I am just watching and trying to figure out what comes next like everyone else.

Big 4% GDP number today will disrupt analysis for a day or two.

DeleteI am enjoying the permadoomers whining and crying about the GDP number this morning. "Fake! Fake! It's all fake!" LOL.

ReplyDeleteWhatsamatter boys, get caught short stocks and long gold again?

Dollar bears are getting pole-axed today, as there continues to be a mad panic rush to buy any and all U.S. Dollars, no matter how many currency deals are struck.

ReplyDeleteHands down the USA is the place to be now, as the economic boom is just now starting.

I surely hope you are right. A a business person it just doesn't feel like a rapidly growing economy. More likely this is "spring back" from the first quarters freeze/not so hot economy.

DeleteOne has to wonder what is in store come October if the punch bowl is finally removed. The market participants weren't too happy about that in the past QE "party is over for now" events.

Delete