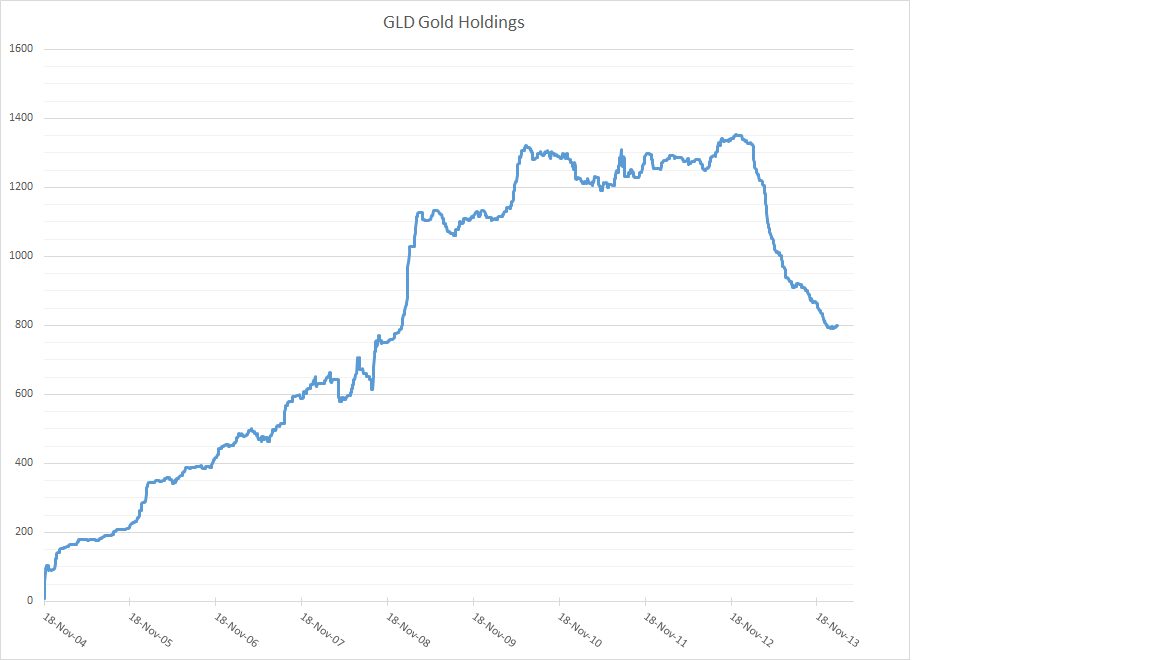

Here is the latest number for the reported holdings of the big gold ETF, GLD. As of the close of business today, GLD is reporting total gold tonnage at 798.85 tons. For a bit of perspective, at the end of last year/start of this year, total holdings were reported at 798.22 tons. In other words, over the last six weeks, Gold holdings in GLD have increased a mere .63 tons!

Yet, the price has gone from 116.17 on December 31, 2013 to 124.43 or an increase of 8.26, some 7%.

What this tells me is that the biggest portion of gains that gold has managed to tack on in this key indicator of Western-based investor gold demand has come from SHORT COVERING, and not from a strong influx of fresh, eager buyers.

No market can sustain any strong advance without a steady, constant steam of fresh buying. Short covering rallies can be quite impressive and can actually flip many technical indicators positive, so they should not be ignored because of the nature of today's computer-based trading programs of the hedge funds.

Also, all true bull markets start with a wave of short covering as the change in sentiment first frightens the bears who have been complacent and riding waves of profits lower as the market descends. Then it attracts some bottom pickers and some opportunistic longs who jump on what they hope is the beginning of a bull freight train leaving the station.

The big question is will this buying become more friendly in the sense that it will consists of more NEW LONGS being put on rather than old shorts being taken off?

Time makes that clear but from a technical standpoint, how the market handles overhead chart resistance levels is key. As more technical levels get violated on the upside, more skeptics commit to the long side. As more skeptics become true believers, sentiment undergoes a shift in which the longs then become complacent and brimming with confidence so that they eagerly buy into each and every dip in price. Let's watch to see what gold will do now that it is nearing a key overhead resistance level, especially in light of the some of the big moves lower in key gold stocks such as Barrick.

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

"key overhead resistance level" the round # $1300 or the fib retrace at 1307?

ReplyDeleteMaybe gold can push towards 1330 by the end of next week?

DeleteIt's the area of :

- 23% Fibo of whole 1805-1180 move on a weekly scale

- upper bollinger band on the weekly scale

- 61% retracement on the daily scale of 1430-1180 (1337)

forgot :

Delete- mlh sup of the weekly downwards pitchfork.

Don't forget NEM which is still trading at historic lows.

ReplyDeleteThe horrifying collapse and epic calamity facing the mining industry continues.

Meanwhile you have consumer stocks like Michael Kors, Under Armor, Chipotle, and Tesla showing no sign of weakness whatsoever.

HUI Monday Gap; A trap or breakaway? The answer as always lies in the Sparks valley floor; the bet here is that it was of the exhaustion variety; swb

ReplyDeleteDan,

ReplyDeleteGold futures large spec net longs, as well as managed money have been steadily increasing longs the past several weeks, although they have been covering more shorts than adding longs also which I guess is better than just short covering.

Someone is obviously selling silver regardless of the gold price. Maybe they should stay tuned to kwn to find out where the silver price is going. !!

ReplyDelete"where the silver price is going"

DeleteWhat is stratosphere? I'll take Wishful Thinking and Future Reading for 400 please.

Thats the bonus question. If there is no silver around, and nobody wants to sell any, what will the price of silver be? Clock is ticking. $100 an ounce. That is the correct answer.

DeleteI think u r smoking too many fatties lately arnie; sparks

DeleteArnie - i think you are right. Once we get back into a bull market in the PMs (I think this current upward phase in gold is a head fake), $2000 gold should happen around $50 silver. The real fun will begin when $2300 and $65 is taken out for the two metals as these are inflation-adjusted highs. $100 silver sounds doable. But the question isnt how high can the PMs go but how low can the dollar go...

DeleteDan, why do you view GLD holdings as necessarily reflective of gold demand? As long as the GLD price doesn't lead the spot price, there is no reason for holdings to increase -- i.e., no arbitrage opportunity. And even if GLD does start leading the price, the arb could happen by other means than exchange of physical gold for shares (e.g., go short GLD, long COMEX futures), especially if the arbitrageur doesn't have or doesn't want to part with physical gold. Or would this be unsustainable?

ReplyDeleteDH;

DeleteWhy are you trying to make things so complicated? Keep It Simple... pull up a price chart of GLD going back to 2004 and overlay a chart of Comex Gold. Then pull up the holdings chart of GLD and lay it over that.

that is all one needs to know as a trader. Why in the world are you even bringing up arbitrage? It is irrelevant to the point I am making.

Western based investment for gold resulted in GLD gobbling up huge chunks of gold in order to satisfy that demand while gold was in vogue. Once it fell out of favor, those who bought GLD dumped it and used the proceeds to buy equities. Gold went down and equities went up as investors chased yield or return on investment in a near zero interest rate environment.

IF investors feel that inflation is going to start picking up, they will come back in and buy gold and GLD.

it really is not that complicated to understand now is it?

Who , in his right mind would buy GLD … If I had to get exposure to gold , these days , as an institution , I would buy GDX , GDXJ , or find myself a vault and buy the yellow metal out right . Why trust GLD ? Bank of New York Mellon , or HSBC ?? its only paper , just like comex

Delete"IF investors feel that inflation is going to start picking up, they will come back in and buy gold and GLD."

DeleteOK, fair enough. But buying GLD does not in itself result in additional shares of GLD being created. And creation of additional shares is the only way for the physical metal holdings behind GLD to increase. Apart from FOFOA-esque explanations, the only reason for a holder of metal to add it to GLD is if he can profit from the difference in price between the GLD shares and the equivalent amount of metal. That's why I brought up arbitrage.

My comment was motivated by your claim that a lack of increased metal in the fund is evidence that the recent rise in the gold price is due to short covering rather than fresh buyers. I simply don't see your logic here. In principle, the prices of GLD and spot gold can both rise to the moon in tandem without a single additional ounce being added to the fund.

DH;

DeleteI did not say that there were no FRESH buyers. I said that short covering was exceeding the amount of fresh buying. Please do not twist what I say. That ticks me off when I make an effort to be precise and then someone misrepresents me.

As far as the rest of your point - go back to 2004 and plot a chart of the amount of holdings in GLD and their steady increase and compare that to the uptrend in the gold price. Then go back a couple of years ago and note the decline in GLD holdings and the decline in the gold price. That is a very simple point I am making.

I frankly could care less about arbitrage, etc. I am looking at the market as a trader and noting relationships to discern sentiment.

SEntiment is what drives markets and sentiment is primarily speculative in nature.

Lastly, the gold conspiracy guys love to emphasize that they believe much of the Gold in the GLD has been bought and sent to Asia. They make my point for me - western investment demand for the metal can be judged by watching the reported holdings in the gold ETF.

Asia bought the gold that the West did not want because the West is chasing equities.

Please stop making things any more complicated than that.

The sort of thing you are writing about is nice for analytical purposes but, and do not be personally offended here because this is not meant as any sort of personal attack, but it is useless to traders.

Dan what about the point made that SLV did not suffer a similar fate as GLD? The price of silver declined by over 50% yet SLV bullion holdings did not drop by anything lkie this much.

DeleteThe theory goes that the GLD bullion was used to satisfy the physical demands caused by the the massive short selling that finally broke down gold early last year? A lot of people have been doing the math and scratching their heads and can not work out where the bullion could have come from.

The point is that if you are correct and the GLD bullion decreased because of the sell off in GLD then why didn't SLV suffer a similar fate?

"The sort of thing you are writing about is nice for analytical purposes but, and do not be personally offended here because this is not meant as any sort of personal attack, but it is useless to traders."

DeleteIndeed, I am not a trader (even though I love your blog). I am trying to understand the big picture regarding the fundamental drivers of the changes in GLD metal holdings over the past several years. FOFOA, Kid Dynamite, Bron, you, and others all have your explanations. I'm trying to understand which explanation, if any, is correct.

Don't look now, but Green Mountain, Facebook, Priceline, Tesla, all at new record highs again.

ReplyDeleteI don't see any evidence of an "economic collapse" anywhere on the tape, unless you are in the gold or coal mining business.

Seems like the consumer is relentless, spending going crazy everywhere, with names like Skechers up 16% in one day and Orbitz up 30%. Crazy, but it is what it is.

I see no sign of a slowdown.

Zero

Nada

Zip

Stay in the system and continue to buy stocks. Hold gold only as minimal insurance in case economic boom causes more inflation.

Retail lifestyle bubble makes internet 1.0 look like kindergarten. Even social network bubble kids are asking, "why did i learn to code, I should have partied in New York and sold luxury goods to China like Michael Kors." Xièxie China for making KORS's EBIDTA margin higher than LVMH.

DeleteGreen Mountain --that's the real deal with their corn syrup delivery system for Coke....

Under Armour--The Nike of tomorrow-selling at a mere 353x FCF.

Dan -

ReplyDeleteThanks for your answer in the previous thread!

Sprott physical trust, phys is -.13 premium to net value. So it does not look like any speculation of new longs is taking place so far. If so, people should bid up phys in anticipation of a bull market.

Now up 7 days off the low. Where is the sweating Richard Russell? How about Tom DeMark? Wow they both earn millions with newsletters yet nowhere to be found after ES 100+ points off the lows.

ReplyDeleteI should quit my job and start a gloom and doom newsletter and make millions feeding off scared investors.

Youd have to stop telling truth.

DeleteAfter the June price lows, Gold made it up to $1420, then back down to the $1200's, then back up to the $1300's, then back down to the $1200's, and now breaching the $1300 line again.

ReplyDeleteWhat are the indicators that Gold will (or won't) re-visit the low 1200's in the next 2 months ?

Cop, I'm no technician, but I can tell you with certainty that there are no indicators whatsoever to point to either side. We all want to know the future, but it's unknowable. Completely, utterly absolutely dark. Invisible, unseen. No one can answer your question. If they could they'd be too busy making some serious money.

DeleteAccording to the french curve on mineset the bottom is in. Is this it? Time to mortgage the house and buy "good gold shares". Again?

DeleteThis comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

DeleteGold indexes up around 20 percent this year DOW and ES flat to down, still huge negativity and non-belief in Gold this is a plus. With growing Government and CB debt and negative real interest rates, slowing western and emerging economies for Gold the path of least resistance is up.

ReplyDeleteCopper is down about .7% today. Yet Silver is up.

ReplyDelete(ref Kitco Copper page)

Maybe the KWN experts are right this time. James Turk calls for 1925.

ReplyDeleteGLD +7.5 tons today

ReplyDeleteYes, it appears that gold is back above the 200-day, now starting to act better.

ReplyDeleteI'm wondering how much Barrick, Goldcorp, Agnico-Eagle, Randgold, etc. have to rise percentage wise from these levels to "catch up" with the rise in these cult consumer and social media stocks the last 3 years.

Let's see, Barrick is at $20, which means if it goes up the same percentage as Yelp has the last 9 months, it will be over $100/share by November, LOL!!!

Heh, one can dream, right??

In retrospect, I should have piled all my money into Priceline, Tesla, Netflix, Chipotle, etc. back in 2009 or 2010 and I would be wealthy beyond belief and would not even need to be watching any financial markets, period.

That's fine - during the next big big decline, you know to buy. I've paid my dues to the Wall St University, and l've learned a hell of a lot from it.

DeleteCant believe how well gold is performing...l'm surprised there hasnt been a reverse flash crash...l would not like to be short right now. Let's see if the weekly number can close above $1300...