Gold has had a nice rally off what is now a TRIPLE BOTTOM ( which amazingly held) near $1180. In the process it has managed to clear two resistance zones; the first near $1220 and the second near $1240. It has subsequently been unable to best the 50 Day Moving Average however and has set back after some early session buying popped it above that key technical level.

The HUI, in spite of an extremely powerful rally in the broader equity markets ( the S&P 500 is up over 2% today) has been comatose which is worrisome if one is a bull.

I mentioned in yesterday's post that if the equity markets rally and especially if the VIX moves lower, gold was going to encounter some selling pressure. That it is doing at the moment. It does however remain higher on the day although well off the best levels reached earlier in the session.

Tomorrow will therefore be important for the short term future of the yellow metal. If it does indeed set back from here, how it handles itself if price does fall towards $1240 will be key in deciphering its next move. Failure there and it will drop back to $1220 as discouraged bulls and emboldened bears will assert themselves.

If the metal manages to attract enough dip buyers to keep it afloat above $1240, the action will be more indicative of a pause or rest in a market that wants to make a run towards $1280. Thus the jury is out at this point.

Buying has been good out of Asia ( what else is new ) but Western-based investment demand is miserable as witnessed by the plunging reported holdings in GLD.

Some want to make some sort of big deal out of this claiming that the "GLD is being "drained" or "raided" to meet demand from the East" but that is an explanation looking for an argument. Who cares who is buying it? No one in the perma gold bull camp seemed to care when the reported holdings were soaring several years back now were they? We could turn the latest theory on its head and say the following:

"Western-based investment demand is pulling gold from all corners of the world to meet it". The simple truth is that for every buyer there is a seller. Some act as if once this gold is bought by some nebulous "East" that it will never be sold again. That is pure rubbish! Gold is bought and sold every day in China as well as in India or Vietnam or anywhere else in the nations that comprise the "East".

Western-based money managers chase yield. If they feel that gold is going to put in a good performance or if they require a safe haven asset in which to park some excess funds, they will buy the metal. If they do not, they will not buy it.

I am on record here as stating that I believe falling reported holdings in GLD is not bullish. If was bullish on the way up for gold way back when, then it is bearish on the way down. One cannot have it both ways.

That is why I am watching this rally with some skepticism. For now, the bulls are in technical control of the market with the chart in their favor.

Let's see what we get tomorrow.

By the way, the Euro plunged on the ECB potential corporate bond buying news.

It stalled out exactly at the former support zone near 1.2800 which is now serving as overhead resistance. The recent bump higher has relieved the oversold reading on the weekly chart so perhaps the currency is reading to resume its move lower. We shall see on that as well.

Lastly for now, the soybean meal market which I noted earlier today, posted a very strong close above the $340 level. It continues to pull the soybeans, AND THE CORN higher.

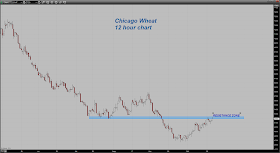

Wheat was pulled higher by talk of planting delays for the soft winter wheat crop in the Eastern portion of the Corn Belt. It popped above $5.20 which is a big level but failed to CLOSE above that line. Wheat bulls can expect to see $5.40 if they can dislodge the bears near this level.

There has been a rather significant amount of short covering by the funds in this market but that is the reason why one has to closely watch these resistance levels. The stronger hands, who have not been squeezed out, are still looking for a level against which to sell. For now they seem to have found it near $5.20. This is shaping up to be an interesting battle.

Tuesday, October 21, 2014

Nearby Meal Tightness Driving Beans Higher

It is the same story that it has been for much of this past year, the tight carryover from last year's bean harvest is meeting up with a reduced current year harvest pace and that has processors scrambling to secure enough beans to produce meal, which seems to be experiencing some tightness right now. That has the meal moving higher on the charts which is pulling both the beans and even the corn higher.

Take a look at this chart and as you do, keep in mind that we are on our way to one of the largest bean harvests ever with a huge expected carryover.

That dark line is the 50 day moving average. Yes, believe it or not, in the face of a massive upcoming harvest, the meal is over that key technical indicator. That is why the funds are buying. Remember, none of that group gives a hoot about fundamentals.

Meal has gone up nearly vertical some $44/ton since the beginning of this month and is trading at levels last seen in early September as traders began to get a true sense of the whopping harvest that was on the way.

I am closing watching its performance near this level however to see if it is going to fade. Farmers continue to be tight-fisted sellers of this year's crop, ( a huge mistake in my view ) as they cannot bring themselves to sell at current levels after being spoiled by years of sharply higher prices for their production. IF ( and I do not know ) meal is going to fail, it will fail near this level.

What makes me extremely nervous about this market is that once the panic selling begins among farmers, it is all going to come at once. The big question a trader has is exactly when that is going to be. I have the utmost respect for farmers who work long hours and deal with a multitude of obstacles at times. However, as marketers of the crops which they so proficiently grow, they suck! They turn bullish at exactly the worst time and become excessively bearish at the wrong time. In other words, they tend not to sell when they should and sell when they ought not to be selling!

By the way, the feeder cattle market hit limit down this morning. It was limit down on Tuesday and Wednesday of last week. Then it hit limit down Thursday early in the session only to move higher and close at limit up that day. It then went limit down on Friday and closed there only to start off this week ( MOnday) by closing Limit up. Let's see now, that is SEVEN CONSECUTIVE TRADING DAYS in which this market has either closed limit down or limit up.

And someone tell me that our markets are not utterly broken! I have been trading cattle for many, many years and have never seen them do this, ever! This is also the reason I strongly advise many would-be traders from NOT trading livestock unless you know exactly what you are doing.

Take a look at this chart and as you do, keep in mind that we are on our way to one of the largest bean harvests ever with a huge expected carryover.

That dark line is the 50 day moving average. Yes, believe it or not, in the face of a massive upcoming harvest, the meal is over that key technical indicator. That is why the funds are buying. Remember, none of that group gives a hoot about fundamentals.

Meal has gone up nearly vertical some $44/ton since the beginning of this month and is trading at levels last seen in early September as traders began to get a true sense of the whopping harvest that was on the way.

I am closing watching its performance near this level however to see if it is going to fade. Farmers continue to be tight-fisted sellers of this year's crop, ( a huge mistake in my view ) as they cannot bring themselves to sell at current levels after being spoiled by years of sharply higher prices for their production. IF ( and I do not know ) meal is going to fail, it will fail near this level.

What makes me extremely nervous about this market is that once the panic selling begins among farmers, it is all going to come at once. The big question a trader has is exactly when that is going to be. I have the utmost respect for farmers who work long hours and deal with a multitude of obstacles at times. However, as marketers of the crops which they so proficiently grow, they suck! They turn bullish at exactly the worst time and become excessively bearish at the wrong time. In other words, they tend not to sell when they should and sell when they ought not to be selling!

By the way, the feeder cattle market hit limit down this morning. It was limit down on Tuesday and Wednesday of last week. Then it hit limit down Thursday early in the session only to move higher and close at limit up that day. It then went limit down on Friday and closed there only to start off this week ( MOnday) by closing Limit up. Let's see now, that is SEVEN CONSECUTIVE TRADING DAYS in which this market has either closed limit down or limit up.

And someone tell me that our markets are not utterly broken! I have been trading cattle for many, many years and have never seen them do this, ever! This is also the reason I strongly advise many would-be traders from NOT trading livestock unless you know exactly what you are doing.

ECB Planning a Corporate QE?

The wire services are reporting this morning that the European Central Bank is considering a plan to purchase corporate debt as part of a response to the Eurozone's sluggish growth. That has pushed the Euro sharply lower and the Dollar higher by consequence but commodity buying is being seen regardless.

Copper, silver and gold are all higher and even crude oil has firmed. Equities of course love that news. Even the grains are moving higher.

More volatility, more uncertainty and more factors for traders/investors to now digest.

Hold onto your hats.... don't you love our monetary masters? They have such a "calming influence" on the markets.

Copper, silver and gold are all higher and even crude oil has firmed. Equities of course love that news. Even the grains are moving higher.

More volatility, more uncertainty and more factors for traders/investors to now digest.

Hold onto your hats.... don't you love our monetary masters? They have such a "calming influence" on the markets.