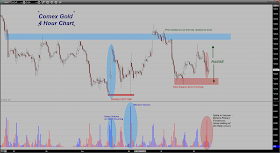

Extreme volatility/wild swings in price was the highlight of gold trading in today's end-of-the-year session. Some fund managers on the long side of gold were heavily dumping positions early in the session to clear their books of one of the worst performing assets of the year. On the other side of that activity were some large specs who have been short the market for most of the year and were busy lifting some of those positions to capture those paper gains.

Around mid-morning, a rash of "sudden orders" to buy ( Dow Jones wire services quoted traders using those exact words) flipped the market higher after it had run down near $1180. It moved as low as $1181.4 before shorts began ringing the cash register to close out the year.

The lack of selling enabled the buying to take price high enough to catch some overhead buy stops and up she went. Here we have another one of those events that I have sarcastically dubbed, "A REVERSE FLASH CRASH" in honor of those who love to regale us with stories of Flash crashes when gold drops sharply as evidence that the gold price is being manipulated lower by sinister forces intent on delegitimizing it as a viable investment.

I trust we will not hear a peep out of that crowd about today's bizarre price swing higher. After all, according to them, this is what gold should be doing all the time and thus this is legitimate price action whereas gold dropping sharply in price is somehow illegitimate.

Honestly, one grows weary of attempting to dispel the market ignorance on display from this group but this is what happens when anyone with a computer and a keyboard is now an authoritative source on market price action. Then again gold seems to spawn more of this sort of thing than many of the other commodity markets. I guess it just comes with the territory. Gold bugs tend to be very passionate about their views - nothing wrong with that - but that very same fervor is what so often makes it difficult for them to see market price action with any sort of objectivity. They have to keep coming up with reasons to explain why their asset of choice is losing them money instead of just admitting that they were wrong and moving on.

What happened is not hard to understand however - gold dropped into a major, major support zone ( I have stated that $1180 is as critical to the future fortunes of gold as was the $1530 price level some time back) where strong buying surfaced once again. The short term players saw that it was holding and began to cover their shorts realizing that the support zone was going to hold for now. As price rose, with a large number of traders out of the market already in anticipation of the holiday tomorrow and low liquidity, there was no one left to sell. Thus there was a air pocket above the market and little to no resistance to the metal's rise.

There is nothing quite as dramatic as one of these typical short squeezes. The volume leaps dramatically as fear and panic hit those who sold into the bottom of the move and are now forced to scramble in order to avoid deep losses. While it looks impressive on the surface, the key is not what happens on any given day but the SUBSEQUENT market reaction over the next couple of days. If the market builds on its gains and continues to extend, then you have the makings of a legitimate short-term bottom. If however the market simply hangs around near the highs of the short covering day and is unable to extend much higher, the odds then favor a continuation of the downtrend with stronger hands coming in to sell at the new and higher level. We simply have no way of knowing which scenario we are going to get until it occurs. SUBSEQUENT PRICE ACTION is therefore the only safe guide to rely upon; not hunches, guesses, and dogmatic assertions from newsletter writers and other various pundits who know no more than the rest of us what will happen tomorrow.

I can tell you this from experience, making any predictions as to future price movements based on the price action from the last day of trading for the year is not wise. The other thing to keep in mind - one day does not a trend make. Gold is in a BEAR MARKET until proven otherwise. It really is that simple. Any market that loses more than 20% for a year is officially in a bear market and at one point in today's session, gold was down over 29%. Do the math.

I will also add this one last thing - that the market faded from off its best levels tends to confirm the idea that we are not going to see much in the way of additional upside as we begin the New Year. The bulls are living on borrowed time and unless something occurs to change sentiment here in the West in regards to gold quite soon, it looks to me like one will be able to buy gold at a cheaper level than they were even at today's lows early next year.

As always, time will tell...

One last thing, some money managers like to come in and buy distressed stocks from poorly performing sectors towards the end of the year. The idea is that many participants are selling losers to square their books and to realize tax losses. Those who come in and buy these stocks which are being thrown out will then look to make a quick 8% - 10% profit as the selling pressure lets up when the New Year begins. It is a short term trade by nature with the theory that the heavy selling is now finished so one can safely buy. This sort of thing can tend to put temporary bottoms in those stocks. As mentioned above, the key to seeing whether or not a trend reversal/longer-term bottom is in the sector is to watch how subsequent price action unfolds and especially volume.

Moving forward this next year, gold's fortunes will be determined by whether or not Asian demand, especially out of China is sufficient to absorb Western-based selling of the metal. As stated yesterday and reiterated today, I am concerned because in spite of such heavy losses in gold, the large specs remain stubbornly bullish; this is not a recipe for a reversal. If anything it is a recipe for more losses ahead for the metal until the bullishness is killed.

When you take a look at this chart of the reported holdings of GLD and see that the holdings are back at levels last seen in January 2009 ( an incredible 5 years ago), it is not hard to understand the drop in the price of gold. What is difficult for me to grasp is why these big specs remain as net longs over at the Comex. The big money in gold has been made on the SHORT side over the last year; trend followers have done fine. It is those bucking the trend that have gotten badly burnt. One wonders just how much more pain that want to bear.

What I am going to be looking for in 2014 is if/when market sentiment begins to turn strongly in favor of "growth/inflation" and away from "growth/no inflation". If/when it does, commodities should see some risk money moving back into the sector in general with the expectation of higher prices as a result of ramped up demand. I am not saying that this is going to happen as I am not in the business of making predictions ( I will leave that to those who have no money at risk in the markets). What I am saying is that this is something to watch for to see if this were to develop.

Such an occurrence would tend to bottom gold but especially silver. Copper prices have already turned higher over the last several weeks and are now up in levels near the top of a trading range that has been in place since April of this year (2013). If copper begins to push higher, especially if it can clear $3.50 convincingly, silver should get some help on the buy side.

I would also like to take a bit of time here to thank all those who have visited the site this past year. I would especially extend my gratitude towards those who post here for your many encouraging words, your insightful posts, as well as your helping to keep this site clear of profanity, ugly personal attacks on individuals and the other assorted crap that is all-too-frequent nowadays in this unethical age. As I have written many times here, opinions on the markets are fair game; those who offer them should expect that others will often take the other side because there is always a bull side and there is always a bear side. If not, we would not have anyone to buy from if there were no bears nor would we have anyone to sell to if there were no bulls. Personal attacks that impugn the motives/character of others is a different story however and that is something that I will not tolerate here, nor should those of you who read and post here allow either. It demeans the site and interferes with what we are trying to accomplish here which is to provide a forum where folks can learn to read the voice of the market and hopefully become better informed in their trading/investment decisions by applying that which they have learned.

A Happy, Safe, and Prosperous New Year to you all. Personally I like to take this time of the year to look back at the many blessings of God and realize just how gracious He is to we who do not deserve such goodness at times. At times we are prone to measuring our "wealth" by the size of our bank accounts but what price can one put on family, health, friends, and our reputations? Such things are irreplaceable.

Once prior to a famous sermon that he preached during what historians have termed, "The Great Awakening", Jonathan Edwards prayed to the Lord asking Him to "stamp eternity on the eyeballs of those who heard him preach". We might do well to consider that more frequently during the course of the next year. It is remarkable how it tends to help us keep things in their proper perspective!

Tuesday, December 31, 2013

Monday, December 30, 2013

Gold Down below $1200

Gold is getting hammered down below the psychological support zone at $1200 as we move into the last day of trading before the advent of 2014. The break, coming in spite of a weaker Dollar, does not bode well for the fortunes of the metal to begin the New Year. The story remains the same - gold performed abysmally this past year as big speculators were chasing gains in the equity markets and yanking money out of gold and many other commodities in general.

I see nothing on the near term horizon to suggest that this is going to change as we begin 2014, barring some sort of catalyst such as an event that comes out of nowhere. Right now the VIX is indicating complete complacency and a total lack of fear/concern anywhere.

The daily chart shows the price moving down into a most important technical support zone. Gold has been able to garner enough buying on forays into this zone to force a rebound in the price, even if that rebound did not last all that long. Whether or not these buyers remain willing at this level is unclear. If not, gold is going to break the bottom of the support zone near $1180 and will easily lose another $30 for starters. If the buyers show up, then the metal can continue to grind sideways above this support zone but without a catalyst to kick it higher, the intermediate trend dictates that rallies in the metal should be sold.

I am noting that the ADX is moving sideways indicating that the downtrend has temporarily halted on the daily chart but that the bears remain firmly in control of this market. If support at $1180 breaks, look for the ADX to turn up as gold will resume its downtrend and might then target the $1100 level depending on how many hedge funds decide to exit from the long side of this market. Remember, they are still net longs in there and that is what concerns me that the bleeding in gold is not yet finished.

We got the CFTC Commitments of Traders data released this afternoon as the report was delayed due to the Christmas holiday last week. It did indicate some long liquidation from the hedge fund community occurred last week but they still are NET LONGS in this market to the tune of some 28,700 contracts. The Other Large Reportables actually increased their net long position about 3,800 contracts with the result that the two groups of large speculators remain net longs. The small specs, or general public, actually finally moved to a small net short position.

The big, bad bullion banks were generally buying again this week but never fear, the "gold is always manipulated at all times crowd" will swear up and down that these banks are the ones that are knocking the price lower. Both the Producer/User/Merchant category and the Swap Dealers were Buying from Hedge funds who were selling this past week.

All in all, the report provides further evidence that money flows are coming out of gold and into equities. This is the reason the gold price is continuing to sag lower. It will until this process ends and then reverses.

I see nothing on the near term horizon to suggest that this is going to change as we begin 2014, barring some sort of catalyst such as an event that comes out of nowhere. Right now the VIX is indicating complete complacency and a total lack of fear/concern anywhere.

The daily chart shows the price moving down into a most important technical support zone. Gold has been able to garner enough buying on forays into this zone to force a rebound in the price, even if that rebound did not last all that long. Whether or not these buyers remain willing at this level is unclear. If not, gold is going to break the bottom of the support zone near $1180 and will easily lose another $30 for starters. If the buyers show up, then the metal can continue to grind sideways above this support zone but without a catalyst to kick it higher, the intermediate trend dictates that rallies in the metal should be sold.

I am noting that the ADX is moving sideways indicating that the downtrend has temporarily halted on the daily chart but that the bears remain firmly in control of this market. If support at $1180 breaks, look for the ADX to turn up as gold will resume its downtrend and might then target the $1100 level depending on how many hedge funds decide to exit from the long side of this market. Remember, they are still net longs in there and that is what concerns me that the bleeding in gold is not yet finished.

We got the CFTC Commitments of Traders data released this afternoon as the report was delayed due to the Christmas holiday last week. It did indicate some long liquidation from the hedge fund community occurred last week but they still are NET LONGS in this market to the tune of some 28,700 contracts. The Other Large Reportables actually increased their net long position about 3,800 contracts with the result that the two groups of large speculators remain net longs. The small specs, or general public, actually finally moved to a small net short position.

The big, bad bullion banks were generally buying again this week but never fear, the "gold is always manipulated at all times crowd" will swear up and down that these banks are the ones that are knocking the price lower. Both the Producer/User/Merchant category and the Swap Dealers were Buying from Hedge funds who were selling this past week.

All in all, the report provides further evidence that money flows are coming out of gold and into equities. This is the reason the gold price is continuing to sag lower. It will until this process ends and then reverses.

Tuesday, December 24, 2013

Merry Christmas

"For

unto us a child is born, unto us a son is given: and the government shall be

upon his shoulder: and his name shall be called Wonderful, Counsellor, The

mighty God, The everlasting Father, The Prince of Peace.

Of the increase of his government and peace there shall be no end, upon the throne of David, and

upon his kingdom, to order it, and to establish it with judgment and with

justice from henceforth even for ever. The zeal of the LORD of hosts will

perform this." ( Isaiah 9: 6-7)

"But thou, Bethlehem Ephratah, though thou be little among the

thousands of Judah, yet out of thee

shall he come forth unto me that is

to be ruler in Israel; whose goings forth have

been from of old, from everlasting." ( Micah 5: 2)

( And this taxing was first made when Cyrenius was governor of Syria.)

And all went to be taxed, every one into his own city.

And Joseph also went up from Galilee, out of the city of Nazareth, into Judaea, unto the city of David, which is called Bethlehem; (because he was of the house and lineage of David:)

to be taxed with Mary his espoused wife, being great with child.

And so it was, that, while there were there, the days were accomplished that she should be delivered.

And she brought forth her firstborn son, and wrapped him in swaddling clothes, and laid him in a manger; because there was no room for them in the inn.

And there were in the same country shepherds abiding in the field, keeping watch over their flock by night.

And, lo, the angel of the Lord came upon them, and the glory of the Lord shone round about them: and they were sore afraid.

And the angel said unto them, Fear not: for, behold, I bring you good tidings of great joy, which shall be to all the people. For unto you is born this day in the city of David a Saviour, which is Christ the Lord.

And this shall be a sign unto you; Ye shall find the babe wrapped in swaddling clothes, lying in a manger.

And suddenly there was with the angel a multitude of the heavenly host praising God, and saying,

Glory to God in the highest, and on earth peace, good will toward men" ( Luke 2: 1-14)

"And without controversy great is the mystery of godliness: God was manifest in the flesh, justified in the Spirit, seen of angels, preached unto the Gentiles, believed on in the world, received up into glory." ( 1 Tim 3:16)

"In the beginning was the Word, and the Word was with God, and the Word was God. All things were made through Him, and without Him nothing was made that was made. In Him was life, and the life was the light of men.... And the Word became flesh and dwelt among us, and we beheld His glory, the glory as of the only begotten of the Father, full of grace and truth." ( John 1: 1-3, 14)

Christmas has a special meaning for those of us who are Christians. We celebrate it not merely for the reason that we believe God took upon Himself flesh and dwelt among us, but more importantly that He took upon Himself flesh for one reason - so that He might offer Himself upon a bloody cross as a sacrifice for the sins all who would come to believe upon Him, thereby satisfying the claims of Divine Justice in His own person and opening the gate to eternal life. This is our "Good News" or Gospel message.

Gold may be a precious thing, as is silver, and we value them in this life, but one cannot take either of them with us when we exit this world. They only have value in this life. As Christians we take the time during this season to reflect on those things which have lasting value.

May you have a wonderful and blessed Christmas.

Sunday, December 22, 2013

Some Christmas Fun

In the spirit of the season, a broker buddy of mine, JB Slear over at Fort Wealth Trading, put together a rather humorous Christmas presentation including yours truly along with JB and Jim Sinclair's face. I think you will get a kick out of it!

Enjoy...MacaReindeer!

http://www.jibjab.com/view/RYntZ1zLsz8wRgvHlIoT

Enjoy...MacaReindeer!

http://www.jibjab.com/view/RYntZ1zLsz8wRgvHlIoT

Friday, December 20, 2013

Weekly Gold Chart

I think the chart speaks for itself. Gold has managed to put in the worst WEEKLY CLOSE since July 2010, three and a half years ago.

The bounce today was feeble, considering the extent of the downdraft on Thursday. It did manage to close above $1200 but just barely. The fact that the HUI could not hold its gains on the day is alarming to me. I would have hoped that it could hold its bounce without attracting more selling.

Based on this, I would have to lean towards saying the gold market still looks heavy to me and could come under additional pressure next week. The one saving grace that it will have working in its favor is that the Bears have made a lot of money this year and might still be looking to cover some additional shorts and book those gains before the end of the year. That, plus the fact that rarely do traders pile on large positions heading into the end of the year; they generally tend to do the opposite. That might take some of the pressure off of the market, temporarily.

Bulls need some serious help very soon....

The bounce today was feeble, considering the extent of the downdraft on Thursday. It did manage to close above $1200 but just barely. The fact that the HUI could not hold its gains on the day is alarming to me. I would have hoped that it could hold its bounce without attracting more selling.

Based on this, I would have to lean towards saying the gold market still looks heavy to me and could come under additional pressure next week. The one saving grace that it will have working in its favor is that the Bears have made a lot of money this year and might still be looking to cover some additional shorts and book those gains before the end of the year. That, plus the fact that rarely do traders pile on large positions heading into the end of the year; they generally tend to do the opposite. That might take some of the pressure off of the market, temporarily.

Bulls need some serious help very soon....

Commitment of Traders

This week's Commitment of Traders report for gold ( covering the period up through Tuesday of this week, 12/17/2013) reveals that the speculative community were net sellers on the week while the "commercial" traders were net buyers.

As many of you no doubt know, today's report both includes the sharp selloff associated with the previous Friday's jobs report. It also includes the sharp rebound that occurred on both Monday and Tuesday of this week. It does not include the wild action coming on the heels of this Wednesday's FOMC statement nor the collapse that occurred yesterday ( Thursday).

Here is what I am taking away from the report - speculators are using rallies in price to add to existing short positions. All three categories - Hedge Funds, Large Reportables and the Small Specs - remain as NET LONGS. This continues to concern me because it indicates a STUBBORN bullishness in the face of a deteriorating technical price chart. Any downside violation of that critical support level at $1180 thus has PLENTY of AVAILABLE FUEL to provide large amounts of selling.

If there is any capitulation occurring in the gold market, it is certainly not showing up in the composition of positions that the speculators are holding.

While I am on this topic, I am going to try, ONCE MORE, to dispel this pestilential notion that the reason why gold is CURRENTLY moving lower is because it is constantly being manipulated by the bullion banks at the behest of the Fed.

This concept, which I have written positively about in the past and to which I adhere during PERIODS OF RISING GOLD PRICES AND A SINKING DOLLAR, is already becoming quite old and wearisome. It seems it makes some feel better as they watch their life's savings evaporate into thin air while they loudly screech that the only reason that they are losing money on their gold and gold related stocks, is because the price is being manipulated.

It is notable that this cry of "manipulation" only works in one direction however, and that is when gold is selling off. When gold is moving higher, there is not a peep mentioned about the sharp rallies that sometimes appear because "after all, gold is only doing what it should be doing were it not manipulated".

Here is the problem with this view, at this stage in gold's bearish move lower - the facts simply do not support it.

I have put together a couple of charts to illustrate this. Let's start first with an excerpt from the Commitment of Traders data, both futures and options, going back to the beginning of this year, 2013.

What I would draw your attention to in particular, is the end of the month of October 2013. This is about the time that the latest fad known in gold circles as "the Flash Crash" began appearing. Whether stated or not, it is implied that there is a nefarious force working to suppress the gold price and this force is always the same - the bullion banks working to do the Fed's bidding.

Keep in mind that the argument goes something like this.... " You know, gold is in backwardation, meaning that demand for the physical is so strong that the only reason the paper price can be moving lower is because it is manipulated. Also, these FLASH CRASHES that occur during the thin market conditions of low liquidity mean that NO LEGITIMATE SELLER ( whatever a "legitimate" seller might be is left undefined) would be engaging in such action. Therefore, ergo, quod est demonstratum, the price is being manipulated lower. Why else would we see large offers coming out of nowhere?

Since it is always the bullion banks who get blamed for manipulating price, one assumes that it is they who are somehow behind this "mysterious" move lower in the gold price.

Regardless, I have maintained and continue to maintain, that it is speculative selling, namely HEDGE FUNDS or some other large reportable entities, that are doing the selling in gold and have been for some time now. I am also on record as stating that these same bullion banks who are constantly being blamed for everything nasty happening to gold, happen to be BUYING GOLD, not selling.

With that in mind, look at the above COT chart detailing the positioning of these large commercially-oriented players. This is their NET POSITION in the Comex Gold market. Now look at the date (Oct 29) in which they began to seriously draw down the overall size of their previously held net short position by BUYING contracts.

Over this interval, approximately a seven week time frame, there has been a reduction of over 37,000 in the net short position of the Producer category so that they are now NET LONG. In the Swap Dealer category, there has been a reduction of about 43,000 in their net short position. In other words, both categories have been NET BUYERS over the entire time frame during which, and this is important, gold has experienced a decline of some $115 in price.

Now look at the gold chart below to see the same time frame illustrated there.

This chart, unlike the COT chart above, covers through the end of this week, and not just through Tuesday this week. Since Tuesday the price of gold has declined even more losing another $30+ in the process.

Also, the CME Group, daily releases information detailing the delivery process for its various futures contract which still provide such. When it comes to gold, the December process has been ongoing. Out of the total 5,448 contracts Tendered or Issued ( by sellers who are delivering), J P Morgan, one of the infamous bullion banks, has stopped, or taken delivery of 5,106 of them for their HOUSE account, not their Customer account! That is no mean feat!

So what do we have? We have a source of data indicating a STEADY BUYING occurring by the large commercially-oriented players in the gold market so that their short positions are being covered even as they have moved to some LONG POSITIONS in the futures market so as to TAKE DELIVERY. One cannot take delivery of a futures contract if one is short the market going into the delivery period.

All this is taking place against a backdrop of falling gold prices while the SPECULATIVE COMMUNITY, is selling. Again, at the sake of excessive repetition, the specs remain as net longs but their net long position is declining as they bail out of gold and move to increasingly play it from the short side.

I should also note here that as the month of December has rolled around and the December gold contract has entered the delivery period, the number of OUTRIGHT LONG positions held by the Producer/Merchant/Processor/User category has increased from 89,853 to 90,760 as of this Tuesday. NOTE - this is using FUTURES ONLY data and not futures and options data because one needs a futures position on the long side to stand for delivery.

On the Swap Dealer front, the December long position has increased from 60,771 to 64,050 as of Tuesday this week.

It should also be noted here that as the longs take delivery of any gold, the futures long position is closed out ( as well as the short who was delivering) and the long positions (along with the short) will be reduced.

I want to also cover one more claim made by some who still refuse to accept the facts but will hold fast to their gold is always manipulated all the time thesis. Some claim that the bullion banks have been the ones recently selling gold futures to knock the price during the session only to then use the hedge fund selling that results as a way to BUY BACK or cover the shorts that they put on to precipitate the downward plunge in the futures market. The problem with this theory is that if the bullion banks were doing this ( and they currently are not), they would have to buy back all of those newly instituted short positions AND THEN SOME, in order to achieve the overall reduction in their NET SHORT position that the Commitment of Traders report details.

For example, if the bullion banks were to sell, let's say 1,000 contracts of gold, overnight in Asia and then wait for the inevitable hedge fund selling to show up so that they could then buy those contracts back, they would have to buy ALL 1,000 contracts or their NET SHORT POSITION would never budge. If they did not, let's say they bought back only 900 of those short positions, their TOTAL SHORT POSITIONS would increase by 100 contracts.

What the COT data reveals however is that the number of outright short positions of the Producer/Merchant category as well as the Swap Dealer category have been steadily SHRINKING since that October 29th date that I used as a reference point. Clearly this would not be possible if the bullion banks were only buying back some of these supposed short positions that are being claimed to be the source of the gold price manipulation. Even if they were buying back ALL of them, that would not be enough to REDUCE the number of outright short positions that they have on the books. They would need to buy back MORE THAN THE 1,000 in our example. In other words, they would have to buy 1,100 contracts after selling 1,000 overnight in order to show a reduction in their total short position of 100 contracts. Thus, they would consistently have to be buying large amounts of contracts ( much more than they are supposedly selling according to some) on a regular basis to give us this constant decrease in short positions which the COT report reveals. It would take some near miraculous feat for buying of that magnitude NOT TO DRIVE THE PRICE OF GOLD SHARPLY HIGHER.

Here is the simple truth about gold as it now stands - the bullion banks try to slow the rise of gold during those periods in which it is rising sharply and the US Dollar is sinking as part of the effort to keep the gold price from signaling any sort of distress, distrust or lack of confidence in the US Dollar and by consequence, the Federal Reserve's stewardship of such. Once the gold price broke below the key chart support level of $1530 in April of this year, the trend in gold turned from one of bullishness to one of bearishness. From that point, specs have been gradually abandoning the gold market and moving towards equities. This is why the price continues to fall, not because some nefarious force has continually been at work in gold since then.

At some point the price will reach a level in which the market views strong value. When it does, the willing buyers at that point and price will outnumber the sellers and the price will bottom and then begin to rise.

One last thing for those who listen in regularly to the King World News Metals Wrap on a regular basis. We are not doing one of those this week and are instead giving Eric and myself a bit of a break.

As many of you no doubt know, today's report both includes the sharp selloff associated with the previous Friday's jobs report. It also includes the sharp rebound that occurred on both Monday and Tuesday of this week. It does not include the wild action coming on the heels of this Wednesday's FOMC statement nor the collapse that occurred yesterday ( Thursday).

Here is what I am taking away from the report - speculators are using rallies in price to add to existing short positions. All three categories - Hedge Funds, Large Reportables and the Small Specs - remain as NET LONGS. This continues to concern me because it indicates a STUBBORN bullishness in the face of a deteriorating technical price chart. Any downside violation of that critical support level at $1180 thus has PLENTY of AVAILABLE FUEL to provide large amounts of selling.

If there is any capitulation occurring in the gold market, it is certainly not showing up in the composition of positions that the speculators are holding.

While I am on this topic, I am going to try, ONCE MORE, to dispel this pestilential notion that the reason why gold is CURRENTLY moving lower is because it is constantly being manipulated by the bullion banks at the behest of the Fed.

This concept, which I have written positively about in the past and to which I adhere during PERIODS OF RISING GOLD PRICES AND A SINKING DOLLAR, is already becoming quite old and wearisome. It seems it makes some feel better as they watch their life's savings evaporate into thin air while they loudly screech that the only reason that they are losing money on their gold and gold related stocks, is because the price is being manipulated.

It is notable that this cry of "manipulation" only works in one direction however, and that is when gold is selling off. When gold is moving higher, there is not a peep mentioned about the sharp rallies that sometimes appear because "after all, gold is only doing what it should be doing were it not manipulated".

Here is the problem with this view, at this stage in gold's bearish move lower - the facts simply do not support it.

I have put together a couple of charts to illustrate this. Let's start first with an excerpt from the Commitment of Traders data, both futures and options, going back to the beginning of this year, 2013.

What I would draw your attention to in particular, is the end of the month of October 2013. This is about the time that the latest fad known in gold circles as "the Flash Crash" began appearing. Whether stated or not, it is implied that there is a nefarious force working to suppress the gold price and this force is always the same - the bullion banks working to do the Fed's bidding.

Keep in mind that the argument goes something like this.... " You know, gold is in backwardation, meaning that demand for the physical is so strong that the only reason the paper price can be moving lower is because it is manipulated. Also, these FLASH CRASHES that occur during the thin market conditions of low liquidity mean that NO LEGITIMATE SELLER ( whatever a "legitimate" seller might be is left undefined) would be engaging in such action. Therefore, ergo, quod est demonstratum, the price is being manipulated lower. Why else would we see large offers coming out of nowhere?

Since it is always the bullion banks who get blamed for manipulating price, one assumes that it is they who are somehow behind this "mysterious" move lower in the gold price.

Regardless, I have maintained and continue to maintain, that it is speculative selling, namely HEDGE FUNDS or some other large reportable entities, that are doing the selling in gold and have been for some time now. I am also on record as stating that these same bullion banks who are constantly being blamed for everything nasty happening to gold, happen to be BUYING GOLD, not selling.

With that in mind, look at the above COT chart detailing the positioning of these large commercially-oriented players. This is their NET POSITION in the Comex Gold market. Now look at the date (Oct 29) in which they began to seriously draw down the overall size of their previously held net short position by BUYING contracts.

Over this interval, approximately a seven week time frame, there has been a reduction of over 37,000 in the net short position of the Producer category so that they are now NET LONG. In the Swap Dealer category, there has been a reduction of about 43,000 in their net short position. In other words, both categories have been NET BUYERS over the entire time frame during which, and this is important, gold has experienced a decline of some $115 in price.

Now look at the gold chart below to see the same time frame illustrated there.

This chart, unlike the COT chart above, covers through the end of this week, and not just through Tuesday this week. Since Tuesday the price of gold has declined even more losing another $30+ in the process.

Also, the CME Group, daily releases information detailing the delivery process for its various futures contract which still provide such. When it comes to gold, the December process has been ongoing. Out of the total 5,448 contracts Tendered or Issued ( by sellers who are delivering), J P Morgan, one of the infamous bullion banks, has stopped, or taken delivery of 5,106 of them for their HOUSE account, not their Customer account! That is no mean feat!

So what do we have? We have a source of data indicating a STEADY BUYING occurring by the large commercially-oriented players in the gold market so that their short positions are being covered even as they have moved to some LONG POSITIONS in the futures market so as to TAKE DELIVERY. One cannot take delivery of a futures contract if one is short the market going into the delivery period.

All this is taking place against a backdrop of falling gold prices while the SPECULATIVE COMMUNITY, is selling. Again, at the sake of excessive repetition, the specs remain as net longs but their net long position is declining as they bail out of gold and move to increasingly play it from the short side.

I should also note here that as the month of December has rolled around and the December gold contract has entered the delivery period, the number of OUTRIGHT LONG positions held by the Producer/Merchant/Processor/User category has increased from 89,853 to 90,760 as of this Tuesday. NOTE - this is using FUTURES ONLY data and not futures and options data because one needs a futures position on the long side to stand for delivery.

On the Swap Dealer front, the December long position has increased from 60,771 to 64,050 as of Tuesday this week.

It should also be noted here that as the longs take delivery of any gold, the futures long position is closed out ( as well as the short who was delivering) and the long positions (along with the short) will be reduced.

I want to also cover one more claim made by some who still refuse to accept the facts but will hold fast to their gold is always manipulated all the time thesis. Some claim that the bullion banks have been the ones recently selling gold futures to knock the price during the session only to then use the hedge fund selling that results as a way to BUY BACK or cover the shorts that they put on to precipitate the downward plunge in the futures market. The problem with this theory is that if the bullion banks were doing this ( and they currently are not), they would have to buy back all of those newly instituted short positions AND THEN SOME, in order to achieve the overall reduction in their NET SHORT position that the Commitment of Traders report details.

For example, if the bullion banks were to sell, let's say 1,000 contracts of gold, overnight in Asia and then wait for the inevitable hedge fund selling to show up so that they could then buy those contracts back, they would have to buy ALL 1,000 contracts or their NET SHORT POSITION would never budge. If they did not, let's say they bought back only 900 of those short positions, their TOTAL SHORT POSITIONS would increase by 100 contracts.

What the COT data reveals however is that the number of outright short positions of the Producer/Merchant category as well as the Swap Dealer category have been steadily SHRINKING since that October 29th date that I used as a reference point. Clearly this would not be possible if the bullion banks were only buying back some of these supposed short positions that are being claimed to be the source of the gold price manipulation. Even if they were buying back ALL of them, that would not be enough to REDUCE the number of outright short positions that they have on the books. They would need to buy back MORE THAN THE 1,000 in our example. In other words, they would have to buy 1,100 contracts after selling 1,000 overnight in order to show a reduction in their total short position of 100 contracts. Thus, they would consistently have to be buying large amounts of contracts ( much more than they are supposedly selling according to some) on a regular basis to give us this constant decrease in short positions which the COT report reveals. It would take some near miraculous feat for buying of that magnitude NOT TO DRIVE THE PRICE OF GOLD SHARPLY HIGHER.

Here is the simple truth about gold as it now stands - the bullion banks try to slow the rise of gold during those periods in which it is rising sharply and the US Dollar is sinking as part of the effort to keep the gold price from signaling any sort of distress, distrust or lack of confidence in the US Dollar and by consequence, the Federal Reserve's stewardship of such. Once the gold price broke below the key chart support level of $1530 in April of this year, the trend in gold turned from one of bullishness to one of bearishness. From that point, specs have been gradually abandoning the gold market and moving towards equities. This is why the price continues to fall, not because some nefarious force has continually been at work in gold since then.

At some point the price will reach a level in which the market views strong value. When it does, the willing buyers at that point and price will outnumber the sellers and the price will bottom and then begin to rise.

One last thing for those who listen in regularly to the King World News Metals Wrap on a regular basis. We are not doing one of those this week and are instead giving Eric and myself a bit of a break.

US GDP increases faster than expected

US 3Q GDP was revised higher from its initial 3.6% increase to a surprising 4.1% increase. The Commerce Department stated that a revision in consumer spending was behind the higher number. The data sent stocks on a tear higher as they set yet another record high. All is well as far as investors are concerned especially if the consumer is spending money. Again, I am merely repeating what the sentiment is in the market right now.

Gold seemed to draw a bit of strength from the number. The thinking was that the Fed's rosier assessment of the economy coming out of the recent FOMC meeting was being confirmed. That led some traders into thinking that if the economy is growing at a faster clip, job hiring will begin to pick up. If that were to occur, there might be some modest pickup in inflation.

Also, Asian demand for gold was stirred last evening as bargain buyers stepped up to grab the metal near 6 month lows in price. Coming at the chart point that it is, technicians are closely watching to see if the critical support zone near $1180 can hold. Gold will have to regain the "12" handle and maintain it to convince bottom pickers that they can wade back into the water. That will buy the bulls a bit of a breather but until they can take price back above $1220 - $1225, rallies will be suspect.

Short covering and bottom picking were the features in gold in today's session. Some shorts are closing out their bets on lower prices and taking their profits with them as they leave for an extended Christmas break. Many will not return until after the start of the New Year. Next week promises to be one of volatility as liquidity begins drying up in earnest. Do not be surprised if we see some strange moves.

By the way, just to have some fun with the Flash Crashers - Gold shot up sharply near mid-morning as some sizeable buy orders entered. One trader quipped that " No LEGITIMATE BUYER would act in such a fashion".

It never seems to end does it? We are even back to backwardation talk once again... sigh.... let's just say it once again - gold will bottom when it is good and ready to bottom. Not a minute sooner and not a minute later. Traders just take the market as it is and attempt to deal with that rather than dealing with conjecture and speculative theories. When the market becomes concerned about something, it will be reflected in the price. Until then, it is just a huge waste of energy attempting to keep up with the latest sensation in the gold market. Honestly, I sometimes wonder if some of these guys have a life outside of the gold price.

I have stated it before but will do so again - Gold is insurance against currency debasement. One buys insurance to protect themselves against unforeseen events HOPING that they will never have to use it. One does not buy insurance and then OBSESS over the policy. You buy it, obtain your peace of mind and then get about with the business of life. Owning gold provides you with the peace of mind that if events unfold that are deleterious to the health of the US Dollar ( if you are an American citizen - obviously citizens of other countries would be focused on their own native currency) your assets are shielded as much as possible.

It does seem to me however that those who keep yearning, pining, hoping, wishing, and even perhaps praying, for a higher gold price are yearning, pining, hoping, wishing and even perhaps praying for the house to burn down so that they can collect on the insurance policy. I find that rather sad. I am interested as much as anyone else in honest money and am more than ever concerned over the mounting US mountain of unfunded liabilities. That is why I own gold but I really marvel that so many seem to almost welcome the chaos that would engulf our society should the price of gold indeed reach some of the levels that many of these prognosticators assure us it will reach. As a father with children, I do not wish to see a society that would more closely resemble something out of a "Mad Max" movie just so that I could bathe in all the Dollars that my $50,000 ounce gold bar would bring me. There is almost a morbid mentality that would wish for such things.

Back to the technical charts - With the S&P 500 making new highs, traders are confirming that money flows are continuing to move into equities as the "go to" investment sector of choice. Until something occurs to change this psyche, I still think gold is going to face some serious headwinds to any sort of SUSTAINED move higher. There will continue to be rallies as shorts book some profits and bottom pickers emerge but the intermediate and short term trend remains lower until proven otherwise. I understand that some of those in the gold community will swear, curse and rant at me for saying this ( Norcini has crossed over to the Dark Side), but the market is what it is and that means accepting it and dealing with it if one is to make money as a trader.

By the way, I am thinking of temporarily changing the name of this blog to "Darth Dan's Market Views" and posting a picture of Darth Vader below mine to show the former Trader Dan and then the transformation to the reviled Darth Dan. When gold finally does bottom and resumes a SUSTAINED uptrend, then I can change the name back to Trader Dan once again with Luke Skywalker having rescued me and turned me back to the correct side of the force.

The HUI is seeing a bit of a bounce today as some shorts cover and some bargain/value buyers move in to take advantage of low prices. That being said, considering that the broader equity markets are soaring into new heights, that this meager bounce is all that the mining shares can put in for right now is rather disappointing. Unless we can see some more concerted buying efforts in the mining sector next week, the HUI is on track for the worst MONTHLY CLOSE since May 2005. That is even lower than the monthly close that occurred during the depths of the credit crisis in 2008. Very depressing stuff indeed.

At least bellwether Barrick Gold remains above that chart gap posted last Tuesday ( Dec 10). While it is not that much, I am sure the beleaguered bulls will take all the consolation that they can find right now. Maybe we will see some guys step in here and buy the miners in anticipation of a short pop higher. Year end book squaring could bring about some selling as investors throw away losers for the year to offset some of the gains that they have made elsewhere in the equity world. Once that selling is finished up, there might be a reduction in willing sellers at these levels, especially as the end of the year draws nigh and traders avoid putting on any sizeable positions as they wait for the advent of the New Year to do so. We'll watch and see what develops.

One more time for emphasis - be prepared for all sorts of strange and inexplicable moves in many of our futures markets. Traders are squaring books for year end and are moving to the sidelines to take some time off. That sort of thing is going to result in some bizarre price swings. Day to day gyrations do not matter as much right now as the longer term trends.

Gold seemed to draw a bit of strength from the number. The thinking was that the Fed's rosier assessment of the economy coming out of the recent FOMC meeting was being confirmed. That led some traders into thinking that if the economy is growing at a faster clip, job hiring will begin to pick up. If that were to occur, there might be some modest pickup in inflation.

Also, Asian demand for gold was stirred last evening as bargain buyers stepped up to grab the metal near 6 month lows in price. Coming at the chart point that it is, technicians are closely watching to see if the critical support zone near $1180 can hold. Gold will have to regain the "12" handle and maintain it to convince bottom pickers that they can wade back into the water. That will buy the bulls a bit of a breather but until they can take price back above $1220 - $1225, rallies will be suspect.

Short covering and bottom picking were the features in gold in today's session. Some shorts are closing out their bets on lower prices and taking their profits with them as they leave for an extended Christmas break. Many will not return until after the start of the New Year. Next week promises to be one of volatility as liquidity begins drying up in earnest. Do not be surprised if we see some strange moves.

By the way, just to have some fun with the Flash Crashers - Gold shot up sharply near mid-morning as some sizeable buy orders entered. One trader quipped that " No LEGITIMATE BUYER would act in such a fashion".

It never seems to end does it? We are even back to backwardation talk once again... sigh.... let's just say it once again - gold will bottom when it is good and ready to bottom. Not a minute sooner and not a minute later. Traders just take the market as it is and attempt to deal with that rather than dealing with conjecture and speculative theories. When the market becomes concerned about something, it will be reflected in the price. Until then, it is just a huge waste of energy attempting to keep up with the latest sensation in the gold market. Honestly, I sometimes wonder if some of these guys have a life outside of the gold price.

I have stated it before but will do so again - Gold is insurance against currency debasement. One buys insurance to protect themselves against unforeseen events HOPING that they will never have to use it. One does not buy insurance and then OBSESS over the policy. You buy it, obtain your peace of mind and then get about with the business of life. Owning gold provides you with the peace of mind that if events unfold that are deleterious to the health of the US Dollar ( if you are an American citizen - obviously citizens of other countries would be focused on their own native currency) your assets are shielded as much as possible.

It does seem to me however that those who keep yearning, pining, hoping, wishing, and even perhaps praying, for a higher gold price are yearning, pining, hoping, wishing and even perhaps praying for the house to burn down so that they can collect on the insurance policy. I find that rather sad. I am interested as much as anyone else in honest money and am more than ever concerned over the mounting US mountain of unfunded liabilities. That is why I own gold but I really marvel that so many seem to almost welcome the chaos that would engulf our society should the price of gold indeed reach some of the levels that many of these prognosticators assure us it will reach. As a father with children, I do not wish to see a society that would more closely resemble something out of a "Mad Max" movie just so that I could bathe in all the Dollars that my $50,000 ounce gold bar would bring me. There is almost a morbid mentality that would wish for such things.

Back to the technical charts - With the S&P 500 making new highs, traders are confirming that money flows are continuing to move into equities as the "go to" investment sector of choice. Until something occurs to change this psyche, I still think gold is going to face some serious headwinds to any sort of SUSTAINED move higher. There will continue to be rallies as shorts book some profits and bottom pickers emerge but the intermediate and short term trend remains lower until proven otherwise. I understand that some of those in the gold community will swear, curse and rant at me for saying this ( Norcini has crossed over to the Dark Side), but the market is what it is and that means accepting it and dealing with it if one is to make money as a trader.

By the way, I am thinking of temporarily changing the name of this blog to "Darth Dan's Market Views" and posting a picture of Darth Vader below mine to show the former Trader Dan and then the transformation to the reviled Darth Dan. When gold finally does bottom and resumes a SUSTAINED uptrend, then I can change the name back to Trader Dan once again with Luke Skywalker having rescued me and turned me back to the correct side of the force.

The HUI is seeing a bit of a bounce today as some shorts cover and some bargain/value buyers move in to take advantage of low prices. That being said, considering that the broader equity markets are soaring into new heights, that this meager bounce is all that the mining shares can put in for right now is rather disappointing. Unless we can see some more concerted buying efforts in the mining sector next week, the HUI is on track for the worst MONTHLY CLOSE since May 2005. That is even lower than the monthly close that occurred during the depths of the credit crisis in 2008. Very depressing stuff indeed.

At least bellwether Barrick Gold remains above that chart gap posted last Tuesday ( Dec 10). While it is not that much, I am sure the beleaguered bulls will take all the consolation that they can find right now. Maybe we will see some guys step in here and buy the miners in anticipation of a short pop higher. Year end book squaring could bring about some selling as investors throw away losers for the year to offset some of the gains that they have made elsewhere in the equity world. Once that selling is finished up, there might be a reduction in willing sellers at these levels, especially as the end of the year draws nigh and traders avoid putting on any sizeable positions as they wait for the advent of the New Year to do so. We'll watch and see what develops.

One more time for emphasis - be prepared for all sorts of strange and inexplicable moves in many of our futures markets. Traders are squaring books for year end and are moving to the sidelines to take some time off. That sort of thing is going to result in some bizarre price swings. Day to day gyrations do not matter as much right now as the longer term trends.

Thursday, December 19, 2013

Long term Gold Chart

This monthly chart reveals possible downside targets IF critical support just below the $1180 level gives way.

Notice the median line and how price is pivoting around this line as it moves lower. This month's price action is especially ominous for price has barely managed to poke its head ABOVE the line before succumbing to selling. Upon closer inspection, one can tell that the selling is picking up tempo. That is why it is imperative that support at $1180 NOT GIVE WAY. If it does, $1155 will be hit in short order, followed by a test of the $1100 - $1089 level.

Notice the median line and how price is pivoting around this line as it moves lower. This month's price action is especially ominous for price has barely managed to poke its head ABOVE the line before succumbing to selling. Upon closer inspection, one can tell that the selling is picking up tempo. That is why it is imperative that support at $1180 NOT GIVE WAY. If it does, $1155 will be hit in short order, followed by a test of the $1100 - $1089 level.

Gold Mauled as Bears Growl

Yesterday's late session plunge in gold, during the Bernanke press conference, was a harbinger of things to come for the yellow metal. It dawned on investors that the Fed still had enough concern about deflationary pressures that they were willing to leave interest rates at extremely low levels for a long time. That reinforced the idea that the mild inflation which the Fed wishes to show up, has not yet made its appearance.

Were it not for the fact that crude oil prices rose sharply today, one would have to think that the fall in the gold price would have the Fed concerned. Crude took off however on ideas that the early tapering by the Fed was enough evidence that the economy is going to be on a steady mend next year and that will result in a pick up in crude demand as gasoline and heating oil prices rise to meet that.

Also helping crude rally was further confirmation that the pipeline from Cushing to Port Arthur will be moving oil down to refineries and alleviating any glut in supplies which had been weighing on the market of late.

With yesterday's FOMC actions and the subsequent Bernanke comments, investors seem to believe that they now have the best of all possible worlds - ultra low interest rates for the foreseeable future, no signs of inflation and an economy on the mend. Translation - buy stocks. That is the message of the market.

In this sort of environment, investors simply see no reason to own gold, which throws off no yield and depends solely on capital appreciation to return on investment. If inflation pressures remain muted, and if confidence is high, ( the VIX SANK EVEN FURTHER TODAY providing proof that it is), gold is a pariah at this point.

People can talk about Chinese demand for gold all they want but it makes no difference as far as Western sentiment goes. Here in the West - gold has few friends. Until this confidence in the Fed and the economy is shattered, gold is going to struggle against strong headwinds. At some point it will get beaten up badly enough to move down into the cost of production and remain at those levels long enough to perhaps force some mine closures, etc,. Maybe then it will finally bottom out.

Keep in mind something I wrote last Friday when the Commitment of Traders report was released - there can be NO CAPITULATION in gold and thus no end to the selling as long as speculators REMAIN AS NET LONGS in the gold market. Too many keep pointing to the building hedge fund SHORT position as some sort of bizarre rationale that gold prices must now stage some sort of rally. I read this sort of thing and ask myself if those who advocate such nonsense have ever really traded anything besides baseball cards and comic books. When the trend is lower and speculators are making money by being short, they have no reason to buy unless upside resistance levels are taken out. If the price moves into those resistance levels and then fails to extend higher, it is a signal to every hedge fund on the short side of the market to sell even more, not buy and get out!

This is what happens when too many self-anointed "experts" give us one prediction after another based on their tea-leaf reading of the Commitment of Traders report without understanding market sentiment and price action.

That brings me back to gold - the failure to hold at what had been shaping up as a secondary bottom at $1220, followed by a primary bottom at $1210, was a huge technical failure. What is worse however is the market's inability at this point to even hold above psychological support at $1200. Losing the "12" handle is a big deal because it deals another psychological blow to the bulls and emboldens the bears even more who are now trying to press their advantage. Every bear on the planet now is salivating over the prospect of reaching that mountain of sell stops sitting just below the $1180 level. If they can reach it, and that is unclear at this point whether they can or not, we will see an avalanche of selling hit the gold market which will easily carry it down to $1150 for starters.

I have put up a Daily Chart to illustrate how tenuous gold's position is right now. It has effectively worked its way lower into a band of EXTREMELY CRITICAL CHART SUPPORT. I would say that this level has almost as much significance as did the $1530 level some time back. When gold fell through that level, we saw wave after wave of selling as hedge fund longs, and other speculative longs, bailed out in large numbers and fresh shorting was established. We would see the same thing occur in my view if this level were to give way and PRICE BE UNABLE TO CLIMB BACK ABOVE IT SWIFTLY.

If you look at the ADX indicator, that line is beginning to turn back up again, after having moved lower. That move lower indicated that the bearish trend was halting and that a range trade was forming. Now that gold has broken below the bottom of that range, the indicator is suggesting that a new leg lower in price could be forming. For that to be confirmed, this chart support level that I have noted would have to give way.

Bulls need some help from somewhere and fast. That the HUI is holding up a bit better than the actual metal today is some consolation. Bellwether Barrick is down nearly 2% as I type these comments but gold is down over 3% so that is a positive, although I will be the first to admit, not much of one on a day like this for the gold bulls. ABX is still holding above that chart gap it made Tuesday of last week; however, it had better not close that gap or it will more than likely retest its recent low.

With rising interest rates here in the US bolstering the Dollar, the precious metals need some Asian buying to keep things from getting even uglier. This rise in rates, which I think is being closely watched by the FOMC, in conjunction with POSITIVE REAL RATES ( due to the official low rate of inflation ) is not helping gold demand here in the West. Remember, traders will view a strong currency as inhibiting inflation.

The question I still have in my mind is how the Fed is looking at this fall in the gold price and whether it is becoming a concern to them at this point. I do not think it is UNLESS it breaks chart support and REMAINS BELOW THAT SUPPORT for an extended period of time. Spikes below support followed by rebounds in price that occur quickly will not disturb them whatsoever as that can be rightly attributed to market volatility. Low prices however that remain are a more serious signal. Gold is signaling no fears of inflation currently exist. If it sinks further and will not pop back, it will be signaling the potential return of deflationary pressures. That will be a problem for the Fed.

Time will tell.

One last thing about crude oil and gasoline prices. There are two ways of looking at a sinking crude oil price and by consequence a sinking gasoline price. It could be interpreted as a deflationary signal, evidencing a sluggish economy in which demand for energy is weak as a result. It could also be interpreted as having a STIMULATIVE effect in the sense that it acts as a sort of "tax cut". It puts more money in the pocket of both consumers and business as their energy costs drop off. I personally think the Fed welcomes a lower crude oil price more in the latter sense although I am sure that were it to rise too much in their estimation, it could have a deleterious effect on the overall economy. What I am trying to say is that just reacting to a rising crude oil price by saying it is inflationary is not quite as easy as it might sound. It requires a bit more nuance to sort the implications out.

Were it not for the fact that crude oil prices rose sharply today, one would have to think that the fall in the gold price would have the Fed concerned. Crude took off however on ideas that the early tapering by the Fed was enough evidence that the economy is going to be on a steady mend next year and that will result in a pick up in crude demand as gasoline and heating oil prices rise to meet that.

Also helping crude rally was further confirmation that the pipeline from Cushing to Port Arthur will be moving oil down to refineries and alleviating any glut in supplies which had been weighing on the market of late.

With yesterday's FOMC actions and the subsequent Bernanke comments, investors seem to believe that they now have the best of all possible worlds - ultra low interest rates for the foreseeable future, no signs of inflation and an economy on the mend. Translation - buy stocks. That is the message of the market.

In this sort of environment, investors simply see no reason to own gold, which throws off no yield and depends solely on capital appreciation to return on investment. If inflation pressures remain muted, and if confidence is high, ( the VIX SANK EVEN FURTHER TODAY providing proof that it is), gold is a pariah at this point.

People can talk about Chinese demand for gold all they want but it makes no difference as far as Western sentiment goes. Here in the West - gold has few friends. Until this confidence in the Fed and the economy is shattered, gold is going to struggle against strong headwinds. At some point it will get beaten up badly enough to move down into the cost of production and remain at those levels long enough to perhaps force some mine closures, etc,. Maybe then it will finally bottom out.

Keep in mind something I wrote last Friday when the Commitment of Traders report was released - there can be NO CAPITULATION in gold and thus no end to the selling as long as speculators REMAIN AS NET LONGS in the gold market. Too many keep pointing to the building hedge fund SHORT position as some sort of bizarre rationale that gold prices must now stage some sort of rally. I read this sort of thing and ask myself if those who advocate such nonsense have ever really traded anything besides baseball cards and comic books. When the trend is lower and speculators are making money by being short, they have no reason to buy unless upside resistance levels are taken out. If the price moves into those resistance levels and then fails to extend higher, it is a signal to every hedge fund on the short side of the market to sell even more, not buy and get out!

This is what happens when too many self-anointed "experts" give us one prediction after another based on their tea-leaf reading of the Commitment of Traders report without understanding market sentiment and price action.

That brings me back to gold - the failure to hold at what had been shaping up as a secondary bottom at $1220, followed by a primary bottom at $1210, was a huge technical failure. What is worse however is the market's inability at this point to even hold above psychological support at $1200. Losing the "12" handle is a big deal because it deals another psychological blow to the bulls and emboldens the bears even more who are now trying to press their advantage. Every bear on the planet now is salivating over the prospect of reaching that mountain of sell stops sitting just below the $1180 level. If they can reach it, and that is unclear at this point whether they can or not, we will see an avalanche of selling hit the gold market which will easily carry it down to $1150 for starters.

I have put up a Daily Chart to illustrate how tenuous gold's position is right now. It has effectively worked its way lower into a band of EXTREMELY CRITICAL CHART SUPPORT. I would say that this level has almost as much significance as did the $1530 level some time back. When gold fell through that level, we saw wave after wave of selling as hedge fund longs, and other speculative longs, bailed out in large numbers and fresh shorting was established. We would see the same thing occur in my view if this level were to give way and PRICE BE UNABLE TO CLIMB BACK ABOVE IT SWIFTLY.

If you look at the ADX indicator, that line is beginning to turn back up again, after having moved lower. That move lower indicated that the bearish trend was halting and that a range trade was forming. Now that gold has broken below the bottom of that range, the indicator is suggesting that a new leg lower in price could be forming. For that to be confirmed, this chart support level that I have noted would have to give way.

Bulls need some help from somewhere and fast. That the HUI is holding up a bit better than the actual metal today is some consolation. Bellwether Barrick is down nearly 2% as I type these comments but gold is down over 3% so that is a positive, although I will be the first to admit, not much of one on a day like this for the gold bulls. ABX is still holding above that chart gap it made Tuesday of last week; however, it had better not close that gap or it will more than likely retest its recent low.

With rising interest rates here in the US bolstering the Dollar, the precious metals need some Asian buying to keep things from getting even uglier. This rise in rates, which I think is being closely watched by the FOMC, in conjunction with POSITIVE REAL RATES ( due to the official low rate of inflation ) is not helping gold demand here in the West. Remember, traders will view a strong currency as inhibiting inflation.

The question I still have in my mind is how the Fed is looking at this fall in the gold price and whether it is becoming a concern to them at this point. I do not think it is UNLESS it breaks chart support and REMAINS BELOW THAT SUPPORT for an extended period of time. Spikes below support followed by rebounds in price that occur quickly will not disturb them whatsoever as that can be rightly attributed to market volatility. Low prices however that remain are a more serious signal. Gold is signaling no fears of inflation currently exist. If it sinks further and will not pop back, it will be signaling the potential return of deflationary pressures. That will be a problem for the Fed.

Time will tell.

One last thing about crude oil and gasoline prices. There are two ways of looking at a sinking crude oil price and by consequence a sinking gasoline price. It could be interpreted as a deflationary signal, evidencing a sluggish economy in which demand for energy is weak as a result. It could also be interpreted as having a STIMULATIVE effect in the sense that it acts as a sort of "tax cut". It puts more money in the pocket of both consumers and business as their energy costs drop off. I personally think the Fed welcomes a lower crude oil price more in the latter sense although I am sure that were it to rise too much in their estimation, it could have a deleterious effect on the overall economy. What I am trying to say is that just reacting to a rising crude oil price by saying it is inflationary is not quite as easy as it might sound. It requires a bit more nuance to sort the implications out.

Wednesday, December 18, 2013

Gold breaks support but recovers

Gold was all over the place today but it really took it on the chin during the Bernanke press conference. It actually broke down below the bottom of its trading range but managed to recover somewhat and claw its way back into the range.

If it breaks below today's low, look out... it will test round number and psychological support at $1200. Right now, it looks tentative to me.

I repeat what I wrote earlier - based on my interpretation of Chairman Bernanke's comments, the Fed is hoping to strike a balance between deflation and inflation in the sense that they want to see inflation but they want to see it tame. What they DO NOT WANT, is a resurgence of deflation. A sinking gold price (below what level I am unclear) that stays down is a deflationary signal. Thus, I suspect the Fed would not welcome a gold price that is significantly lower than current levels, especially if that gold price were accompanied by a collapse in certain key commodity prices.

If that were to occur, in conjunction with a labor market that shows no signs of strong improvement, I could easily see the Fed INCREASE bond buying. At this point, we are going to remain heavily dependent on subsequent economic data releases for a clue as to whether or not inflationary pressures are increasing or not. I believe that the payrolls numbers are going to be even more significant than they have been moving forward.

I noticed that once again silver could not maintain its footing above the $20 mark for long. If growth both globally and domestically is indeed picking up, one would expect silver to move higher alongside of copper. The jury is still out.

Ten Year Treasury Yield Closing in on Yearly Highs

It will be interesting to see the response from the various FOMC governors should this critical indicator push ever closer to 3%. Their response or lack thereof will give us a good clue into the thinking of the broad committee.

You might recall that this summer, the rate spike elicited extreme nervousness and concern among the Fed governors who immediately began sounding a dovish tone on the economy overall and the bond buying program in regards to any tapering.

Remember, the Fed today left the door open to additional monetary stimulus should the economic data warrant such.

You might recall that this summer, the rate spike elicited extreme nervousness and concern among the Fed governors who immediately began sounding a dovish tone on the economy overall and the bond buying program in regards to any tapering.

Remember, the Fed today left the door open to additional monetary stimulus should the economic data warrant such.

Market Confidence Soars on FOMC

As those of you who regularly read this blog know by now, my favorite indicator for measuring investor confidence/complacency is the Volatility Index or the VIX.

Notice how the index initially soared higher when the news that the Fed was tapering to the tune of $10 billion. A large number of investors panicked. However, the reaction following that was one of increasing confidence due to both the wording of the FOMC statement, and, Chairman Bernanke's comments during his last press conference.

I maintain that gold needs something to impact CONFIDENCE before it mount a SUSTAINED RALLY HIGHER. With the VIX falling, and the stock market soaring into new all time highs, gold is looking for some friends right now as there is nothing on the radar screen of investors AT THIS MOMENT, to give them a strong reason to chase gold prices higher.

Now the key for gold is whether or not it can hold chart support near $1220. If it loses that level, it is going to test round number psychological support at $1200.

I will get a chart of gold up a bit later today. As you no doubt realize, it has been a very busy day for traders.

Notice how the index initially soared higher when the news that the Fed was tapering to the tune of $10 billion. A large number of investors panicked. However, the reaction following that was one of increasing confidence due to both the wording of the FOMC statement, and, Chairman Bernanke's comments during his last press conference.

I maintain that gold needs something to impact CONFIDENCE before it mount a SUSTAINED RALLY HIGHER. With the VIX falling, and the stock market soaring into new all time highs, gold is looking for some friends right now as there is nothing on the radar screen of investors AT THIS MOMENT, to give them a strong reason to chase gold prices higher.

Now the key for gold is whether or not it can hold chart support near $1220. If it loses that level, it is going to test round number psychological support at $1200.

I will get a chart of gold up a bit later today. As you no doubt realize, it has been a very busy day for traders.

FOMC - Taper Arrives - Finally!

We finally got the big "T" word today. The announcement by the Fed of a $10 billion cut in the bond buying program was greeted by the markets with the usually volatility as the HFT crowd had a field day picking pockets but once the dust settled down a bit and some saner heads prevailed, traders were able to actually think about what the Fed statement means.

It looks to me like the Fed basically gave the market a near perfect bowl of punch. Cut back on the bond buying program and dispel some of the criticism it has been receiving from some quarters about keeping the program at full size for too long while simultaneously sounding an EXTREMELY DOVISH TONE on the interest rate front. In short, they managed to convey that they are still concerned about DEFLATIONARY forces reasserting themselves but are comfortable scaling back some bond buying as they monitor that situation.

The reaction in the gold market was fascinating to watch as traders tried to figure out exactly what to think about this new state of affairs. The initial kneejerk reaction was to sell on the announcement of a taper; however, I believe the dovish attitude towards interest rates eclipsed any fears of a slowdown in the liquidity injection mechanism. That allowed gold to catch a bid and keep above that now incredibly significant chart support level at $1220.

Basically the Fed left the door open for a period of ultra low interest rates for an extended period of time. One thing I noticed was that they seemed to play with the unemployment number threshold a bit ( "well past 6.5%"). That was something new to me.