Remember when those two words were popping up all over the place, whether on T-shirts, Bumper Stickers, Skate Boards, etc.? It was like so many other fads that have come and gone although it is apparently back in vogue, at least when it comes to the lemmings that the Fed has piped into piling back into equities.

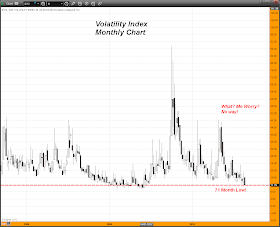

Take a look at the Complacency Index as I like to call it or the "Fear Index" as others have dubbed it- the Volatility Index. It reached levels in today's trading session not seen since April 2007, that is a month shy of SIX YEARS AGO!

Wall Street hasn't a care in the world and apparently the sky is the limit for the equity indices. And I used to think Wall Street loved Easy Al (Alan Greenspan)! They are so in love with Uncle Ben (Ben Bernanke) that I think we are going to see them start naming streets after him in New York's financial district.

I have said it before and will say it again, you cannot fight the tape on this rally in the equities. Everything we ever learned about being able to print your way to prosperity is obviously utterly wrong; the modern day alchemists have proved that not only that it is, but that every age/generation that has ever come before us completely missed the mark.

The Central Banks have managed to create an environment in which Bear markets are a thing of the past, never to be witnessed again in our lifetime. And Yes, Virginia, there really is a Santa Claus...

In Bernanke Street...Santa comes to visit EVERY night :)

ReplyDeleteDan! I didn't think you looked that old in your photo! "In our lifetime."? :-)

ReplyDeletePower Corrupts:

DeleteI remember when we were trading gold back in 1380 when the Black Death plague hit. I said at the time that the alchemists were going to flood the gold market with lots of lead that they had changed into gold and that prices were going to tank as a result.

We all went short.

Then an ancestor of Goldman Sachs (look it up on Ancestry.com) came in and squeezed every one of us out and gold rallied 100 florence!

Couldn't resist messing a bit with ya! :o)

All kidding aside - I do sometimes wonder if these Central Bankers have discovered a way to make bear markets obsolete. They can evidently print their way to prosperity without any regard whatsoever to the enormous amounts of debt continuing to build in the system...

it really is astonishing.

One does wonder what the consequences will be. Maybe they can keep the equity markets going by sheer volume of new money. Maybe they don't have to worry about the debt markets because the Fed is buying everything the Treasury puts on the auction block. Maybe they don't even have to worry about the foreign exchange markets because Japan and everyone else is doing the same.

DeleteOne of these days, Reality will rear its ugly little head. A commodity crunch of some kind (oil, especially)? A war? (I have been amazed with how easily the markets have shrugged off Syria, Mali, and all the other places where people are shooting at each other. But what if things go wrong in Saudi Arabia, or Japan/China over those little islands?)

John Bogle said somewhere in an interview a month or two ago that this is one of his worries; the market prices do not reflect even a remote possibility of any seriously bad geopolitical news.

I suspect that the equity market, which is so incredibly artificial in its pricing, will turn very, very hard when Something Happens. Those HFT algos are going to move prices in the blink of an eye.

"anything that cannot last forever, by definition, will not" ~Herb Stein

DeleteBy now every middle-class head-of-household in Amerika should be satisfied that this rally in equities is the real deal. There is no longer any reason for them to feel uncomfortable committing their retirement accounts, and any other spare dollar they can find, to the stocks of US companies. Now is not the time to think about what happened in 2001 or 2008, the great minds of our time say that this time will be different. ;-)

ReplyDeleteP.S. - Any US company except those pesky miners!

DeleteAt this point, I care not what anyone thinks, gold and several miners, selling houses, silver, and a majority of mid tear miners are currently trading at UNBELIEVABLE discount to future cash flows..specifically if Gold were to rise. I cannot see selling the ^HUI no matter how high and hot the blow torch on stocks is. The BLS employment numbers are misleading and the MSM is shouting them from the rooftops. Dow surges!!! All time highs going higher. Exit please. The corporations have cut to the bone and profits cannot be lifted much without GROWTH. We will see, but time to get out of T's, certain stock sectors and get into the miners. Sorry if I am pumping but what kind of world am I living in? It is bizarro ville. I flew into JFK this morning and got a union cab driver who punched the clock, then proceeded to not have a clue as to where he was going. Many middle eastern countries dominate the livery and limo business in and around the big city. Anyhow, to get to my destination, I had to have him get out his GPS. FRIGHTFUL...The sights along the way were even more scary. I have not been to the big city in 5 years. Based on observations today, I would not be buying no matter what in residential properties, as I believe that market is about to tank. Even on the top end. It appears that Paulson is moving to Puerto Rico. Better sun, lots of nice properties, cheap. Bloomberg is running as fast as he can straight into Socialism if he is not careful his city will own all the properties.

ReplyDeleteThe Piper must always be paid...the day will come when the check must go in the mail.

ReplyDeleteDear Dan,

ReplyDeleteI've been reading your website and Jim's for over a year, nearly on a daily basis.

I always loved your comments and vision, but today is the first time I'm going really crazy about something, and that is the opportunity I thought I saw to use some leverage being long right now on the gold market.

Let me detail : I completely respect the quote below :

"If gold does become as volatile as some of us are expecting it to become in the not-too-distant future, I will certainly trade in much smaller size. SWings of the nature that we are expecting can unnerve even the most experienced of traders. Antacids are not good for your overall health and extreme price movements will get the stomach juices going overboard to the point where they will eat a hole in your stomach if you are not careful.

Leverage is a monster that needs to be respected!"

And normal money management dictates as a routine that one's trading positions should never exceed a certain small percentage of one's trading account.

But are we not here in a very special situation, if everyone I read seem to agree that the bottom has been set?

Jim's last interview on KWN :

"There is no question that the momentum of the gold market has made a significant change. The market has moved from decidedly bearish to neutral, and the potential for moving from neutral to positive is extremely high. My feeling is that the bottom we have already established will not be violated, and the market will now begin its move towards $3,500 coming out of this experience.”

So, speaking "trading" here, we are talking about a VERY HIGH probability of having a bottom for gold at or above 1500 $, for a long-term target of 3500 $ +, correct?

So we are talking about a risk/reward ratio of about 20/1?

Putting a stop loss at 1470 makes me take a risk of 100 $ loss per contract, for an event extremely unlikely to happen, correct?

And on the other hand, my positions may at least double from here, with a gain of 2000 $ per contract.

Don't we have a huge opportunity to get in the market with some leverage here, as traders, long-term oriented?

I'm not talking about managing 10 futures contracts with 10.000 cash. That is totally stupid.

But I'm talking definitely about being a bit agressive on the long side now, given the apparent HUGE risk reward and LOW probability of gold ever breaking down below 1500 $.

I won't do it, because Jim advocates for 100% phyz and no leverage, and I respect my teachers and their wisdom.

But what's behind this?

I understand volatility will eventually get more and more crazy and psychologically unsustainable. But likely at higher price levels, or am I wrong?

The danger is coming later on, but if one bought today at 1580 $, will we ever revisit 1500$ or below in the coming months, on the long path towards 3500? Apparently we are pretty close to the bottom, so I don't fully understand.

If you have any lights on this, as a master of trading and money management, it would be most appreciated... :)

Hubert,

DeleteI'm playing with leverage some. Personally, I think much of your logic is sound. I am keeping my eye on two possibilities that I must take seriously:

1. The big 20/1 payoff surge we're all looking for will likely happen AT THE SAME TIME as a level shift in volitility to the up and down sides... The mountain might have a moat around it. Can your leverage make it safely accross the moat?

2. The availability of leverage will probably dry up pretty quickly when volitility, price, and physical-link uncertainty all surge at the same time... margin requirements will skyrocket right along with the price, or if they don't, for some reason, the value of the contracts won't be able to take anywhere near full advantage of the surge, since no one will trust the promise of physical supposedly backing them.

Hubert;

DeleteThe gold futures market gives you a huge leverage in and of itself by its very nature. The question I learned to ask, after losing lots of money in my early trading career, is NOT how much I can make on a trade but rather how MUCH I CAN AFFORD TO LOSE. Ask yourself that question when you take a position calculating the potential loss from a definite chart point at which you know that the trade has gone bad based on your entry point. Once you have that number, you can trade accordingly. If you are correct in your trade,the potential loss disappears as the market moves in your favor with your only action at that point being to examine the chart daily (or more often) and see at what point you would either need to move your now trailing stop or at least make a mental stop.

If you are wrong in the initial trade and the market moves against you and then reaches the point at which you calculated the potential loss that you were willing to accept, hopefully that is the worst you will lose. I say, "hopefully" because a highly volatile and fast moving market can trade right through your stop filling it far away from your price.

Hope this makes some sense. Also, keep in mind a simple adage that I learned early: Bulls make money; Bears make money; but Pigs get slaughtered. Part of a trader's mental discipline is learning to avoid both GREED and FEAR at their proper times. There is a time to push on a trade and a time to let it ride but also to avoid being overly aggressive. These markets can make you a lot of money based on the way they move nowadays with a small position. The flip side is that they can clean you out faster than a dose of castor oil if you are on the wrong side...

Trade wisely...

Dan

Thanks Dan, much appreciated!

DeleteHere, I put a stop loss not too far from current prices, and I think I have a good chance not to hit it overall. If I do, no regrets, that's fine and was part of the game. I'll take the loss without losing my pants :)

You are right : don't trade what you can't afford to lose.

I'm a bit agressive on paper because most of my longs are on my core physical unleveraged position...so I gamble a bit now on the paper.

I intend to sell bit by bit as we reach 1640;1700;1800 up to 1/2 of my recent buys, and let the rest of the longs go where they want, and I think I'll raise my stop loss up above my entry level as soon as gold goes beyond 1650.

That way, I'm reducing my risk a bit more.

Anyway now, I'll treat the small bet I made on this swing/long term bet as I do for intraday : stop loss is here, target as well, now I stop watching the screen and go for a beer for one or two months :)

Thanks to you and Jim, as I think without you I'd have been "more" aggressive on that one, and maybe let my emotions take over sometime later.

Now the bet is quite reasonable and I'll still make sweat dreams about rising gold prices :)

Wish you well,

Last year I talked my Dad into selling some of his stock and buying gold. Yesterday he called me and wondered if he should sell his gold, you know the stock market is so high right now he said. I replied, would any financial adviser suggest you sell when your investment is low? He said, well okay then.

ReplyDeleteI certainly will be glad when gold takes off again, but for now we all have to watch Uncle Ben pull the rabbit out of the hat every day. :-(

Dan, thanks for the laugh when you were trading in 1380, LOL!!

Dan,

ReplyDeleteI read the required reading on Harvey's website authored by you about the CME, futures market.It provides great market insights in 1994. Seems you had alot of premonition and all of is right in front of us. Great work!!! At that time you were probably still a bit of an angry gunslinger getting taken to the woodshed occasionally. Your recommendation of looking at worst case given the current gold manipulated, HFT dominated, Fed and Bank controlled markets seems like great advice for all of us . Though I would like to say I really want to see the markets return to free trading, it is almost dead on that it certainly will reflect how bad off we truly are as a nation. That reflection will be like "Medusa" looking into the mirror. How about the new SEC appointee coming right out looking to start working on another push towards taking over the $2.7T in money market accounts. I would say the Federal Government is in need of guranteeing their $3T dollar balance sheet with privatized savings. I read alot and am precocious, but if I am not mistaken, one Anne Barnhardt is certainly looking like the Amazing Kreskin. Just saying, it is coming, and it aint pretty. Thanks Dan for your information, your humor, but mostly from providing great knowlege for us johnny come lately type of gold bugs.

When Ronnie Reagan said when the Government comes screaming "I am from the government and I am here to help, RUN". They (SHE) will say how much the goverment wants to help in getting return back on that large pile of money sitting there paying nothing in interest. Just let us manage it, we will give you 3% a year as that will be so much more than you can earn. RUN!!!!!!!!!!!!!!

ReplyDeleteThis game of gold futures needs to end! When one visits the zoo and stares at the lion in its cage does anyone dare enter? Gold futures is the lion in the cage, and this lion continues to feast bc of all the greed in leverage! Volume is an illusion an it is not needed, boycott Gold and silver futures, take physical possession and watch the lion starve

ReplyDelete