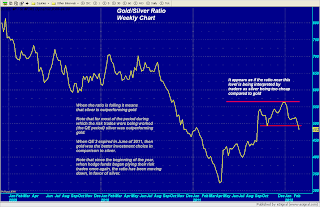

See the following chart and the comments therein.

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

Tuesday, February 28, 2012

HUI still stuck below resistance

Gold and silver mining shares are moving higher today, especially silver shares, but the HUI is still lagging from a technical analysis perspective. It just cannot seem to clear this stubborn level near the 555-560 region.

If you note on the chart, this band of horizontal resistance also corresponds exactly with the downside gap that opened up in early December of last year. This gap is currently serving as a barrier for further upside progress.

We will have to watch to see whether bulls in mining shares are feeling confident enough to try to mark these things up agains the hedge fund ratio spread traders. One would have expected a better performance in these seriously undervalued shares especially with silver's sharp rally through resistance at $35.50 and gold's ability to remain above $1780. So far, nothing doing.

If you note on the chart, this band of horizontal resistance also corresponds exactly with the downside gap that opened up in early December of last year. This gap is currently serving as a barrier for further upside progress.

We will have to watch to see whether bulls in mining shares are feeling confident enough to try to mark these things up agains the hedge fund ratio spread traders. One would have expected a better performance in these seriously undervalued shares especially with silver's sharp rally through resistance at $35.50 and gold's ability to remain above $1780. So far, nothing doing.

All Boats Rising?

Take a look at the following set of charts and see if it leaves you as confused as I am.

First the broader stock market as indicated by the S&P 500:

Now comes the commodity complex as illustrated by the Continuous Commodity Index:

Lastly comes a chart of the US long bond:

The rising stock market is supposedly the outcome of an improving economy, or so we are assured by all the experts. The economic recovery is evidently proceeding "so well" that the S&P 500 just made a brand new 52 week high in today's session and is now amazingly back at the exact same level it was prior to falling off a cliff in the summer that the 2008 credit crisis erupted. I guess we can all relax now since obviously the entire fallout from that fiasco is now behind us... or is it?

First the broader stock market as indicated by the S&P 500:

Now comes the commodity complex as illustrated by the Continuous Commodity Index:

Lastly comes a chart of the US long bond:

The rising stock market is supposedly the outcome of an improving economy, or so we are assured by all the experts. The economic recovery is evidently proceeding "so well" that the S&P 500 just made a brand new 52 week high in today's session and is now amazingly back at the exact same level it was prior to falling off a cliff in the summer that the 2008 credit crisis erupted. I guess we can all relax now since obviously the entire fallout from that fiasco is now behind us... or is it?

I am being sarcastic here since what we are seeing is the effects of liquidity splashing all over the entire US economy. It is that factor that is sending hot money into not only the equity markets but also the commodity markets and is pushing up the cost of tangibles once again. Rest assured that once these hedge fund money flows begin intensifying even further into the commodity sector (wholesale prices), we are going to all see this passed through on the retail side of the equation.

This is perhaps the reason that the bond market is not going in the opposite direction of the stock market. If the economic recovery were in fact actually as strong as the price action in the S&P 500 is signifying, the bond market would have already dropped below the bottom of its trading range and would have begun a strong downtrend portending a rising interest rate environment. It is not doing that.

This tells us that the bond market does not buy into all the hoopla surrounding the rising price of equities and is not anticipating anything remotely resembling a period of strong economic growth ahead of us in the immediate future. While one would think that rising commodity prices would be viewed as evidence that inflationary pressures are slowly building from the Fed's near-ZERO interest rate policy, bonds seem to have made up their mind that these rising prices, particularly energy prices, are going to act as a DRAG on the economy moving forward.

Until we see a breakout to the downside in the bond market, all the talk of an improving economy is just that - TALK. When I see long term interest rates beginning to rise steadily, then I will believe it. Until then, it is just the inevitable result of issuing enormous amounts of liquidity in an environment conducive to nothing more than WILD-EYED hedge fund speculation.

Subscribe to:

Comments (Atom)